Trade AI only

Get access to tokenized investment opportunities on our platform, powered by blockchain. For Accredited Investors (AI) only.

Currently Trading

| Name | Type | Risk | Region | Sector | Ask | Bid | Last Trade |

|---|---|---|---|---|---|---|---|

OPUS 3.5 |

Bonds | Low | Asia | ESG | 1.5 | 1.4 | 1.4 |

OPUS 3.5 |

Bonds | Low | Asia | ESG | 1.5 | 1.4 | 1.4 |

OPUS 3.5 |

Bonds | Low | Asia | ESG | 1.5 | 1.4 | 1.4 |

OPUS 3.5 |

Bonds | Low | Asia | ESG | 1.5 | 1.4 | 1.4 |

Successful past investment deals we have closed

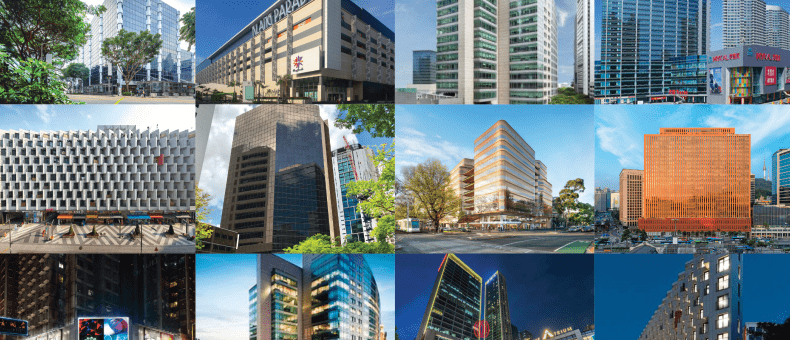

Opus – series 003

- Asia Pacific

- Array

The Issuer is an SPV wholly owned by to be incorporated for the sole purpose of issuing the Notes. The net proceeds from the Fixed Rate Notes would be applied towards general corporate finance purposes.

- Loan Quantum: SGD 25,000,000

- Tenor: 12 months

- Gross Returns (p.a.): 3.5%

- Minimum

Investment: SGD 200,000

New Bridge Road

- Singapore

- Array

SDAX launched an exclusive opportunity to participate in a property loan for the refinancing and lease extension of a shophouse located in the Downtown Core of Singapore, conveniently located opposite Clarke Quay MRT Station.

- Loan Quantum: SGD 9,347,692

- Tenor: 7 months

- Gross Returns (p.a.): 6.5% to 10.35%

- Minimum

Investment: SGD 100

Project CP

- Singapore

- Array

SDAX launched an exclusive investment opportunity to participate in Secured Property Financing Loan with a first charge over a strata-titled commercial shop unit along Orchard Road (“the Property”). The loan will be used to refinance the property and/or working capital. Borrower’s principal proceeds is earned through the provision of co-living spaces.

- Loan Quantum: SGD 3,060,000

- Tenor: 12 months

- Gross Returns (p.a.): 6.5%

- Minimum

Investment: SGD 50,000

Navigating Growth as Cycles Evolve

US growth has increasingly been driven by a surge in capital investment as companies race to scale AI infrastructure. Corporate ...

Risk-off Sentiments and a Case for Consolidation

Equity markets plunged 2-3% last week as investors resorted to profit-taking. US large-cap technology and growth names, which have had ...

Someone Turned Up the Political Noise and Markets Heard It

Political pressure has intensified in the UK, and markets are reacting. In these times when central banks across the globe ...

Tech Taps the Bond Market

In the absence of hard US economic data, conviction about global economic growth remains elusive. Yet, as we noted last ...

A World of Equals

Global growth appears to be accelerating, even allowing for the absence of recent US data. Inflation remains sticky, however, keeping ...