Goldilocks makes a re-appearance

- Market Insights

- Financial Insights

- Worse-than-expected US employment data leads to anticipation of rate cuts from September, aligning with a Goldilocks scenario.

- Lower-than-expected US jobs growth offsets concerns from stronger inflation reports.

- China’s potential quantitative easing boosts Chinese equities but risks upsetting the Goldilocks scenario.

- Traders may see a growth surge and risk-on sentiment, especially in equities.

- Long-term investors should monitor medium-term inflation and consider holding gold.

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

Last Friday’s weaker-than-expected US employment report temporarily relieved the Fed from the market’s criticism of its sanguine view on the inflation threat. Despite several data points of late signalling higher-than-expected headline inflation, wage inflation, and increased industrial confidence, the market placed significant importance on the disappointing employment report. We wonder why such emphasis on this report in particular? In our opinion, it’s wishful thinking.

The market seems to be hoping that the Fed is eager to cut rates and stimulate asset markets that were losing momentum. It’s a return to the Goldilocks scenario—a soft landing with no stress!

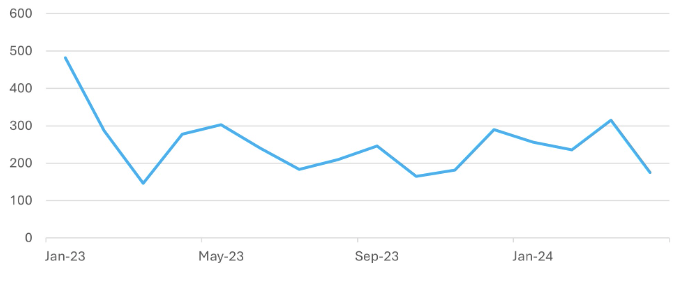

Chart 1: US Monthly Employment Growth Surprises to the Downside

Source: Bloomberg

The employment report revealed that only a net 175,000 new jobs were created in the US economy in April, significantly below the anticipated 240,000. Additionally, wage growth in this survey was lower than expected, at +0.2% month-on-month. However, this wage growth data contrasts with the quarterly employment costs index, which exceeded expectations, showing wage growth at an annualized rate of around 5%.

The market reacted strongly to this report, driving bond yields sharply lower. The market is now pricing in two Fed rate cuts by the end of the year, with the expectation that the earliest the cuts will begin will be in September.

In Japan, despite raising its inflation forecast to 2.8% from 2.4%, the Bank of Japan has maintained interest rates at zero and continues to pursue an accommodative stance, which has led to a depreciation in yen.

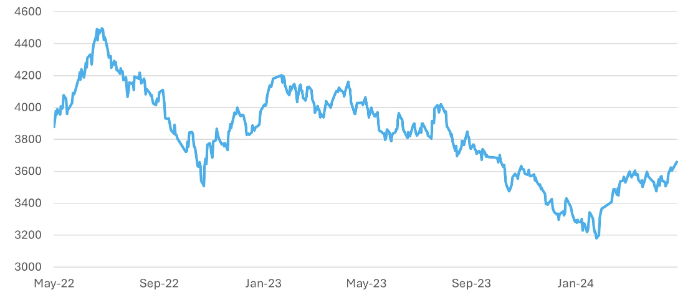

Similarly, in China, there are signs of monetary accommodation akin to the strategies employed by the Fed and the US Treasury since 2008. Following the Fed’s lead, the Chinese central bank is laying the groundwork for government spending monetization. To counterbalance the economic impact of the real estate sector’s meltdown, the Chinese government is injecting substantial support into the tech and ESG sectors. In fact, the government’s commitment to its stimulus plans may be even stronger, considering the potential loss of export market share to Japanese corporations.

China’s central bank, the PBOC, recently announced its openness to market operations similar to the Fed’s direct purchases of US government debt. This announcement sets the stage for a Chinese economic reflation supported directly by the PBOC. With inflation below target, the PBOC could end up financing the Chinese government’s expansion efforts in the tech and ESG sectors. However, there are concerns about China’s EV industry, which has the capacity to saturate global markets if access is granted. Most of the demand for EVs comes from emerging and frontier markets, which have limited credit access. If China extends its credit to these markets, strong demand could be funded without the need for US market access, benefiting Chinese markets significantly.

Chart 2: China’s CSI 300 index supported by economic and monetary reflation?

Source: Bloomberg

We’ve been in the market long enough to recognize that it can sometimes become overly enthusiastic about a flawed positive narrative. There are compelling reasons to believe that the markets might be overly optimistic about the global economy. A recent article (“Instability”, May 4th) by Doug Noland on Seeking Alpha, for instance, highlighted several global forces that could be setting the stage for a significant global bubble. Despite persistent inflation and a surge in growth driven by substantial government spending and exceptionally loose financial and credit conditions, the Fed seems determined to remain accommodative.

The world’s three largest economies—first, second, and fourth—are all pushing for growth despite persistent inflation, which can initially benefit risk assets. However, if inflation becomes too high, central bankers will be forced to change their narrative. The Fed, while previously emphasising data dependence, shifted last week to discussing generalities, highlighting the recent decrease in inflation rather than its potential return to target levels.

In a world where central banks are taking risks with inflation, the level of government bond yields will hinge on the market’s perception of central bank policy credibility and their actions to control long-term interest rates. Determining the fair value of the US 10-year bond therefore is as much about economic fundamentals as it is about the perceived extent of rate manipulation by central banks. Although the Fed announced that it will reduce Treasury purchases in the coming months, the market is aware that the Fed can and will reverse course if yields rise.

The summer months could see risk markets enjoying the growth narrative with supportive central bank policy. Equities and credit would likely provide further good returns, discounting the Goldilocks scenario of accelerating growth and accommodating central bankers. However how long could such a scenario continue given the markets memory of the high inflation of recent quarters? Only time will tell – China’s evolving adoption of the rest of the world’s manipulative monetary policy could end up scuppering the good news via a burst of global inflation. Gold remains an important hedge in portfolios.