For Accredited Investors Only

Investment Details

About the Issuer and Loan Purpose

The Issuer is an SPV wholly owned by to be incorporated for the sole purpose of issuing the Notes.

The net proceeds from the Fixed Rate Notes would be applied towards general corporate finance purposes.

Investment Highlights

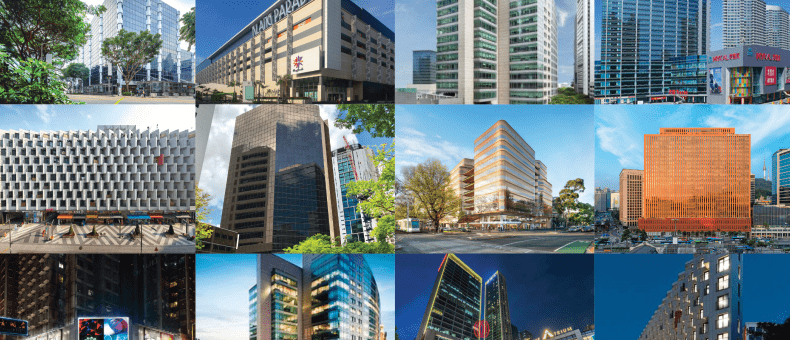

- Coverage – The Notes are guaranteed by entities whose income is derived from the net distributions from ARA’s stake in a portfolio of income producing real estate properties (“Portfolio”) in real estate funds and private REITs managed by ARA (“ARA Funds and REITs”)

- Diversity and Quality – Concentration risk is minimized with the Portfolio comprising:

- 20 real estate properties

- in five (5) key Asia Pacific countries (Singapore, Australia, Hong Kong, China and Malaysia)

- across two (2) asset classes (office and retail)

- Strategic Alignment with the Issuer – The Portfolio comprises fund manager co-investments in the relevant ARA Funds and private REITs that are highly strategic to ARA’s fund management business and alignment of interest

- Strong Parent Company – The Portfolio is professionally managed by ARA, an Asia Pacific based real assets fund manager with global reach, with approximately SGD 122 billion in gross assets under management as at 30 June 2021; the management team has on average over 25 years of real estate experience. ARA is also the manager of six listed REITs – Suntec REIT, ARA Logos Logistics Trust, and ARA US Hospitality Trust (listed on SGX) and Fortune REIT, Prosperity REIT, and Hui Xian REIT (listed on HKEX)

- Base Currency – The Series 003 Notes will be issued in Singapore Dollars, or such other currency as may be determined by the Issuer

- Short Term – The Series 003 Notes will have a fixed term of 12 months

Product Suitability

What would you gain or lose in different scenarios?

- Best Case Scenario

- Investor getting the investment amount of 5.5% p.a. to 6.5% p.a. payout (adjusted by day count)

- Worst Case Scenario

- Borrower defaults, Personal Guarantor defaults, and we get into recovery of the value of the loan via sale of the property. Recovery value would then be the net value of the sales proceeds against the loan amount outstanding.

Investor Profile for this issuance should be MODERATE.

The nature of the investment is MODERATE.

Risk & Reward involved with the investment is MODERATE.