Nothing is Straightforward

- Market Insights

- Financial Insights

- US growth surprises to the downside but no one quite believes it

- US inflation still persists

- FOMC – expect more about the words than the action

- Focus on ex US equity markets

- China is back

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

Last week’s US economic data showed that you can’t have entrenched views or exaggerated portfolio positions amidst an economic backdrop that remains highly fluid. It was just a couple of weeks ago that US economy appeared to be on a strong footing with a continuous flow of better-than-expected economic data. Back then, the Citigroup Economic Surprise Index (or CESI) for US growth surprises was at a level of 40. Two weeks later, after a much weaker-than-expected first quarter GDP figure, the CESI index is down to a level of just 15.

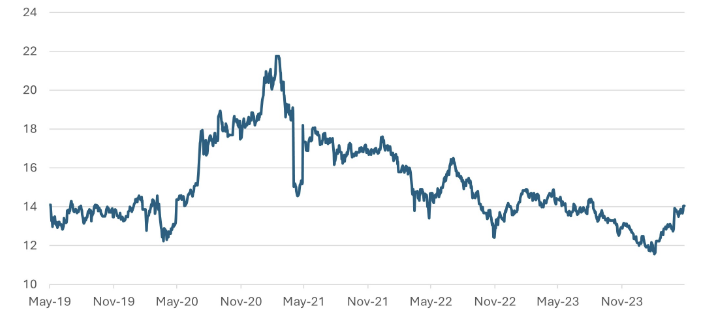

Chart 1: US Economic Growth Data Strengthen before Losing Some Teeth – All in a Week

CESI Index of US growth data surprise

Source: Bloomberg

The first-quarter US GDP report was disappointing. The economy grew at its slowest clip in two years, registering a 1.6% headline growth, compared with market estimates of 3%. There were two sources of disappointment: government and household spending, which, though, look reversible in the coming quarters. Government spending can be lumpy, while higher energy prices impact household spending. The bottom line is that economists have transferred their growth disappointment in Q1 to a growth upgrade in Q2, to leave annual growth forecast almost unchanged at 2.4% for the year.

US equities rallied 2.7% on the week despite bond yields remaining close to their recent highs. As we move through the first quarter results season, the gentle rise in equities helped the market in corporate profit estimates. Equities rallied despite a much stronger-than-expected PCE inflation reading. The core PCE has strengthened to a 4.4% annualised rate over the past quarter, while super-core inflation is at 5.5% annualised over the quarter.

FOMC more about the words than the action

With an FOMC meeting scheduled this Wednesday, it will be interesting to see how the Fed navigates through the current inflation spike. The Fed meeting is likely to maintain status quo, and the market, which has adopted a wait-and-see perspective of late, expects little change in Fed’s statement. However, at the press conference post the meeting, Chairman Powell can provide some direction. For sure, we do not see alarm bells, but we do expect some acknowledgement that inflation is unlikely to fall back soon. Commentators are concerned that the Fed may have to answer the question of not when they might cut rates, but if they will cut at all in 2024. The market doesn’t fully price a rate cut until the December meeting.

The rally in the broader US equity market was helped by a strong growth in the NASDAQ index, and, yet again, the small cap index struggled. The tech-heavy NASDAQ was helped by some strong AI-related gains for both Microsoft and Alphabet, which offset disappointments at META. The Nasdaq rose 4.2% on the week. The SmallCap 600 and MidCap 400 rose just 2% each.

Tech heavyweights Amazon and Apple report this week, with the market hoping that the two will add further energy to the tech rally. The market will also be hoping that Amazon delivers a recovery in margins after last quarter’s setback. Also, the market will be looking to see how their AI offerings are progressing. Apple’s results will likely be less impressive, with a fall expected in both revenues and earnings.

Emphasising our overweight of equities outside of the US

The ebbs and flows of the US equity market aside, our focus remains on an overweight position in Europe and Japan. We and the market continue to believe that Europe can enjoy an earlier rate cut in the eurozone with the ECB likely cutting rates by the July meeting. The positive outlook for rate makes up for a still disappointing outlook for corporate profits forecasts. The forecast EPS level of the index is down since the start of the year although it has recovered from an April low. Japan’s local market returns are strong; however, the dollar’s strength has been particularly evident against the yen with Japanese authorities still struggling to contain it.

China is back.

This past week has seen a notable strengthening in the Chinese equity market, driven by record inflows from foreign investors. Chinese equities, while undervalued, have been searching for a catalyst to unlock their potential, and recent developments indicate they may have found it. Last Friday, foreign fund purchases of Chinese stocks reached an unprecedented monthly total of $3 billion. Both UBS and Goldman Sachs have bolstered this positive outlook; UBS upgraded its recommendation for Chinese stocks to overweight, while Goldman Sachs predicts a 40% upside, highlighting significant international confidence in the market.

The surge in foreign investment into Chinese equities may also reflect a broader trend of investors searching for viable opportunities amid a generally lackluster landscape in both other emerging markets and global equities. For instance, India, a previous favorite in the emerging markets, is currently facing challenges as it awaits election results. Meanwhile, other emerging markets are experiencing a loss of momentum, with their currencies weakening against a strengthening dollar.

Chart 2: Current PE multiple of the CSI 3000

Source: Bloomberg

Anecdotally, positive developments are emerging from China, where the corporate sector appears to be regaining confidence and momentum. This revival suggests that the economy may be entering a period of stabilization, which investors would likely view favorably. Upcoming industrial surveys from Caixin are expected to reflect this trend, with confidence indicators likely showing consolidation. This could further enhance the attractiveness of Chinese equities to global investors.

Chart 3: Caixin Survey of Industrial Confidence Consolidates Above 50

Source: Bloomberg