US not ready to Samba

- Financial Insights

- Market Insights

- US economy and markets struggling with uncertainty

- Brazil, meanwhile, shows resilience as interest rates are falling and the economy is in good shape

- Emerging market debt has been cheaper but still offers reasonable value

- US inflation report this week will likely show still sticky core inflation

- Oil prices continue to rise with the fundamentals pointing to still higher prices

- We advocate holding a position in oil stocks for inflation risk mitigation

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

The US asset markets managed to pull themselves out of a bit of a tailspin last week. Investors sold off both equities and bonds and the recent dollar rally lost some momentum. Sometimes it is worth discussing unlikely contrasts just to keep one from anchoring their views on the past rather than the reality of the present. While the reality of the present is in front of us, our contrast is between the US and Brazil, which we discuss below:

1. Brazil’s credit rating upgrade – and the US’ downgrade

On 26 July, Brazilian debt was upgraded by Fitch from BB- to BB, which is two notches below investment grade. Fitch said it was impressed with the recent fiscal reforms in Brazil and the country’s commitment to further reduce the fiscal deficit and trim overall indebtedness.

For the US though, it was déjà vu 12 years later. In a move that surprised many, Fitch downgraded the US from the highest AAA rating to AA+ on concerns about deterioration in the country’s finances. S&P had already downgraded the US from AAA to AA+ back in 2011. Since then the US debt-to-GDP ratio has risen from 65.5% to 97% and is projected to shoot up to 115% of GDP by 2033. In a critical assessment of the fundamentals of US’ fiscal policy governance, Fitch noted that “there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025”.

2. The Brazilian central bank cuts rates – the Federal Reserve may need to tighten further

Last week, the Brazilian central bank surprised the market with a 50bps cut in interest rates, taking the Selic rate down to 13.25%. The market anticipates that the rate could decline further to 11.75% by year-end.

Meanwhile, in the US economists continue to debate whether the Fed may have to raise rates still further in its upcoming meetings.

3. Inflation in Brazil falls; increases in US

Inflation in Brazil has fallen from a peak of 12% to 3.1% in July. There are expectations that US inflation data, which is due on Thursday, will show US headline inflation rose from 3.0% to 3.3% in July.

4. The current Brazil President was released from jail – A future US President is threatened with jail!

How all of these factors affect the spread of Brazilian debt over US debt is open to debate. However, the key point is that on many metrics Brazil appears better placed in both relative and absolute terms when compared with the US. Clearly, the Brazilian asset markets are no match for the US , but it provides more evidence of the slow demise of the US as an omnipotent place to invest.

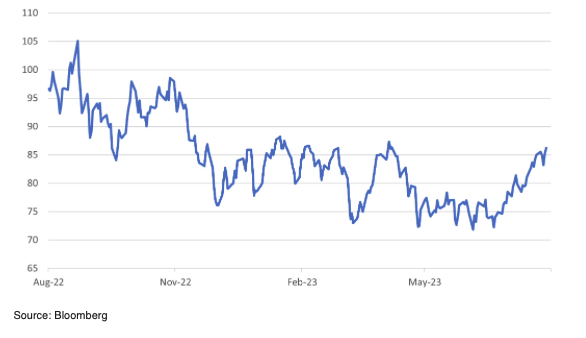

Chart 1: Brazilian and US 10-Year Government Bond Yields and Spread

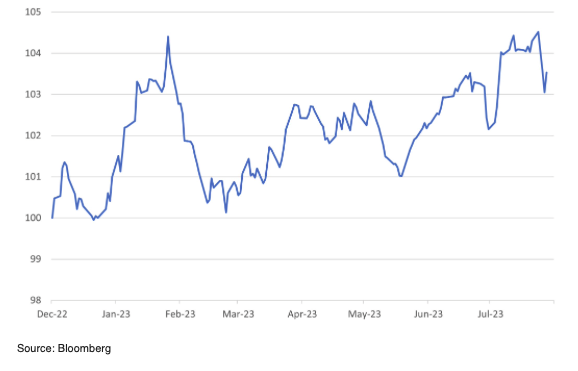

Among the emerging economies, although asset markets in China are still facing some real challenges, the vibrancy of the Indian asset markets and an improving Brazilian economy provide much-needed support to the good performance of the emerging market bond index (Chart 2). Year to date, the emerging market index has returned 3.5% largely through spread compression. Reflecting a decrease in credit risk, spreads have turned tighter at around 350bps; they were around 300bps back in 2021. With an increasing number of emerging countries likely to be cutting policy rates ahead of the Federal Reserve, we believe that the asset class can continue to outperform the US bond market.

Chart 2: Emerging market Bond Index (TR) rebased to August 2022 =100

US inflation is not beaten

The markets were on edge last week ahead of the US labour market data, and this week the focus is back on inflation data. Unfortunately, with the Fed’s interest rate policy-making remaining data-dependent, every data point has been eliciting an even higher level of vigilance. Last week’s labour market data showed vibrancy in new job creation, and wage inflation was marginally ahead of expectations. An example from the logistics industry shows some of the broader challenges facing the economy. Yellow Corporation recently went bankrupt because of significant labour and fuel cost pressures and a high level of debt. Industry leader FedEx has also been grappling with higher costs. FedEx pilots recently rejected an offer of a 30% wage increase. Some media reports suggest that significant shortages of new pilots have seen pilot salaries skyrocketing with some FedEx aviators now earning as much as $700,000 per year. Ongoing negotiations with unions in several industries remain unresolved – Hollywood and hospitality workers remain in dispute over salary increases.

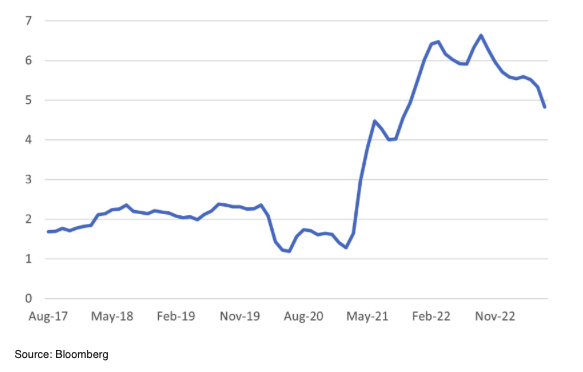

This week’s US CPI data will likely show a rise in headline inflation from 3.0% to 3.3%, but that is less important than the core inflation data. The market expects core inflation to remain at 4.8%, and that is the nub of the Fed’s problem. Some (like us) will argue that US growth is very robust at present, which would naturally cause greater inflation risk. But even those that argue that the US is already slowing down, they must be disappointed that core inflation is remains sticky despite some weakness in demand in some sectors of the economy.

Chart 3: Core Inflation Sticky at 4.8%

Oil prices a risk to inflation

Those who expect inflation to ease would be wise to look over their shoulder and see some of the emerging dynamics in the oil market. Saudi Arabia has extended its voluntary cut of 1 million barrels per day. Meanwhile, the US is delaying its absolutely necessary purchases of oil to replenish its strategic reserves. Instead, it is trying to buy back at lower prices. The dynamics of the oil market, however, suggest that prices should be edging higher and not lower. At some stage, we suspect the US will just have to step in and pay the price. US strategic reserves are at a 40-year low. Also, the latest weekly draw on US crude oil inventories was the highest since the data started in 1982. We continue to advocate holding oil equities as a way of mitigating against inflationary risks resulting from higher oil prices.

Chart 4: Higher Oil Prices Threaten Even Higher Inflation