- Market Insights

Update for week of 15 March 2023: US inflation data due this week, market expects 6.0% year-on-year

The mini-banking crisis centred on SVB in California continues to damage market sentiment with equities down and high-quality bonds rallying. Gold Silver and Platinum have rallied 5-7% over the past week while the dollar has slipped.

The bond market is seeing extreme price movements as investors reprice some credit down heavily and US treasury yields experience wild swings. The yield on the two-year US Treasury rose 18bps after sliding 60bps on Monday. The biggest one-day slump in decades.

Chart 1: US 2-year government bond extreme volatility

The pressure remains on those banks that were seen by the market to be vulnerable in the wake of the failure of SVB. Moody’s put all long-term ratings of First Republic Bank on review. This action reminds us of the challenges in the global financial crisis where (late in the day) rating downgrades only added to market volatility as the market sought out the who’s next to fail. We are seeing a rush of investors re-aligning their deposits taking them out of banks that they believe are less credit-worthy and placing them in the top six banks.

In Europe Credit Suisse is in the limelight. The cost of insuring the bonds against default rose to an all-time high and the stock price fell as much as 15%.

Chart 2: Credit Suisse Credit default Swap

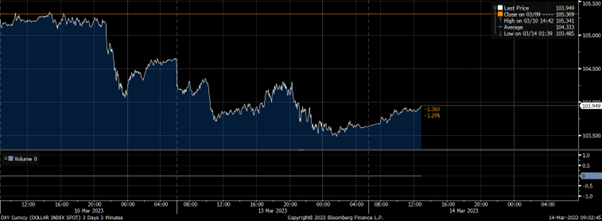

In Asian trading the dollar appears to be stabilising after a sharp fall in the past three days.

Chart 3: US dollar trade weighted index

Gary Dugan

Chief Executive Officer & Chief Investment Officer,

The Global CIO Office