Taking the Edge off the Risks

- Financial Insights

- Market Insights

- Weaker-than-expected US inflation data reduces the risk of further outsized Fed rate increases

- The dollar is likely to be under downward pressure as both the Bank of Japan and the ECB remain under pressure to tighten rates

- The reduced risk of a higher dollar and dollar interest rates is a boon for emerging market assets

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

Last week’s good US inflation report, which showed prices increased at their slowest pace in two years, somewhat blunts the risks of very high interest rates and has reinforced the recent weakness of the dollar.

A weak dollar, in our view, is particularly helpful to the emerging markets, which should be the first bloc of countries to be in a position to cut rates to further strengthen their economies and asset markets.

US inflation—A downside surprise

Last week’s better-than-expected US inflation report led to a rally in both bond and equity markets. When markets are on the rise, there’s often growing pressure on commentators to go with the flow by expressing more positive views about the global economy. However, we caution investors to not get too carried away by just one good US inflation number. Instead, it would be best to look at the overall picture of how the risks to the markets are evolving in the backdrop of the current inflation scenario.

Our interpretation, given the recent US inflation news, is that the risk of persistently high inflation and substantial increases in Federal Reserve’s policy rates has decreased. The reopening of supply lines and the growing price sensitivity of consumers are contributing to a decrease in inflationary pressures.

Assuming that the risk of significantly higher US interest rates has diminished, this should be beneficial for emerging markets. High US interest rates often worry these markets where central banks, devoid of options, may be forced to raise their own rates to protect their currencies. However, a weaker dollar and the levelling-off of US interest rates would allow emerging countries the room to operate more independently. With this new found flexibility, emerging markets may potentially cut interest rates through the balance of the year. It also provides them with an opportunity to pursue growth without the fear of igniting a currency crisis or a significant increase in inflation.

In fact, a few emerging markets look already set to cut rates over the balance of the year. Latin America looks likely to lead the charge with a rate cut from Chile within the month and major countries such as Brazil and Mexico following in due course.

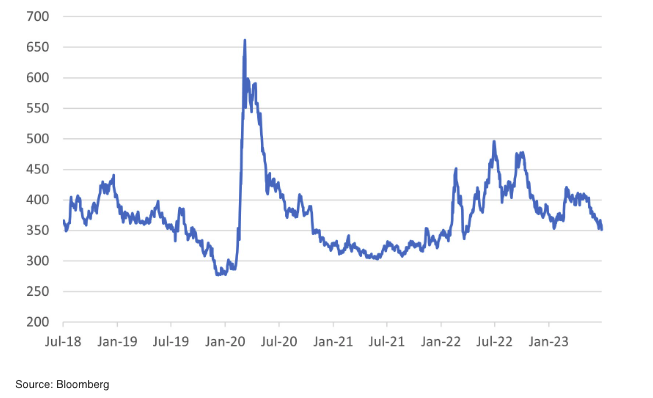

We believe that despite the recent good performance there is still an opportunity in emerging market debt. The emerging market debt index (EMBI) has already seen a good narrowing of the spreads over treasuries (Chart 1). The spread has dropped to 350bps from close to 500bps a year ago. However, over the past year the emerging market debt has shown its mettle with a lack of drama, in contrast to the woes of the small and medium-size US banks in the first quarter last year.

Chart 1: JPMorgan Emerging Market Debt Index Spread Over Treasuries

A recent survey by Swiss asset manager Vontobel found that three quarters of the institutional mangers they surveyed were looking to increase allocations to emerging market debt. There has also been an increased appetite for emerging market debt in local currency given the market’s conviction that the dollar will remain relatively weak if indeed we are approaching the peak in US policy rates.

Japanese monetary policy set to move onto a path of normalisation – Positive for Yen

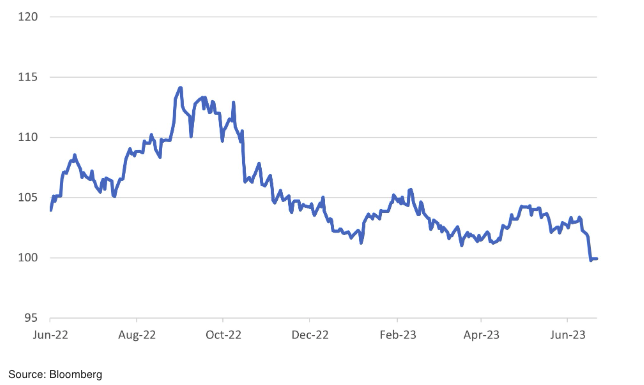

The dollar weakness could be reinforced by a shift in policy by the Bank of Japan to a marginally tighter policy. After a steady stream of better-than-expected growth data and higher-than-expected inflation, we expect an adjustment of the so-called yield curve control. In essence, the BoJ will allow bond yields greater freedom to move higher. The seeming start of a path to monetary policy normalisation would be taken positively by the equity market even if there is a commensurate headwind to corporate profits growth from a stronger yen.

Chart 2: US Dollar Trade-Weighted Index Drops Away

Overheating in Europe – A Stronger Euro?

Parts of Europe may suffer under a record heatwave, but the region’s economic outlook is distinctly cloudy and stagnant. Recent indicators along with a marked softening in the momentum of service sector growth suggest a recession is taking hold in the eurozone. The HCOB Eurozone Services PMI was revised downwards to 52.0 in June 2023, a significant drop from 55.0 in May and marking the weakest level since January. Meanwhile, the manufacturing PMI was revised downwards to 43.4 in June 2023, signalling the sharpest deterioration since May 2020. In line with the weak data, the ECB downgraded its growth forecasts for the eurozone in its latest bulletin, expecting GDP growth of only 0.9% this year, followed by 1.5% in 2024.

What is worrying the markets and the ECB is that softer demand is still not translating into lower underlying inflation. While headline inflation fell to 5.5% year-on-year in June from 6.1% a month earlier, core inflation rose to 5.4% from 5.3%, mainly due to sticky service price inflation. The same pattern (only more extreme) is being witnessed in the UK.

As in the UK, much debate in the eurozone revolves around whether the path for inflation is tied to the labour market’s performance. The eurozone is now faced with ‘full employment stagnation’ where demand for workers is resilient, and supply is constrained. The eurozone unemployment rate at 6.7% is half the level it stood at ten years ago at the depths of the euro debt crisis. The employment rate (the share of the labour force at work) currently stands at 75% compared with 67% a decade ago. This is indeed a hot market, but the other side of the coin – productivity growth – is relatively weak and real incomes are stagnant. There are many theories about why this is happening, ranging from labour hoarding to jobs growth being biased to the less productive services sector. Nonetheless, combine this with an annual increase in hourly labour costs of 5% in the first quarter, and the ECB has a challenge. Real wage gains may indeed be limited this summer, but the rate of increase in the nominal variables (wages, and prices) is too high.