Taking a Breather

- Market Insights

- Financial Insights

- The Fed takes a breather, but ‘promises’ two further rate rises

- UK MPC could spring a surprise and raise by 50bps this week

- Bank of Japan still waiting for an opportune time to adapt their monetary policy – bad news for the Yen

- US equities a reflection of the tech sector not the economy

- High yield bonds face building challenges

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

As we had suspected, the Fed took a breather last week choosing to temporarily pause its rate hike cycle. The ‘breather’ though just didn’t seem consistent with the narrative the central bank presented to the markets after its meeting. The Fed still sees the need to raise rates and expects to keep the rates elevated level for some time. The Fed and many other central banks see inflation risk persisting for some time to come. It then begs the question: why doesn’t the Fed just get on with moving the interest rates to an appropriately tighter level? Why then take a pause?

The median point of the Fed governors’ forecasts of where the benchmark policy rate would be at year-end has inched up to 5.6%, from the median forecast in March of 5.1%. These new set of projections and the fact that inflation, growth, and employment have recently beaten forecasts make one wonder as to why the Fed isn’t just getting on with raising rates.

Chart 1: The Fed’s forecast for year-end 2023 Fed funds rate has risen at every meeting for a year

The market currently prices a 70% chance of a 25bps increase in the Fed funds rate at the July meeting and then nothing beyond that, even though the US central bank has signalled a high probability of the need to raise rates twice before the year ends. The market is concerned that the economy will lose momentum in the coming months.

Other central banks look likely to continue raising rates. The ECB sprang a hawkish surprise last week with its forecasts suggesting that inflation will remain problematic. The market consensus has moved to expect a further rate increase well beyond last week’s 25bps hike, probably to the 4% level by year-end.

Could the UK MPC diverge too and spring a surprise?

The market expects the UK MPC to raise rates by 25bps this week, but we would not be surprised if the MPC voted for a 50bps hike. UK consumer prices and wage inflation are still uncomfortably high, with limited evidence that they will revert to a level that would convince the MPC that the situation is firmly in its grip.

The Bank of Japan is slow to turn – Yen’s weakness to continue

Despite a new leadership, the Bank of Japan shows little signs of changing course. New Governor Kazuo Ueda continues to reiterate that inflation will moderate through the balance of the year. Hence, there is little sign of a move to adapt the Yield Curve Control policy. Consequently, the Yen has been left to fend for itself, which has seen it drift out further versus the dollar.

When Right is Wrong

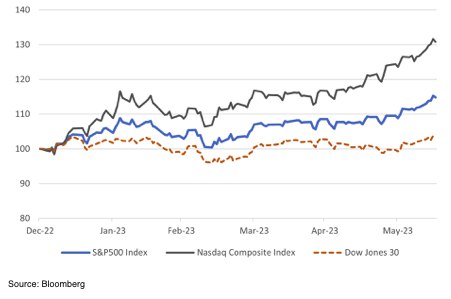

Are you – like me – sitting there scratching your head and asking “what happened?” Our views at the start of the year were that inflation would prove to be more problematic than the consensus expected, and that US policy rates would rise further than the market thought. We have been proved right on both counts, but we were somewhat wrong to assume that that would necessarily mean trouble for the US stock markets. Of course, it depends on which equity market index we are looking at to gauge the health of the economy. While the S&P500 has returned an impressive 14.9% and the teach-heavy Nasdaq a stellar 30.8% year-to-date, the ‘old economy’ Dow Jones 30 has returned just 3.5%. The AI/Chat GPT phenomena has overwhelmed all. As has been often quoted by strategists in recent months, only a handful of stocks have contributed to most of the gains the market has witnessed. We are reminded of an old adage here: “You are buying a stock market and not an economy”.

Chart 2: US equity market performance driven by technology sector

Tech rally not supported by the trend in 2023 consensus earnings forecasts – but who cares?

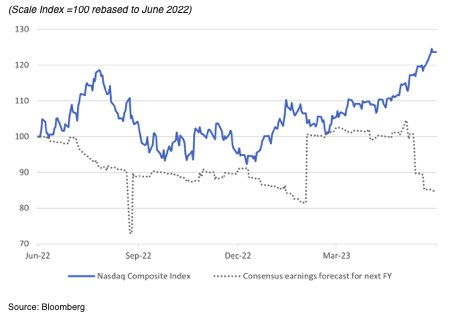

As a further thought on the US tech sector, the rise in the Nasdaq Composite Index is at complete odds with the trend in the corporate profit forecasts for the index constituents. Consensus forecasts for the current year have dropped 15% since February, while the index has surged 25% during this period. We would admit that the valuation of the tech sector is a lot more than just about the next 12 months, but the 40% gap between the trend in corporate profits and the performance of the NASDAQ Composite Price Index is a bit confounding. However, it’s a good measure of the hype or excitement surrounding AI at present.

Chart 3: Nasdaq Composite index at odds with direction of earnings forecasts

The Challenge to High yield Borrowers from Maturing Debt

We sounded a mini alarm bell on high yields last week, arguing that spreads did not appear to discount the likely angst resulting from worries that Fed policy may slow down the economy. What compounded our concerns further was a chart we sourced from a Bloomberg article that highlighted the short duration of the US high yields – the lowest in the history of the index. As a borrower what you don’t want is the challenge of relatively high interest rates and an increasing risk of not being able to roll over your debt. A few decades ago – in 1989, to be precise – the average borrower, although paying high interest rates on their debt, wouldn’t have been so worried about rolling over their debt as the average maturity at that time was 10 years. Today, high yield borrowers are facing both high interest rates (average US corporate borrowing costs were up 22% in Q1, according to a survey by financial data provider Calcbench) and an average maturity of just five years. In essence, the US high yield sector will witness a wall of refinancing much earlier, which, in our view is, another reason for caution.

Chart 4: The Bloomberg US Corporate High Yield Index- Lowest Time to Maturity in History