Really?

- Financial Insights

- Market Insights

- The drop in US inflation leaves long-term interest rates closer to real returns but not quite

- US inflation expectations are still on the rise potentially pushing the case that bonds yields are not yet attractive enough for wholesale buying.

- Mixed economic data shows robust growth but clouds on the horizon from higher unemployment and tighter credit conditions.

- India – The growth market

Gary Dugan

The Global CIO Office

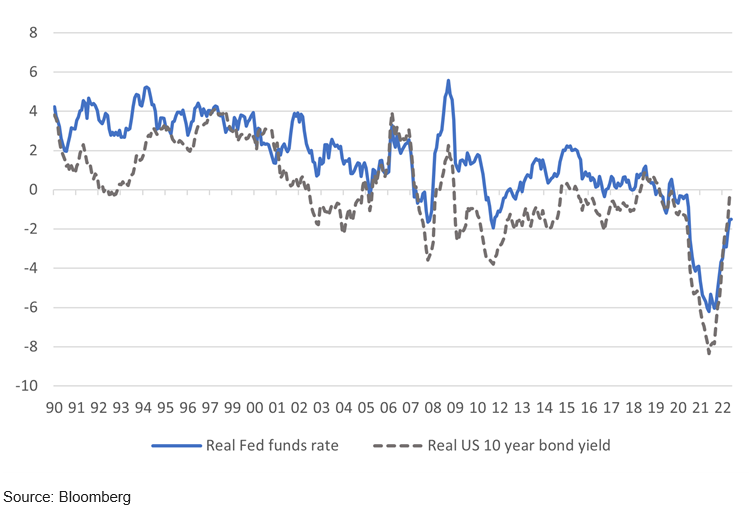

US interest rates are (almost) real

As expected, the US headline inflation rate fell to 4.9% in April. With an increase in the Fed funds rate and rebound in long-term interest rates combined with this downward path for inflation, it is only a matter of time before yields turn real, i.e., interest rates move above the current rate of inflation. The Fed funds rate, as Chart 1 shows, is hovering near the current rate of inflation, while the 10-year government bond yield is still somewhat shy of inflation. The Fed funds rate is just 10bps below the rate of inflation. 10-year government bond yield are 150bps below the rate of inflation.

Chart 1: The real US 10-year government bond yield and the Fed funds rate

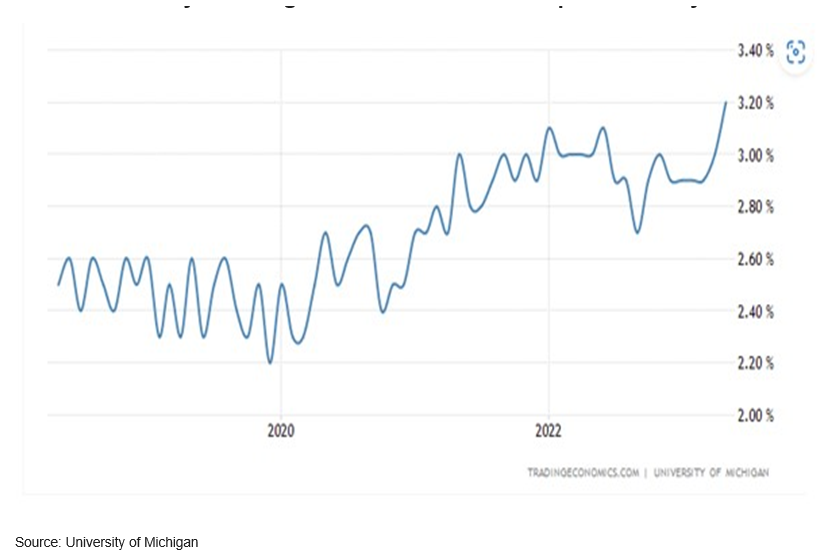

On the surface, as the charts suggest, the real bond yields and the real Fed funds rate have moved back to a range that is a lot closer to the historical norms. But what troubles us are the longer-dated bond yields that sit a good 100bps below what would ordinarily be seen as the ‘optimum’ real yield. Hence, to be a buyer of longer-dated bonds, one has to firmly believe that inflation will eventually settle closer to the 3% mark rather than the current 4.9%. Indeed, household expectations for inflation for the next 5-10 years are in a range that is close to 3% , but those expectations have been on the rise. Data last week showed that the University of Michigan’s survey of inflation expectations over the next 5-10 years rose to 3.2% compared with market consensus of 2.9% and the Fed’s target of 2.0%. Those higher inflation expectations may see investors demanding higher bond yields as compensation for the higher inflation.

Chart 2: University of Michigan household inflation expectations – year 5-10

The New York Fed also recently reported an uptick in household three-year inflation expectations in April. Some analysts have excused the outlook for inflation as quite unstable given the increase in inflation expectations of late. All of the data plays to the idea/assumption that inflation looks sticky going forward. Inflation data still fails to consistently support the view that inflation is simply on a gently declining trajectory.

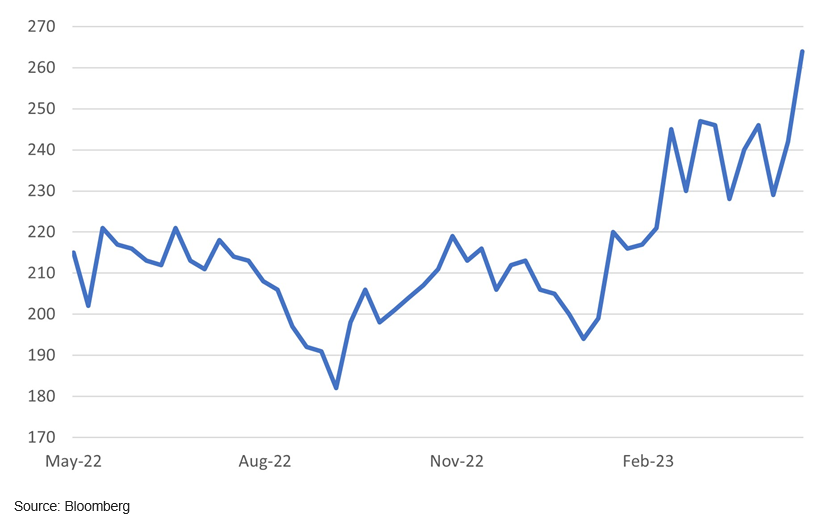

The markets continue to be challenged by mixed economic data. As we outlined last week, global growth remains relatively robust and industrial confidence is generally upbeat. However, the market is also aware of the clouds on the horizon. Last week’s US data showed a marked increase in tightening of lending conditions. Jobless claims, meanwhile, rose at a pace that normally signals an impending recession.

Chart 3: The jump in US jobless claims signals challenges ahead for growth

India – The growth market

A two-week tour of five major India cities left me greatly convinced that the Indian asset markets are well on their path to gaining a standalone status in foreign investor portfolios and not just be a part of the emerging market story that in any case is a bit complex.

Investment in infrastructure is enabling the country and its entrepreneurs.

I’ve been a close follower of the Indian economy largely through the Modi government years. The early structural changes, for sure, altered the international investors’ perspective of India, but the more recent huge, visible changes in the country with straight highways between cities, new high-tech airports, and new power lines spreading across the country are a testament to the country’s growing economic potential. The greater infrastructure is enabling entrepreneurs to take their ambition to a new level.

The energy in the country is palpable, as is the increased confidence and ambition among its people. India is scaling up its ambition – and spending – across industries and growth is following.

From entrepreneurs across industries, I heard of stepped-up ambition, a significant increase in achieved revenue growth, large increases in realised equity value, and outsized expansion plans. The IMF recognised the strong growth potential in its most recent report released two weeks ago, setting out the case for India to be the fastest growing economy in the world with GDP growth of 5.9% projected for the current fiscal year.

India has already become the third-largest domestic aviation market in the world. A few weeks ago, the country’s domestic air traffic hit a record high of 456,000 passengers flying on a single day. The number of operational airports in the country has doubled to 148 in 2023 from 74 in 2014. The Bengaluru airport, for instance, recorded 96% growth in passenger volume in the last financial year, i.e., 2022-23.

Last calendar year the top seven cities added more than 2.6million sq ft of mall space, a 27% increase on the previous year. This year the largest seven cities are expected to add another 11 million sq ft of mall space, more than three times the past three (COVID-affected) years combined.

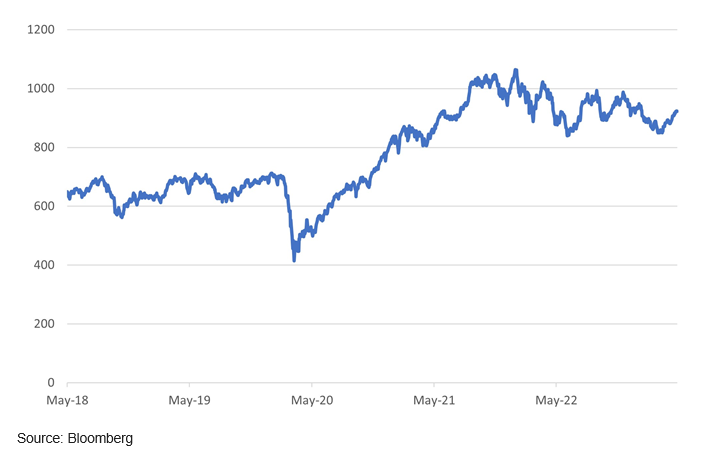

The equity market has marked time since the COVID rally. Domestic investors have lined up to scoop up stocks. Equity ownership of domestic investors continues to grow and touched a new all-time high of 24.4% in December last year. Retail ownership of the equity market stands at 7.34%, a low number by international standards (US is at 23%), but still an all-time high. However, international investors, it appears have been too preoccupied worrying about the Fed and the risks of a US recession to see clearly the opportunity that is India. We are looking for opportunities in the Indian equity market to add significantly to our portfolio. We see India eventually taking off as the growth market in the world.

Chart 4: MSCI India equity index (TR $) has marked time since post COVID rally