Nothing is For Certain

- Financial Insights

- Market Insights

- The market’s positive reaction to last week’s news flow was exaggerated by the closing of an enormous, short treasury position in the market

- Given elevated volatility in asset markets now is not the time to take outsize risk positions

- We see signs of weakening US growth, however the read through is not necessarily for significantly lower inflation and early rate cuts

- We recommend limited risk taking at present – stay broadly invested in markets with a bias to overweighting cash

- The news flow from Japan remains constructive for the equity market

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

It does not feel like an environment for elevated risk taking. While the markets enjoyed the outcome of the FOMC meeting and the subsequent soft US employment report, as investors (and the central bankers) we are still living from data point to data point in the US at present.

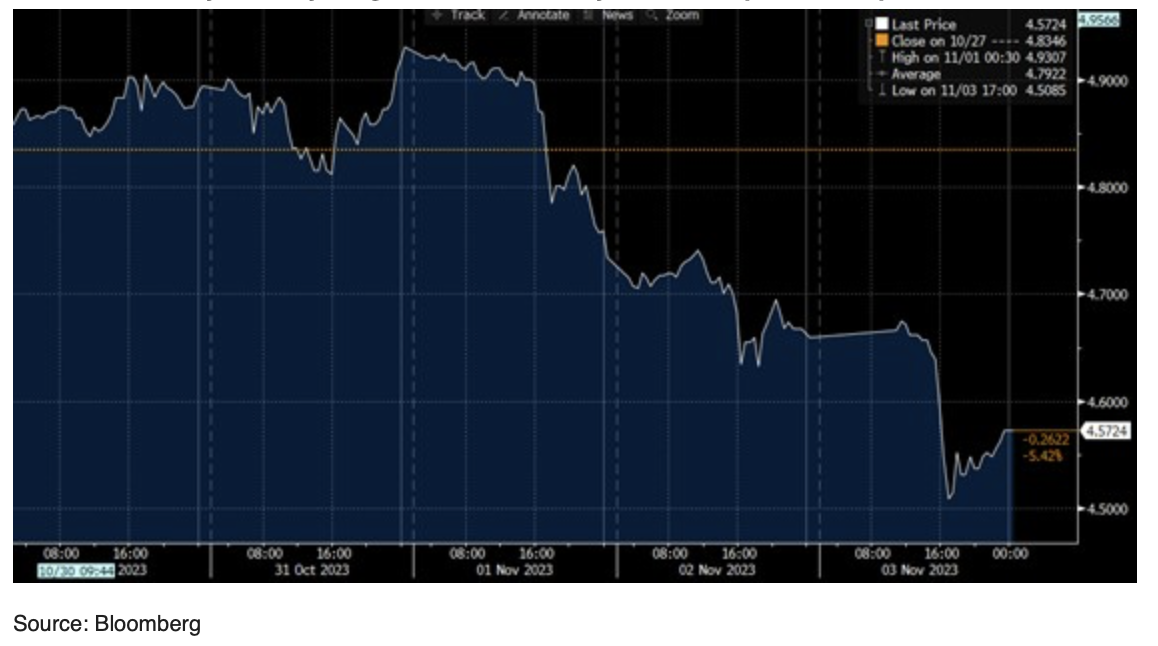

As a money manager, the time to take additional risk is when volatility is low, and you have confidence in your view of the markets. Last week, volatility in the bond market was unprecedented with a peak to trough drop of 43bps in the US 10-year government bond yield. It would be wrong to see the move as a validation of a more positive view of the future. The fall in bond yields was for sure the consequence of good news from policy makers and economic data. However, the scale of the rally in the bond market was exaggerated by the closing of a huge, short position in the treasury market.

Chart 1: Intraday US 10-year government bond yield – Exceptional drop on the week

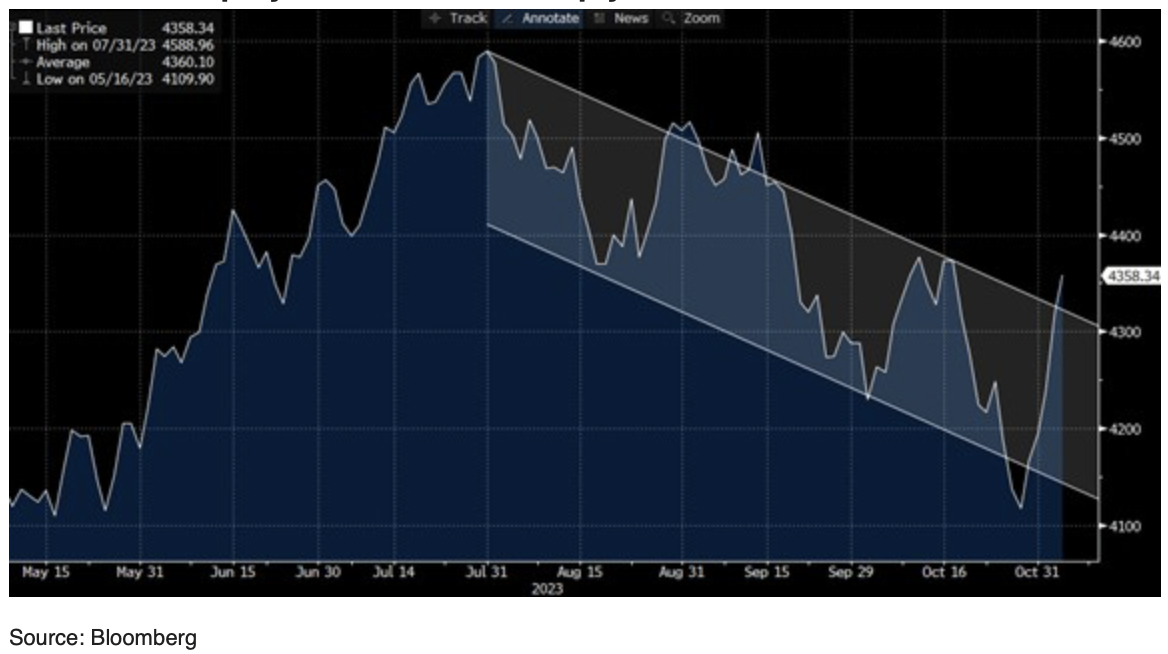

Last week’s rally in the US equity market was universal with 479 of the S&P 500 components recording gains on the week. The recent rally has seen the US equity market notch up gains of 5.9% since the 27 October close. But that is just one part of the dynamic. The important question is whether the market remains – for all intents and purposes – in the downward channel established since the end of July or whether we are close to the peak of a bear market rally?

Chart 2: US equity market rallies sharply from recent low

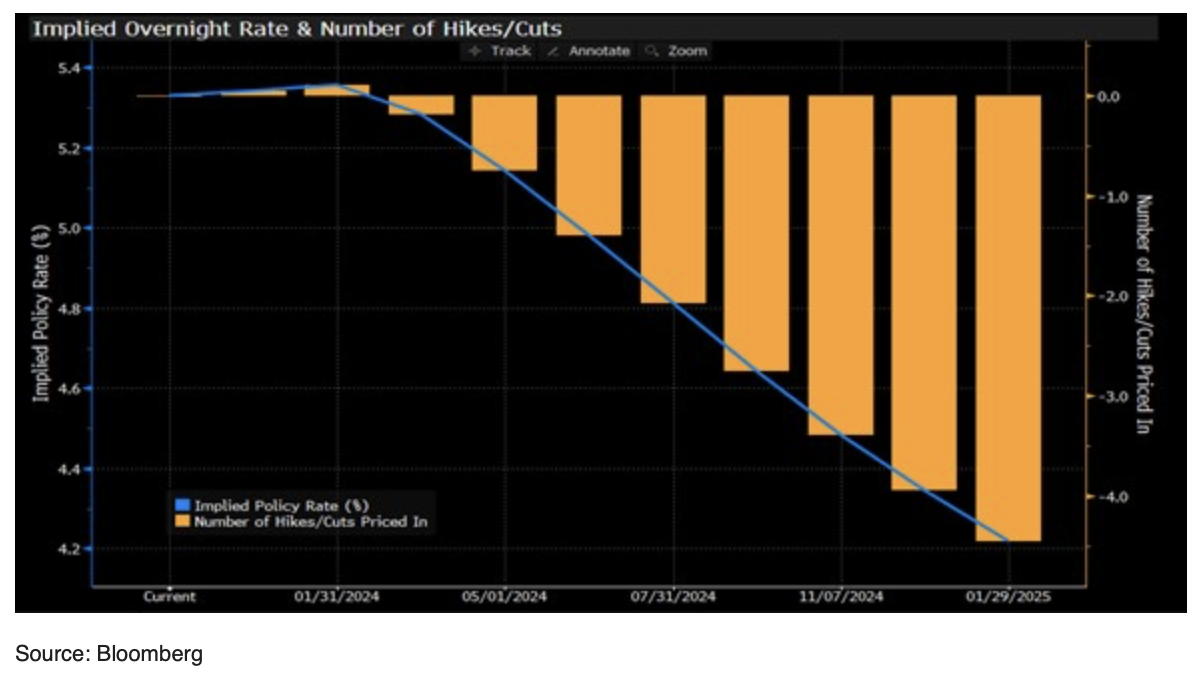

The volatility that we see in the markets is because of the prevailing macro conditions, but the FOMC’s repeated adjustments to policy views have also created uncertainty. Under the chairmanship of Jerome Powell, the markets have become used to an almost entirely reactive Fed policy making. Since the days of the ‘transitory inflation’, the US Fed has often dramatically shifted its stance, adding to the volatility in the markets. For instance, over the course of the last two meetings, we have seen both a hawkish tone in September and a more conciliatory dovish stance in November. The September meeting surprised the market, raising the risk of a further rate hike and the likelihood of the policy rates remaining elevated for some time to come. The November meeting, however, has led to a strong view priced into the market that rates have peaked and that the Fed will cut through the course of 2024.

The market prices a first rate cut in the second quarter followed by three further cuts over the rest of 2024.

Chart 3: Market expectations for Fed policy rate moves over the next 15 months

Geopolitical challenges could weigh on GDP growth

The geopolitical challenges in Europe and the Middle East add to the downside risks to both the outlook for global growth and inflation.

The equity market has run to discount the main positive of the week – the drop in long-term interest rates, but not the related negative, i.e., the likely fall in corporate earnings forecasts as GDP growth declines. Over the past month, through the quarterly results season, analysts’ forecasts for the earnings of the S&P500 constituents have in aggregate remained unchanged, although estimates for revenue growth have marginally fallen. Economists currently expect US GDP growth of 1.5% in Q4 – significantly lower than the 4.9% reported thus far for the third quarter.

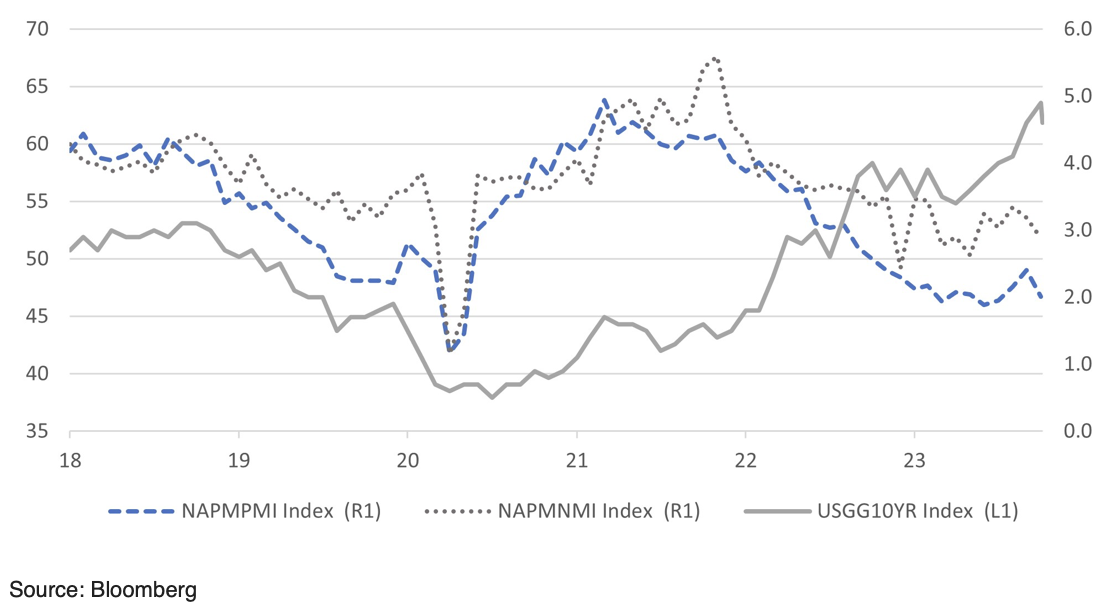

Both the ISM manufacturing sector survey and the ISM service sector survey signal that the GDP growth in Q4 could indeed falter somewhat. After the recent rebound in confidence for both the manufacturing sector and the service sector, the latest data for the month of October was worse than expected. It is interesting to note that the last time the manufacturing sector survey was at these levels the US 10-year yield was at 0.5% to 1.0%. Other than for the COVID crisis, and the recent noise in the economy, service sector confidence has not been at this level since 2010.

Chart 4: ISM service sector survey still above 50 but manufacturing potentially in recession

We must remind ourselves that we are in unchartered territory given the combination of circumstances in the markets that investors have not faced in decades. Inflation may be down, but it is not out. US bond yields may be lower on the week, but they are still higher than we have witnessed for many years. Geopolitical challenges are extreme, with potential outcomes that could only make things worse. Meanwhile, in the largest economy in the world, we wait to see if one of the primary candidates for the president’s post will be locked up or free to compete in the next election. In the second largest economy in the world, the intentions of the president are opaque, although at least last week, there was a slither of good news with a significant stimulus programme in train.

We do not have all the answers on handling the current circumstances as investors build their portfolios. Still, we encourage them to stay close to their benchmarks and not speculate wildly on the economy’s direction going forward or the moves policymakers are likely to make.

It is best to invest in regions and markets with at least news of supportive policies. Last week, the Japanese government approved a supplementary budget worth around 2% of GDP over the next three years. The budget aims to offset the impact of inflation on the spending power of Japanese consumers. While there is an expectation among economists that wage growth may accelerate in 2024, there is a time gap where income growth is way below the rate of inflation, potentially pulling confidence lower and leaving the economy at risk of decelerating seriously. We remain positive on the Japanese equity market.