Mounting Headwinds to Markets

- Market Insights

- Financial Insights

- Signs that investors are expecting higher inflation for much longer

- Geopolitical challenges in the Middle East continue to generate inflation risk

- Bond market volatility visibly on the rise

- More corporates allude to the economic cost of high rates

- Remain tactically cautiously invested

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

In our latest presentation to a discerning group of private clients and investment professionals, we conducted a poll regarding the outlook for inflation in the United States over the next two years. The query posed was straightforward: Where will US inflation stand in two years? The results were telling, with only a mere 20% of the respondents envisioning a scenario where inflation hovers within the Federal Reserve’s target range of 1% to 3%. In stark contrast, a resounding 80% of the participants foresaw inflation ranging from 3% to 5% or even surpassing the 5% mark.

These findings serve as a candid reflection of the prevailing apprehension among investors in the current global economic landscape. Although economic recovery more or less remains on track, central banks are far from declaring a victory in their battle against the tide of inflation.

Even prominent figures in the central banking world, like Reserve Bank of Australia (RBA) Governor Michele Bullock, have expressed concerns. Bullock has pointed out that inflation, particularly in the persistently sticky services sector, may prove challenging to tame. Federal Reserve Chair Jerome Powell has been equally forthcoming, stating, “We are closely monitoring recent data that showcases the resilience of economic growth and the strong demand for labor. Any further evidence of sustained growth above the norm, or a halt in the labor market’s loosening, could jeopardize our progress in managing inflation, potentially necessitating further monetary policy tightening.”

This week’s US inflation data represented by the PCE deflator is expected to show month-on-month change in core PCE deflator increase from 0.1% to 0.4% – a further sign of the persistence of underlying inflation pressures.

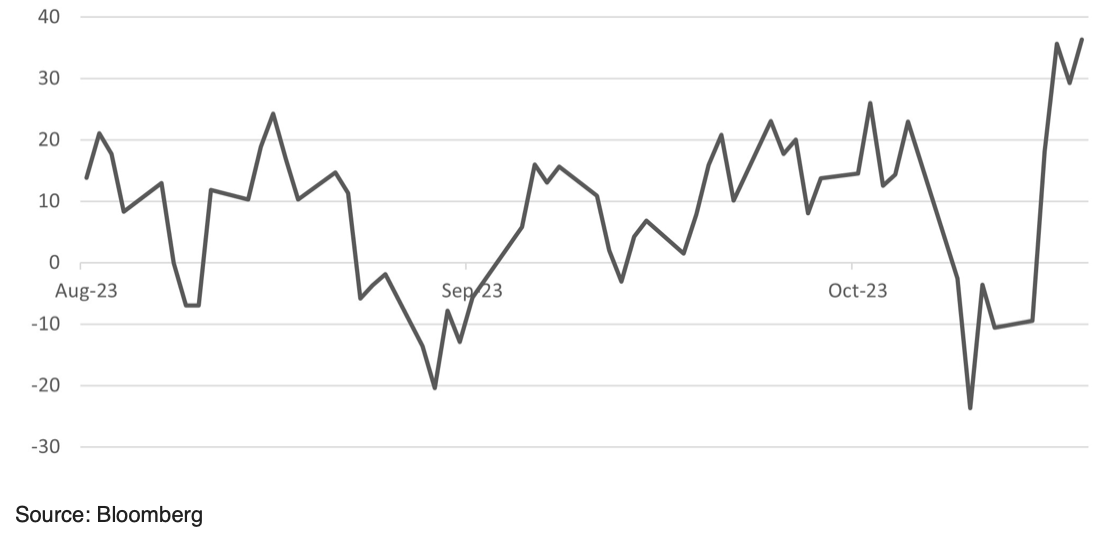

As discussed in our previous newsletter, the geopolitical landscape, particularly the events in the Middle East, has introduced a dichotomy of circumstances. Generally, these situations tend to induce risk aversion among investors, typically prompting a flight to the safety of bonds. However, in this instance, there exists a dual risk of reduced economic growth and elevated inflation. The surge in oil prices further reinforces the newfound correlation between bond and equity returns, leaving investors with limited avenues to shield themselves from downside risk. In fact, the recent 36-basis point increase in the yield of the U.S. 10-year government bond in just five days represents the most significant five-day yield surge witnessed in half a decade.

Chart 1: Five-day basis points change in US 10-year government bond yield – a multi-year high

More Inflation

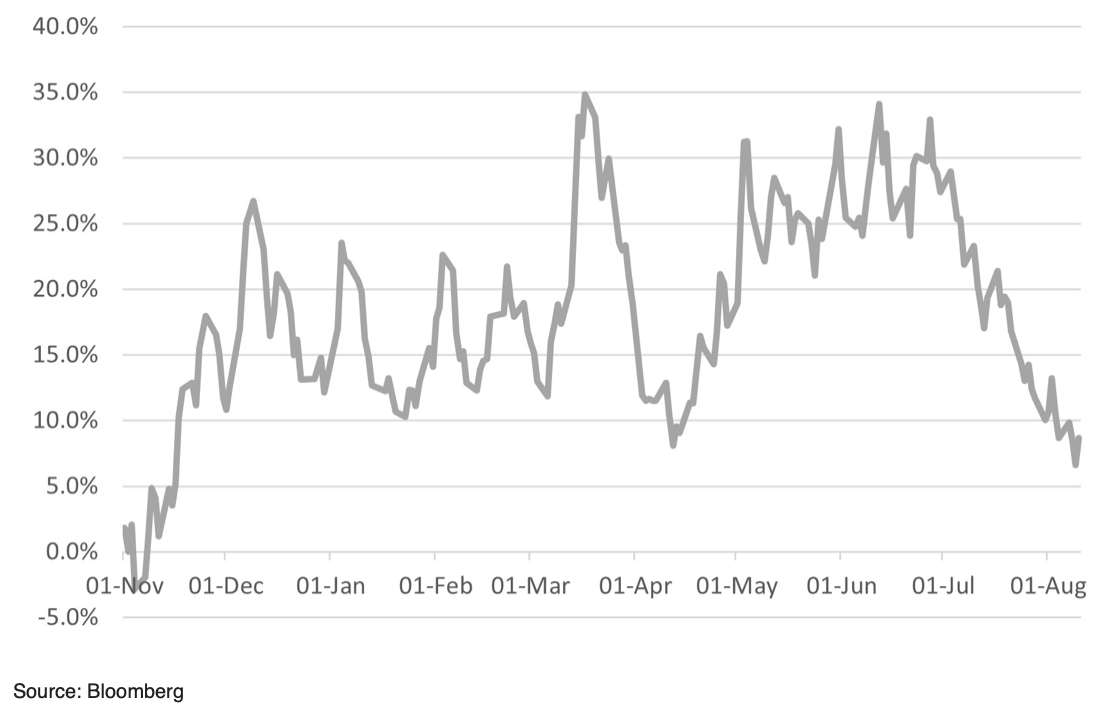

The looming specter of inflation grows even more imposing, especially considering the recent sharp ascent in oil prices, which have shot past $90 per barrel in recent days. If oil prices persist at this level throughout the rest of 2023 and into 2024, this could potentially inject another bout of inflation into the global economy. Historically, oil prices had exerted a dampening effect on headline inflation, particularly when compared with the preceding year’s high oil prices. However, as we approach November and December, if WTI oil remains at its current level of $90, it would translate to a 25% year-on-year increase in prices. Notably, the dip in oil prices in late September and October facilitated a swift 10% reduction in the average U.S. gasoline price, helping tame U.S. headline inflation somewhat. However, we now face the prospect of a complete reversal of the benefits garnered from falling oil prices, and potentially more. (Refer to Chart 2 for a visual representation of this dynamic).

Chart 2: The implied year-on-year change in oil prices were WTI to stay at $90

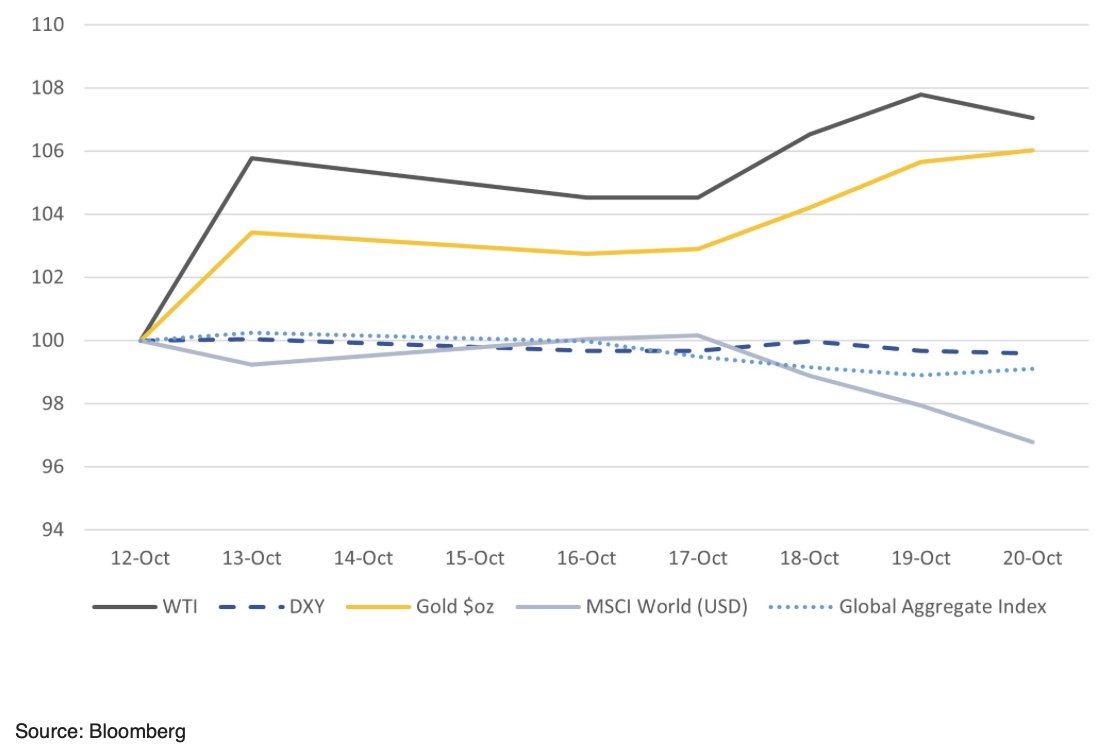

Equities are beginning to react more noticeably to the rising bond yields, which was evident from the somewhat tumultuous ride in the markets last week when equities showed declines from 2% to 5%. Notably, the usually stable Swiss market index saw a sharp 5% drop over the week.

Higher Interest Rates and a Depressed Economic Outlook

As the persistence of inflation continues to worry policymakers, the impact of long-lasting higher interest rates on various sectors of the global economy and select companies is becoming increasingly evident. The changing economic dynamic prompted Tesla CEO Elon Musk to express his concerns about the adverse effects of high interest rates on the demand for cars. Consequently, Musk said, the company has decided to delay the construction of a planned factory in Mexico, which, in turn, resulted in a 16% plunge in Tesla’s stock for the week.

Even as Tesla sounded concerns about higher interest rates, Goldman Sachs Bank found itself dealing with issues related to its Commercial Real Estate (CRE) portfolio. The bank reported another write-down in this portfolio in its recent quarterly results. Although Goldman has successfully reduced its CRE exposure by 50% year-to-date, this reduction has been primarily achieved by significantly devaluing these assets to ultimately remove them from its books. For the just-concluded quarter, the company took a real estate-realted impairment charge of $358 million. Only a few weeks ago, Goldman Sachs Asset Management had discussed the potential for a 20-40% downside for the office sector. We must note here that there is a massive $2.6 trillion worth of US CRE loans maturing over the next five years. Nevertheless, even as it discussed those challenges, Goldman Sachs saw its share price experience a more modest decline of 3% on the week.

Solar power equipment provider SolarEdge sounded an alarm last week, warning of a significant slowdown in demand for solar panels across Europe. The company attributed the slowdown to high interest rates increasing the overall cost of investing in solar installations, which are typically expected to yield returns over an extended period. Consequently, SolarEdge’s share price plummeted by 30% during the week.

Chart 3: Markets struggle with higher oil prices

All data rebased to October 12, 2023 = 100

Our recommended portfolio strategy stands firm, reflecting our commitment to prudent investment management. We maintain a defensive posture, holding a solid allocation to cash and gold. It’s essential to exercise caution regarding high yield debt’s cyclical nature; we recommend avoiding excessive exposure. While we suggest underweighting duration in bond portfolios, we urge a measured approach and discourage an excessively short duration position. This approach is rooted in our awareness of the potential for significant growth setbacks if geopolitical tensions escalate. In the realm of equities, we stand by our advice to include exposure to the energy sector as a valuable portfolio hedge. Our overweight position in Asia, with a particular focus on Japan and India, remains unchanged.