Maybe we should talk about 5%

- Market Insights

- Financial Insights

- A reaccelerating global growth has economists having to consider much higher long-term interest rates

- Meanwhile, economists have revised up third-quarter growth forecasts on strong end-consumer demand

- Historical precedents suggest a 5% US 10-year government bond yield is possible

- Japan delivers a huge upward surprise on GDP growth

- Prospects of higher long-term interest rates weigh on equity markets, but upward revisions to corporate profit forecasts could help equities hold ground

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

The “shock” of a reacceleration in global growth even as core inflation persists and remains sticky is pushing investors – and economists – to consider levels of long-term interest rates that were previously unthinkable. We believe that there are good arguments for why a 5% US 10 year bond yield is quite possible.

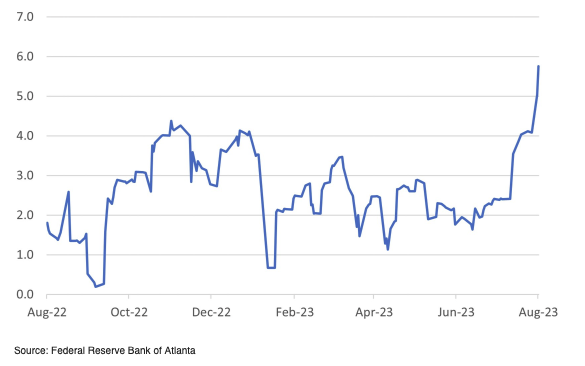

But the growth story first. US economic data last week was far more robust than the market had expected. On virtually any measure, retail sales growth for July was twice the market estimates. Industrial production growth at 1.0% month-on-month was well ahead of consensus expectations of 0.3% (acknowledging a small downward revision to the previous month’s number). The Philadelphia Fed survey saw a surprise spike in industrial confidence (outlook) to an index level of +12 compared with estimates of -10. Based on the current data flow, the Atlanta Federal Reserve estimates that it is consistent with GDP growth running at an annualised pace of 5.8%.

Despite many a market commentator being in denial, US growth is running at a pace far quicker than consensus expectations, and inflation is not necessarily trending back to the Fed’s long-term target range. The market doesn’t lie, and the US 10-year government bond yield now fiddling with 4.30% is a sign of investor discomfort with – and despite – the strength of the economic data flow. The forecast last week that the US 10-year yield could reach 5% made us sit up and take notice for reasons more than one. We had spoken exactly along those lines a year ago at a conference here in Dubai, but some in the audience looked at us in disbelief – as if we had come from a different planet.

Chart 1: Nowcast Estimate of the Current Pace of GDP Growth (%)

The US economic surprise index has climbed to a level of +77, maintaining its positive trend over the past six weeks. It is the biggest positive surprise of all US economic data since economic recovery started taking hold in late 2020/early 2021 after being initially battered by COVID.

Chart 2: US Economic Surprise Index Hits the Heights

The bond market is unsettled, and investors will need some time to understand where high yields are headed. It is even difficult to put a range to the US government bond yield given that just the previous week we hit a multi-year high of 4.27%, which is, rather ominously, the highest since August 2007. The spike in yields has caught many a bond manager off guard. We monitor the performance of the strategic bond funds that typically run very active bets in the bond market. Our straw poll of the performance of strategic bond managers over the past two weeks shows that many lost money, or made little headway.

We agree with the view that the US 10-year government bond yield could test the 5% level in coming months. Chart 3 below shows the current level of the US 10-year yield adjusted for current inflation levels. Based on the current levels of inflation (the solid line), the real US 10-year yield is not at an exceptional level and could easily spike a further 100bps to match the real yield levels we saw in 2007 and then in 2016.

There are other arguments, too, for higher yields over and beyond the inflation risk. Considering Fitch recently downgraded US debt, investors may ask for an extra risk premium, since

- US debt no longer has the prized AAA credit rating status.

- US fiscal policy is out of control, with inordinate amounts of additional debt being added to the government debt on a daily basis.

- The US Federal Reserve still needs to trim its balance sheet further, adding to the net supply of bonds to the market.

- In 2007 government debt-to-GDP was far lower, and the US Federal Reserve had yet to invent quantitative monetary easing (and tightening).

Chart 3: US 10-Year Government Bond Yield

Bond experts have tried to model the recent move-up in yields to explain the spike. The consensus is that the regular variables detailing a move in bond yields explain only about 50% of the recent increase in yields. Therefore, something else is at work, since the models built taking into consideration the well-behaved inflation over the past decades are struggling to recognise the new dynamics at work in the economy.

In the meantime, according to the surveys of institutional investors, they have a greater than usual exposure to bond duration. Hence, bond yields could rise further if these investors decided to square off their positions and sell bonds.

Bond markets may not be looking forward to this week’s Jackson Hole symposium of central bankers. Given the backdrop of stronger-than-anticipated growth and still persistent core inflation in most parts of the developed world, the central bankers will likely remain hawkish. Third-quarter global growth forecasts are up around 0.5% in recent weeks as economists have reacted to stronger-than-anticipated consumer spending growth. Investors should expect central bankers to reinforce their message that policy rates will be ‘higher-for-longer’.

Japan – a nominally strong economy

The Japanese economy delivered a big growth surprise last week with second-quarter annualised GDP growth of 6.0% quarter-on-quarter, which was twice the market estimate. However, Japanese GDP data is notoriously noisy; hence, we would only take the numbers partially at face value. We suspect that any subsequent revisions to the data may lead to a drop in headline growth; however, there are more apparent signs of life in the Japanese economy, and we expect the Japanese central bank to remain under pressure to allow a further modest tightening of monetary policy.

Equity markets may see a silver lining

Equity markets should be basking in glory of the high rate of nominal growth; however, the yield spike has pulled the market back from its highs. The US equity market has fallen 5% from its end-July high and may fall a further 4-5% from current levels, taking the S&P500 back to the technical support level of around 4200. In the near term, there could be further downside risk to equities. The bearish bond markets may still provide a significant headwind to the markets. The silver lining from the upgrades to nominal GDP growth is the likelihood of upgrades to corporate profit forecasts through the balance of the quarter.