Look out for What they say, not What they do

- Financial Insights

- Market Insights

- The Fed should raise rates by 25bps and signal that they are not necessarily done

- US economic growth appears to be re-accelerating

- The ECB to follow the Fed and leave open the posibility of a further rate rise in September

- The Bank of Japan is still in two minds about tightening this week

- Pressure builds in China for a substantive fiscal boost – we live in hope

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

There are widespread expectations that the Fed will impose a 25 basis point rate hike this week, but the markets will be more keen on what the Fed has to say rather than what it actually does. What compounds the problem for the US central bank is that the US economy remains quite robust.

- The Atlanta Fed estimates that second quarter real GDP growth in the US has run at a seasonally adjusted annualised rate of 2.4%.

- Conditions in the labour market remain strong with close to full employment. The number of job openings has started to rise again.

- There are signs that inflation could re-accelerate. Gasoline and oil prices have both risen recently. Householders’ perception of inflation has also risen; the University of Michigan’s 5-10 year inflation expectation is at 3.1%, at the upper end of the recent range.

Sentiments that the markets are going to be challenged by tough macroeconomic conditions have disappeared (well, almost!). A Bank of America July survey of fund managers shows that 68% of the surveyed managers expect the economy to experience a soft landing, with just 21% expecting a hard landing. The growing perception that we are headed for a soft landing is evident in the performance of some sectors. REITs, for instance, have performed well over the past three weeks and they are one of the sectors that had previously discounted Armageddon as the valuation of many of the companies fell to significant discounts to their stated net asset value.

The ECB is also expected to hike the deposit rate by 25bp to 3.75%. The early part of the week sees some data points that may affect the mood of policymakers. For ECB Chair Christine Lagarde, it may be a slightly more complex task of deciding whether the data warrants a rate hike at this meeting itself or in September. The outlook for the economy remains mired in a raft of conflicting signals. Industrial confidence was strong in April but weakened markedly in May/June without any key driver. This week’s industrial confidence surveys should show us whether the softness in the economy was just a pause or whether that softness will extend and see the economy experience some weak growth. Economists are generally of the view that a recovery in consumer confidence will help the euro area economy regain its poise. Last week’s consumer confidence data release showed an improvement, but, by historical standards, consumer confidence remains well below the long-term averages.

We remain underweight European equities. The eurozone will experience significant challenges ahead as it tries to align monetary policy with the general conditions of the economy. For example, this week sees the ECB raising rates at a time when Spanish consumer price inflation is likely to report a further fall to just 1.3% year-on-year and Italy producer price inflation at -4.3%. The challenge for the ECB is that German inflation for July is expected to rise to 7.1% while for France it’s estimated to increase to 5.2%. European corporate profit forecasts have drifted lower since mid-May, keeping the equity market in check.

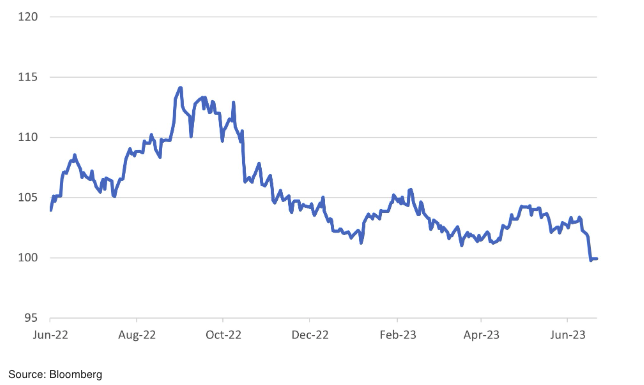

Chart 1: Eurostoxx Index Struggles to Provide Absolute Upside as Earnings Forecasts Slip

Eurostoxx index and Eurostoxx expected corporate profits rebased to Dec 22 =100

Bank of Japan action unlikely to upset the equity rally

Japanese equities, on which we retain our overweight view, have marked time of late, in part because of the bout of yen strength, which saw it climb to 138 against a dollar from 145. More recently, however, that strength has unwound somewhat with the Japanese currency settling around the 142 level. The yen’s volatility has been partly driven by the variety of opinions on the Bank of Japan’s next move. While the elements for a rate hike are in place, whether the BoJ will deliver a marginal tightening of monetary policy at this week’s meeting is still an open debate.

The market expects the BoJ to revise its inflation forecasts. Last week’s headline and core inflation readings were ahead of market expectations. Headline inflation of 3.3% was well ahead of the 1% inflation level when the Bank of Japan introduced its Yield Curve Control policy. While a tightening of monetary policy is not always seen as positive for the equity markets, in the case of Japan, it could indeed bring back some normalcy that has been absent for a few decades now!

Chart 2: Nikkei 225 Peaks Out

China – Hope Eternal

China’s GDP data last week disappointed the markets, with the CSI 300 equity index declining 2.0% on the week. Second-quarter GDP at 6.3% year-on-year was well below consensus expectations of 7.1%. Retail sales in June were up 3.1%, which is very modest considering the country is still in the rebound phase post the lockdowns. While the economy needs more confidence among householders and businesses, pressure must be building on the leadership to make a more significant shift in policy. The still higher youth unemployment rate at 21.3% in June will keep up the social pressure for some change of course by the policymakers.

In our view, exposure to Chinese equities remains a significant tactical opportunity. The 20% underperformance of the market against the global equity index year-to-date leaves it primed for a sharp recovery on any good news from the policymakers. The most likely policy mix going forward would be a further modest cut in interest rates, help for the housing market, and a further fiscal easing. We must note here that the post-COVID re-opening of China resulted from pressures emerging within the country and was a complete surprise. The social pressure could again encourage the authorities to move swiftly to bring a more sizeable response to the economic malaise causing economic imbalances in the country.

Chart 3: China’s Marked Underperformance Versus MSCI ACWI

MSCI China vs MSCI ACWI rebased to July 2022=100