It's Getting Hot Out There

- Financial Insights

- Market Insights

- World temperatures recently have been the highest on record

- US labour market strength coupled with likely still-high core inflation has the bond market worried

- US equity market looks complacent, but may remain so through a helpful reporting season

- Japan’s economy is running hot with strong CAPEX and wage growth

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

Last week was unprecedented at least on one count: the World witnessed the highest average temperature on record, not once, but thrice during the week. The phenomenon brought the focus back on how human activity is causing a rapid deterioration in global climate. A top climate scientist, Dr Paulo Ceppi from Imperial College London explained that the “Global temperatures will only start to approximately stabilise once the world reaches net zero”.

Employment growth in the US, too, remains hot if not outrightly unprecedented. The ADP employment survey last week showed that the US economy added close to 500k new job against expectations of 225k. Even as job growth remains hot, Fed’s predicament has been getting a firm grip on inflation and stabilising the US economy. Jerome Powell, the Fed chairman, has been candid in not ruling out back-to-back rate increases: “If you look at the data over the last quarter, what you see is stronger than expected growth, a tighter than expected labour market and higher than expected inflation….I wouldn’t take moving at consecutive meetings off the table at all”.

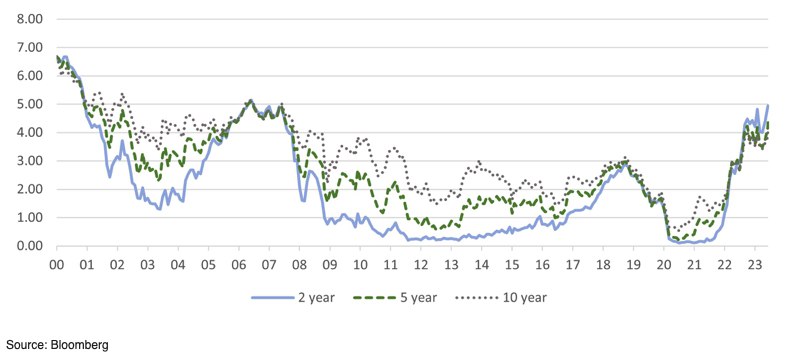

Bond yields – like temperatures – are running hot, too. While office air conditioning units ran full throttle fighting higher temperatures, traders in the bond market were witnessing some of the highest yields in years. In the US, the 2-year and 5-year government bond yields are now at their highest since 2007 (on monthly data).

Chart 1: US government bond yields at 16-year highs

In terms of yields, longer-dated bonds fared much better than their shorter-dated counterparts. The 10-year yield was up 20bps whereas the 2-year bond yields were virtually unchanged – the so-called bear flattener.

Performance of the US equity market at odds with the bond market

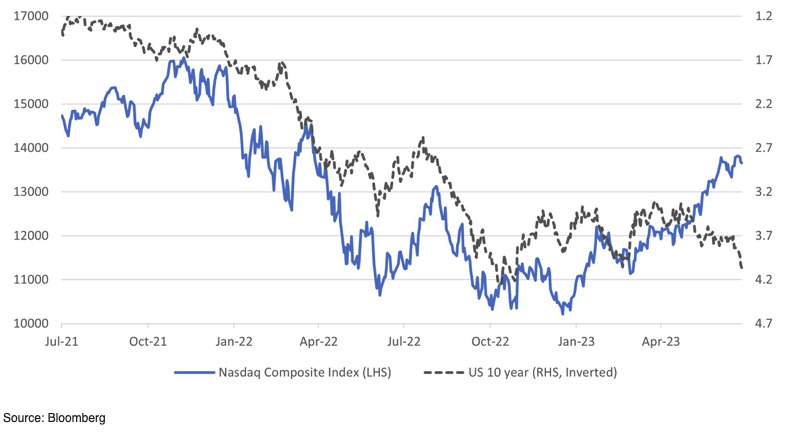

The equity markets experienced a downturn during the week in response to the sudden spike in bond yields. However, the US equity market remained relatively unchanged. We sense that investors are hesitant to sell their stocks and reposition into bonds because they fear missing out on potential rallies that may ensue if second-quarter corporate results exceed expectations. The consistent stream of positive economic news, particularly from the service sector, is likely contributing to investors’ reluctance to sell. To emphasise further, I have used a chart provided by Charles-Henry Monchau, a fellow CIO based in the Middle East. The recent performance of the NASDAQ Composite Index contradicts the recent trend of the US 10-year bond yield (Chart 2). Typically, an increase in long-term interest rates results in a decline in the value of growth stocks, such as those in the NASDAQ technology sector.

Chart 2: The recent rally in the Nasdaq Composite at odds with the rise in US 10-year yield

A US full employment recession?

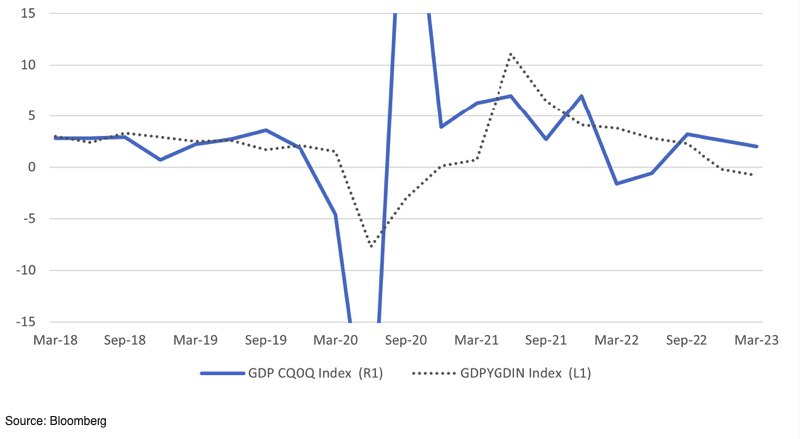

Given how recent US economic data has played out, there is a growing debate amongst economists as to whether we are in the midst of a full-employment recession? Recent strong employment data reinforces the fact that we are witnessing what can be termed as full employment, but questions may arise if indeed there is recession. The concept of growth is a bit technical and relates to the difference between Gross Domestic Production (GDP) and Gross Domestic Income (GDI). US GDP growth has beaten market expectations, whereas GDI data indicates that the US economy has been in recession since Q4 2022. Whether you put more weight on the GDP or the GDI number, the recent strong employment data and the ongoing persistence of high core inflation leaves no room for a cut in interest rates anytime soon.

Chart 3: Some measures of US economic growth suggest that the US is in recession

The debate then extends to whether the Federal Reserve has an effective tool in the form of interest rates to control inflation in the US economy. Unlike the UK where mortgage interest rates reset frequently, most US households have fixed-rate mortgages that remain unchanged for long periods, possibly decades. While an increase in interest rates can negatively affect the corporate sector, its effect on households is likely to be less pronounced. Furthermore, the Fed faces challenges due to the US government’s persistent overspending, which adds an additional demand factor that is ‘insensitive’ to interest rate changes. In fact, US government spending is projected to rise by 1.7% in 2023 before stabilising in 2024. According to the Congressional Budget Office, the US government deficit is expected to swell to 5.3% in 2023, expanding further to 6.1% in 2024 and 2025.

What will it be like going forward? Inflation and full employment look likely to persist even if the US economy moves into a technical recession. If indeed there is a marked slowdown in growth, the Fed’s ability to react in the form of measures will be impaired by the likely persistence of close to full employment and high core inflation. Indeed, at this juncture, there is every reason to believe that the Fed will have to push hard on the brakes with (quick) rate increases as they may not prove to be an effective tool to reduce growth – and inflation.

Bellwether stocks lead the charge of the reporting season this week

This week sees several major US financial firms reporting quarterly numbers. Focus this week will also be on the June US CPI report, where the consensus expects a 0.3% month-on-month increase in inflation, but core inflation is expected to be still running at around 5.0%. Unless inflation surprises majorly to the downside, the Fed is almost certain to increase policy rates by a quarter percentage point at its next meeting. Major banks such as JPMorgan Chase, Wells Fargo, and Citigroup report what is likely to be a challenging quarter with such an inverted yield curve and the aftermath of the mini banking crisis. The other prominent names reporting numbers will be Delta Airways, United Healthcare, and PepsiCo. The markets will be glued to the respective CEO’s take on the general health of the US economy.

Japan’s economy runs hot

It’s getting hot in Japan too, which should further support the Japanese equity market. The economic data flow continues to show Japanese economy is accelerating. A Bank of Japan Tankan survey showed that companies’ appetite to increase capital investment had risen strongly for the second consecutive year. Japan’s salaried workers, meanwhile, are seeing an acceleration in their wages. Total cash earnings rose 2.5% year-on-year against expectations of 1.5%.