It doesn't get any better, it gets tougher

- Market Insights

- Financial Insights

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

The Middle East is at the centre of global geopolitics once again – and this time for some very unfortunate reasons. Whether the developments will have a bearing on the financial markets is something that only time will tell, but the profound human suffering that has affected so many lives will certainly affect our collective psyche. Our hopes and prayers are for an eventual de-escalation and the restoration of peace in the region.

Just a few weeks ago the Middle East was the focal point of discussions at the G20 meetings, as global leaders tried to strike a chord on various issues. What also drew the world’s attention was the proposed India-Middle East-Europe Economic Corridor that promised to be a game changer given its potential to renew global integration. As the situation in the Middle East continues to evolve rapidly, this dream of greater regional cooperation and economic development must not be allowed to falter. The connectivity of the Indian subcontinent with the Western world would usher in an era of economic progress, bringing the opportunity for growth and prosperity to many.

Oil could pose problems

In the interim, these turbulent times carry the ominous prospect of elevated oil prices and heightened economic uncertainty. In essence, inflation is being wielded as a weapon, posing a threat to the supply of oil and potentially causing further disruptions to supply chains, notably through the strategically vital Strait of Hormuz.

Should the current hostilities intensify, there is a heightened risk of a substantial surge in oil prices, with some experts even speculating levels of $100-150 per barrel. Of course, the upper end of this range is contingent on a severe disruption to oil shipments via the Strait of Hormuz. At the very least, we anticipate an immediate upward pressure on oil prices resulting from the likely reinstatement of tighter oil sanctions against Iran. It is crucial to note that Iranian oil sales have covertly risen to the tune of 1 million barrels per day, as the United States had previously tolerated increased Iranian oil supply. It is essential to remind our readers here that United States’ strategic oil reserves are at their lowest in four decades, providing just 17 days’ worth of global consumption.

Gold as a hedge?

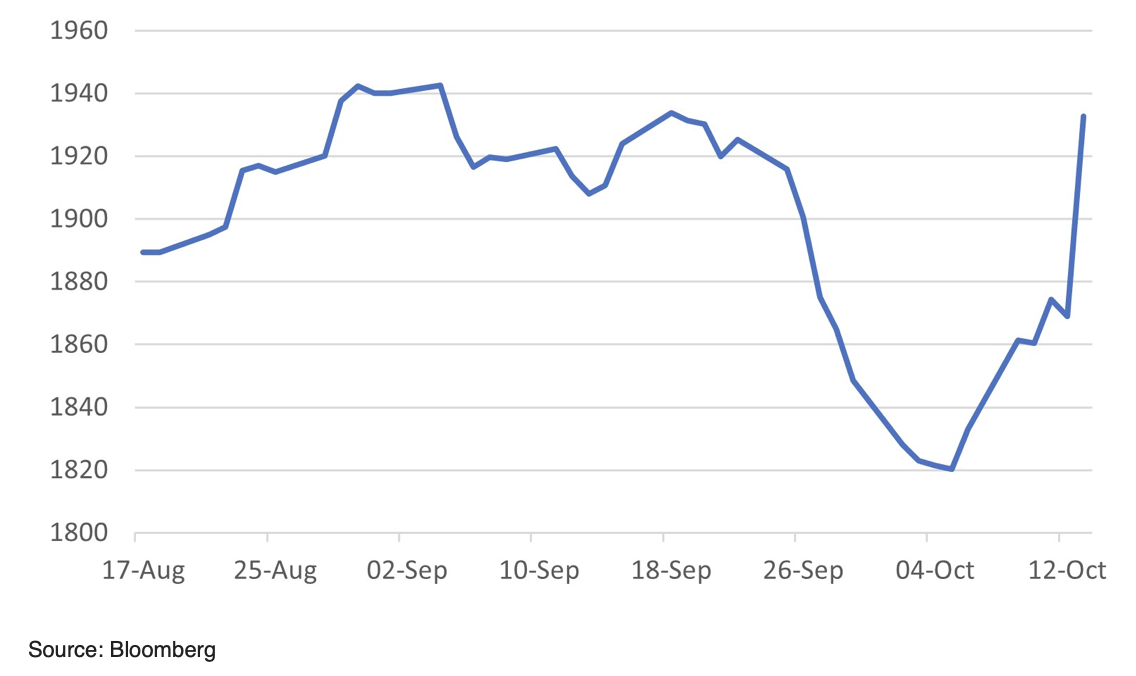

In this volatile environment, we continue to advocate for a prudent allocation to gold within investment portfolios. Despite challenges from some quarters regarding the relevance of this asset class in portfolios, particularly with the U.S. dollar showing strength and cash generating attractive returns, it is important to remember that the value of cash does not appreciate when geopolitical challenges loom large. Gold serves as a hedge, insuring against unforeseen or immeasurable risks in the market.

Chart 1: Spot Gold price surges sharply to one-month high from low of $1820

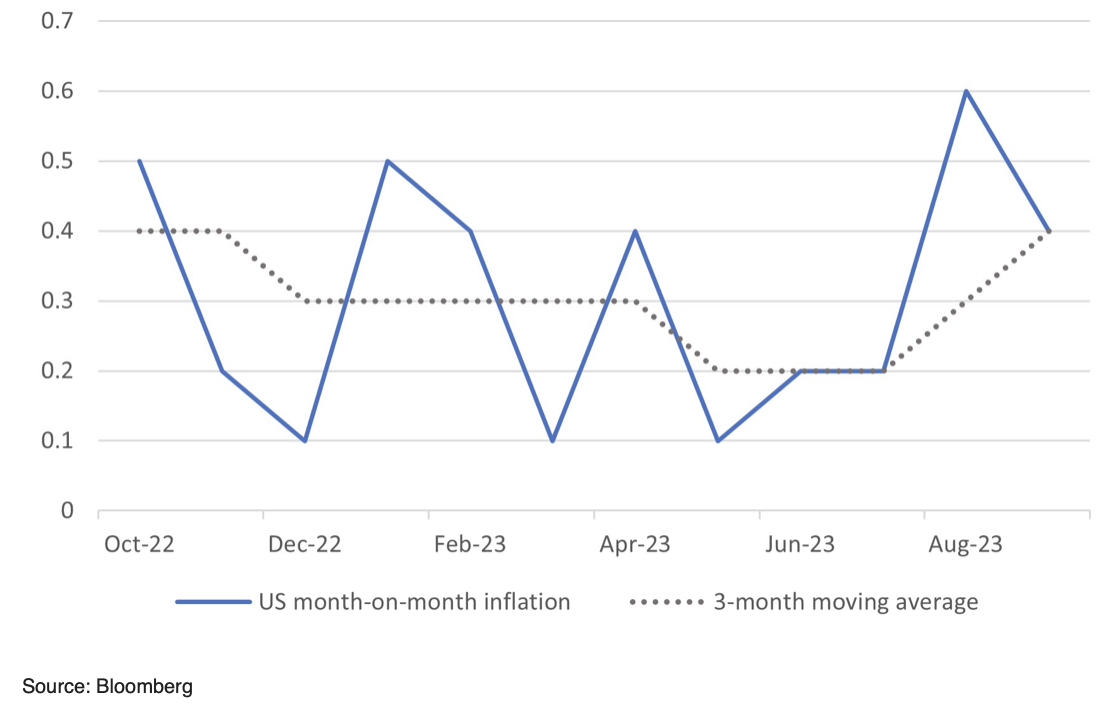

Inflation: As troubling as we suspected

Last week’s US inflation report delivered an unexpected surprise to the market, confirming our earlier suspicions. Inflation surged at a higher-than-anticipated 0.4% month-on-month pace in September, compounding the previous month’s 0.5% uptick. This current trajectory of greater increase in monthly inflation marks a significant departure from the modest 0.1% to 0.2% upticks observed in the preceding two months.

Last week, markets briefly toyed with the idea that the Federal Reserve might reconsider any further rate hikes. However, by the week’s end, the economic dataflow demonstrated a reinvigorated inflationary momentum. Both the Producer Price Index and Consumer Price Index surpassed expectations, and the looming spectre of elevated energy prices threatened to exacerbate inflation further.

Chart 2: Month-on-month US inflation re-accelerates

It is important to regard the recent market movements and ‘expert’ opinions on the outlook for US policy rates from last week, as transient noise rather than robust, well-founded analyses. The market’s earlier predictions regarding inflation proved inaccurate on many occasions, despite ample pre-data indicators suggesting an upward risk.

Furthermore, some commentators contended that the recent surge in long-term interest rates could obviate the need for further short-term rate increases. Nevertheless, we believe it would be imprudent for the Fed to rely on market-driven interest rate hikes to shape its monetary policy. Substantial academic research supports the notion that it is the central bank’s policy rates that wield the most influence in the realm of monetary policy.

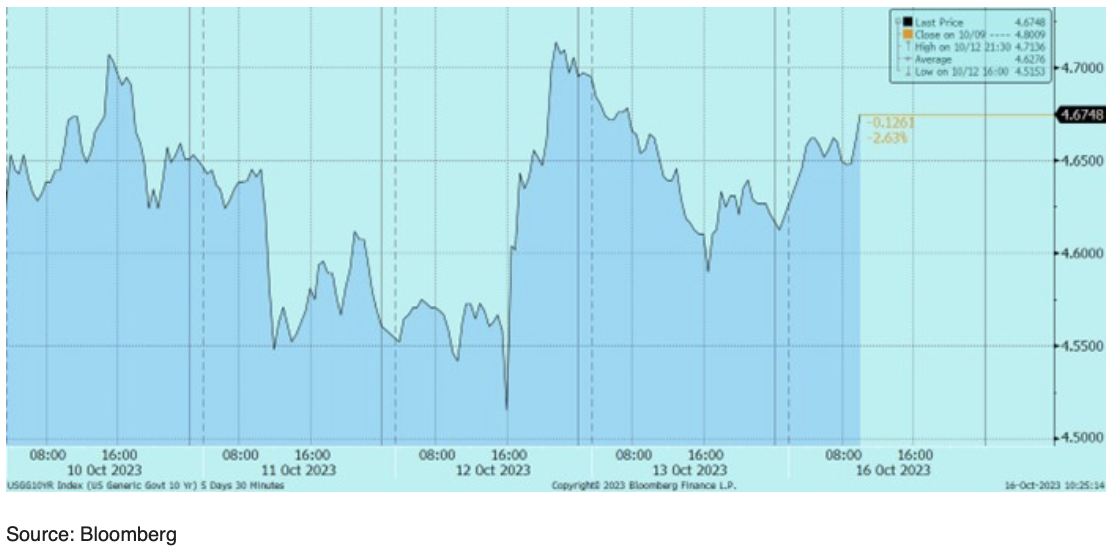

As illustrated in Chart 3, the US 10-year yields fluctuated dramatically during intraday trading. We wonder if investors genuinely believe that a sharp ascent in these market rates alone would be sufficient to compel the Fed to alter its policy stance!

Chart 3: US 10-year intra-day displays significant volatility

Peering into 2024 with the IMF

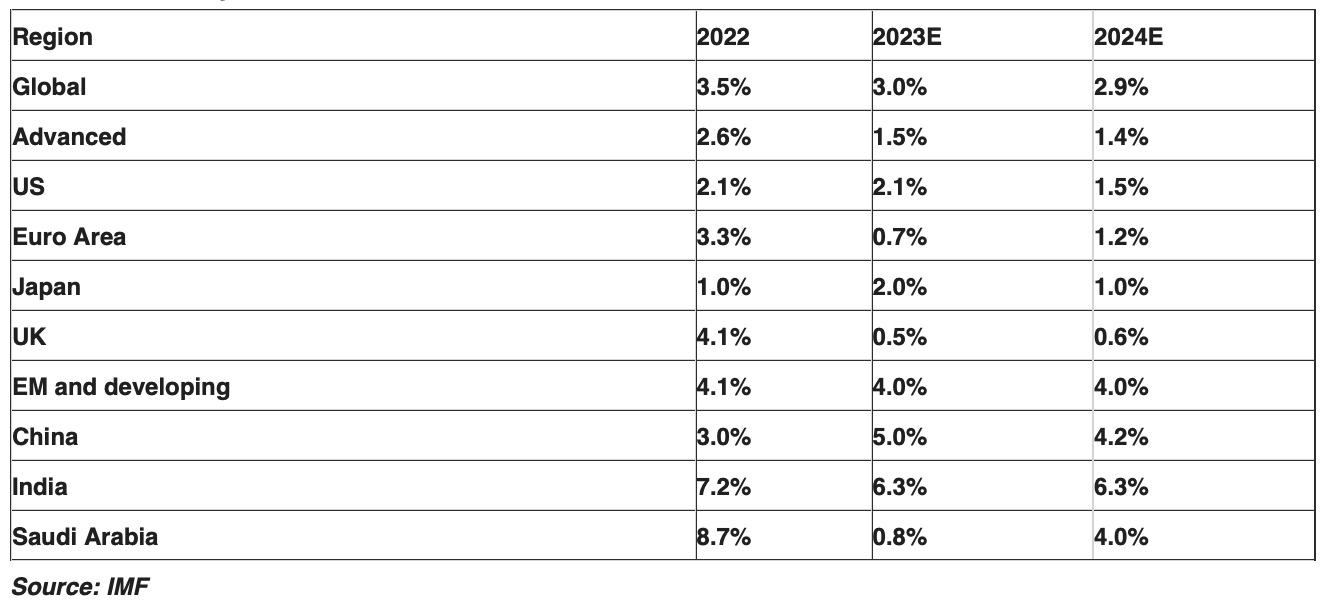

The most recent IMF projections for 2024 make for a sobering read. While they have not shifted significantly from the previous report, the fact that we are a mere two-and-a half months away from 2024 compels us to assess the impending challenges facing the world economy. Global growth is undergoing a noticeable shift, with the developed world showing signs of weakening. Consequently, the global economy is becoming increasingly reliant on emerging countries for economic vitality.

The IMF anticipates a gradual decline in global inflation from its peak of 8.7% to 6.9% by end-2023 and 5.8% in 2024. However, it is worth noting here that IMF has revised its inflation projection for 2024, increasing it by 0.6%.

Here’s a summary of the IMF forecasts:

In conjunction with these new forecasts, the IMF commentary underscores the importance of central monetary authorities maintaining credibility in their efforts to restore price stability. Furthermore, it alludes to the critical need for governments, particularly in the United States, to challenge themselves in restoring fiscal discipline.

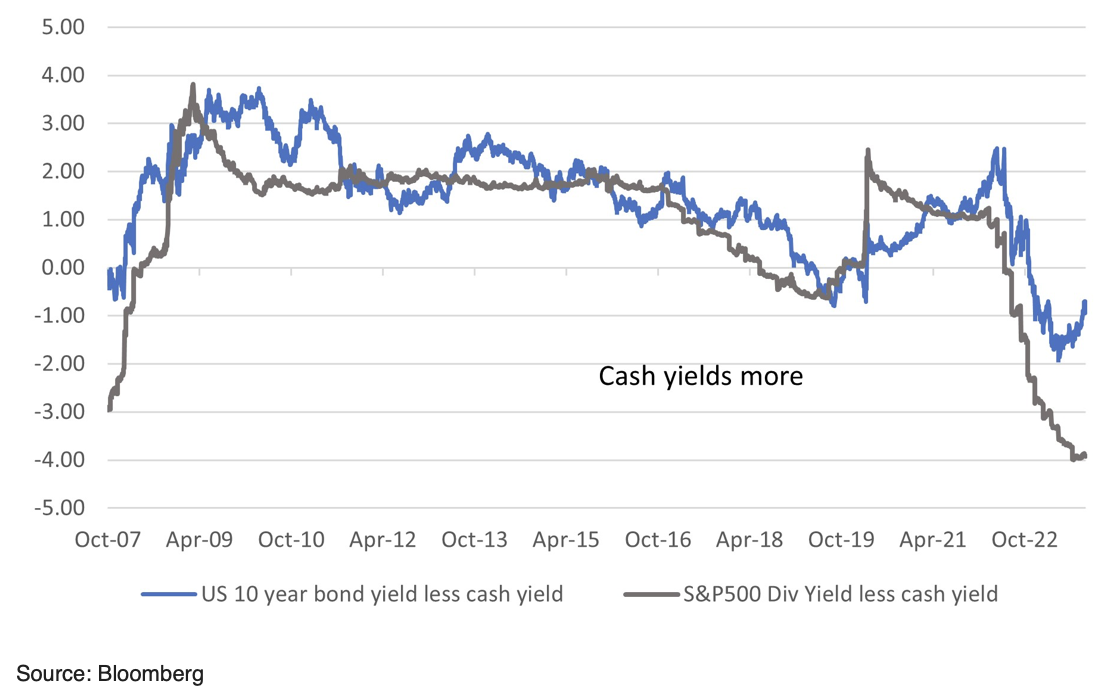

Cash is King for retail investors?

Evidence of retail investors de-risking their wealth came with Blackrock announcing that it had seen a net redemption of $13billion from long-term investment funds, the first outflow since the onset of the COVID-19 pandemic in 2020. While we are sympathetic with investors who are trying to protect their wealth, and see the merits of cash yields beating many assets by a good margin, we also believe that as an when the central bank’s job is done cash yields will fall and bonds will provide the cushion of capital gain from rising bond prices as bond yields fall. A portfolio strategy that has diversity of bonds and cash is still the right strategy even for this time of higher-than-expected inflation.

Chart 4: US 10-year government bond and US equity market yield less than cash