History is Not on the Side of a Fed Rate Cut

- Financial Insights

- Market Insights

- A Federal Reserve rate cut requires a marked deterioration in the US economy and/or financial markets

- Chinese equity market needs a revival of consumption, and so does the government.

Gary Dugan, Chadi Farah, Bill O'Neill (Consultant)

The Global CIO Office

History says a Fed rate cut is not on the cards

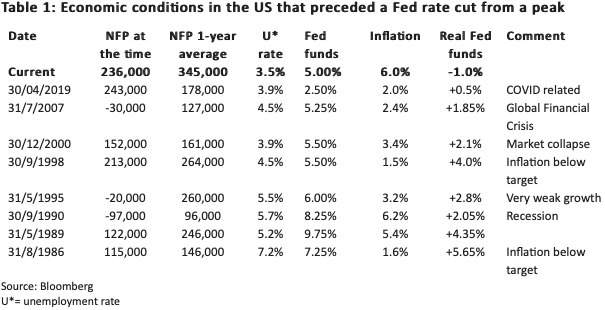

Looking back at the history of the circumstances that led to a cut in rates by the Fed, it is evident that an interest rate cut is not on the cards. Of course, a catastrophic fall in the markets or the economy could make the Fed rethink its plans. Table 1 below shows the economic circumstances over the past 40 years that preceded a rate cut after a peak in the tightening cycle. We would make a few observations here:

- Only once (during COVID) did the Fed cut rates when they were negative in real terms – as they are today.

- Unemployment would need to surge to at least 4.0% or, more likely, 5.0% to justify a cut in rates.

- Monthly nonfarm payrolls on a rolling basis would need to fall by at least 100,000, or more to rein in wage inflation.

- A peak in rates has typically occurred with a recession and/or a financial crisis.

- The Fed has never cut interest rates from anything lower than a positive real rate of 1.9%; today, real rates are negative.

We rule out a Fed rate cut unless one or more of the following conditions occur:

- US inflation falls to 3% or lower, and the unemployment rate jumps to 4.5%

- Global growth collapses

- Financial markets witness a sharp pullback.

- The financial system witnesses a significant stress.

China is different

Data due out this week will make it evidently clear that the Chinese economy is at a very different trajectory in its economic cycle relative to much of the rest of the world.While much of the world is struggling to suppress inflation, data from China should show March inflation at a meagre 1.1% year-on-year. We believe the low inflation will make it easier for further central bank and government action to support the economy. We expect China’s central bank, the PBOC, to cut its one-year policy rate by 10bps in due course. We also expect China’s new aggregate social financing growth to continue at close to 10% per annum. The data released in March showed that money supply growth in China was running at the fastest pace in some seven years. M2 money supply growth is running at 12.9% year-on-year.

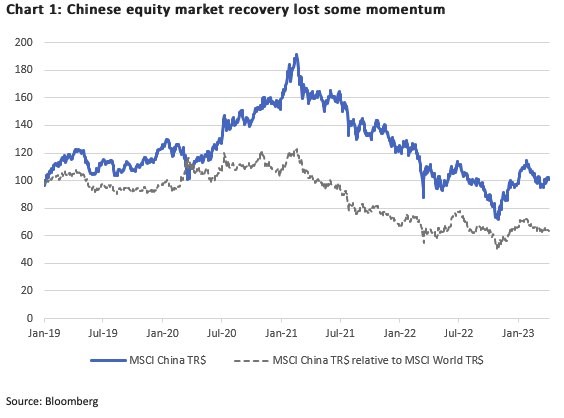

After staging a sharp rebound earlier, the Chinese equity market has lost momentum in both absolute and price-relative terms over recent months. Part of the Chinese market’s underperformance has been driven by developed markets benefitting more substantially from the changing market perception about the likely future path of US interest rates.

We advise investors to be patient at this juncture. The market has value, as evidenced by the P/E of the equity market, which is below long-term averages, and the price-to-book value. We must bear in mind that China witnessed stringent lockdowns over a rather protracted period of time. Any economy would take time – and efforts – to recover from such a severe lockdown. Consumers and businesses are only just getting used to their freedom. Moreover, there are some promising signs, with the service sector and construction activity already showing good growth. The consumer sector will be critical, too. Economists expect the Chinese population to eventually catch up on some of the profound underspending seen through the lockdown. China’s population has been nervous about spending. A recent PBOC survey, for example, showed that the percentage of residents inclined to “spend more” increased by just 0.5% on the previous quarter to 23.2%. Notable was the weak recovery of car sales in the year to date.

The challenge about Chinese consumer spending is not the lack of savings or income but more a lack of confidence. We therefore expect the Chinese government to refrain from instituting significant measures to boost income. Household savings rose to 38% of disposable income during the pandemic, the highest since 2014. Damien Ma and Houze Song, writing in Foreign Affairs (China’s Consumption Conundrum, March 16th, 2023) highlight the need for the Chinese government to adopt policies that have a structural impact on consumer confidence. These measures include:

- Support for the real estate sector

- Reversing some of its big-tech crackdowns, particularly on edu-tech, could boost employment. Youth unemployment stands at 17%.

- Addressing the looming pension and healthcare liabilities that worry households.

- Explicitly committing to a pro-consumption agenda.

The political choice of whether to support consumption is stark as the authors note, “China can either choose a pro-consumption path or risk forfeiting its goal of becoming the world’s largest economy over the next decade”.

To conclude, a survey on Chinese consumer preferences conducted by Deloitte in November 2022, before the lockdown ended, made interesting observations. According to the survey, Chinese consumers were more reflective of their spending preferences during the pandemic than they seemed to have been in the past. Householders had reduced their impulse buying, prioritising quality and value, with a bias towards domestic brands. Consumers were less inclined to satiate their material needs and were more interested in their physical and spiritual satisfaction. They continue to embrace innovation. The survey found that consumers increasingly favoured live streaming and instant retail.