Growth Challenges the Market

- Financial Insights

- Market Insights

- US economic data shows much more strength in growth than previously thought

- Inflation data has been at the lower end of expectations, but may re-accelerate

- A US 10-year bond yield of 4% is a challenge for US equity valuations

- European equities look better value after the 10% relative correction

- The Bank of Japan finally signals a shift in policy even if it is dressed up as temporary

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

There was a lot of news and central bank action to digest last week. Growth remains robust, inflation a little less threatening – good news for markets but buy wisely.

One simple conclusion from the economic data flows was that the US economy is not on the cusp of a recession, in fact far from it. We expect the equity markets to experience some further momentum. Central bankers in the US, Europe, and Japan, meanwhile, delivered tightening measures that differed in approach, but indications from them about future moves were amply clear: any policy shifts going forward will be very data dependent. Equities, in all likelihood, may continue to make progress until the growth at hand, notably out of the US, soaks up the resources leading to potential inflation pressures.

Last week’s second-quarter US GDP report, labour market data, and consumer confidence surveys all stood out. We have all along emphasised week after week that US economic growth is much more robust than the market had forecast initially, and last week’s economic data only reinforces that view. To put things in perspective, last week:

– US Q2 GDP came in at 2.4%, materially stronger than consensus expectations of 1.8%

– Durable goods orders hit 4.7% versus market expectations of 1.3%

– Initial jobless claims fell to 221k versus market expectations of 235k

The market believes that recent data releases fit the much-discussed soft-landing scenario where growth remains robust, but inflation is waning. Last week’s PCE inflation data, a gauge that the Federal Reserve follows closely, was better than expected at 3.8% quarter-on-quarter annualised, although it was still way ahead of the Fed’s long-term inflation target of 2.0%. The stronger-than-expected growth data pushed the US 10-year government bond yield to 4.0%. Those who expect the 10-year government bond yield to drop back through the balance of the year predicate their forecast on views that the US economy will slip into a mild recession in the coming months. Data out recently, however, still show strong US growth soaking up spare resources.

Economists have underestimated the impact of President Biden’s fiscal boost. Strong growth in government spending and support for the government initiative of re-shoring manufacturing have been aiding US GDP growth. Private investment is strong – business investment was up 7.7% in Q2, the most robust pace of growth since Q1 2021. As mentioned earlier, durable goods orders in June were well ahead of expectations.

The market was pleased with lower-than-expected core PCE inflation, and the employment cost index showed further moderation in labour costs. However, we remain concerned that the re-acceleration in growth could result in higher inflation. Basic economics tells us that growth eats up the economy’s resources and eventually generates inflation. The US economy continues to inch towards full capacity.

A word of warning here – President Biden’s fiscal looseness is undermining the impact of rate increases. If inflation indeed re-accelerates, the only intervention could be through monetary policy to bring it under control. In the build up to the US Presidential election we will not able to rely on US government prudence to rein in growth. Just consider in the back of your mind how a 6% Fed funds rate might feel!

Asset market consequences – US equity market valuations challenged by higher bond yields

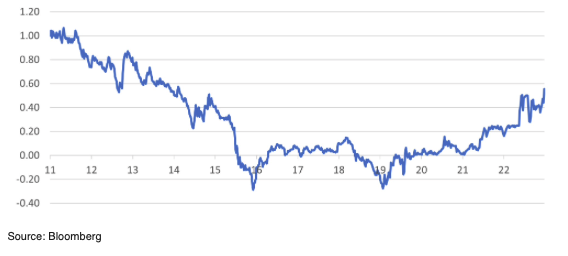

The number that shines bright on the market data sheet now is the 10-year yield that has climbed back to 4.0%. For the equity market, the good economic news will help sentiment, but the higher government bond yields will constrain P/E valuations. High P/E multiples cannot ordinarily persist if bond yields are rising. Chart 1 gives some insight into the relationship between the US government bond yield and the P/E of the S&P 500. The link – and the conclusion that we can draw – is multi-faceted, but the rule of thumb is that higher bond yields mean lower valuation for equities. The current P/E multiple for the S&P 500 of 21.7x, a level that is typical with bond yields of 3%, not 4%. If the US 10-year yield stays at around 4%, it lends itself, based on history, to P/E multiples closer to 17x. That would imply the equity market would have to fall 20% to bring it to fair value. The only way the market can solve this conundrum is if we see significant upgrades to corporate profit forecasts.

Chart 1: S&P 500 Actual P/E and the US 10-Year Government Bond Yield

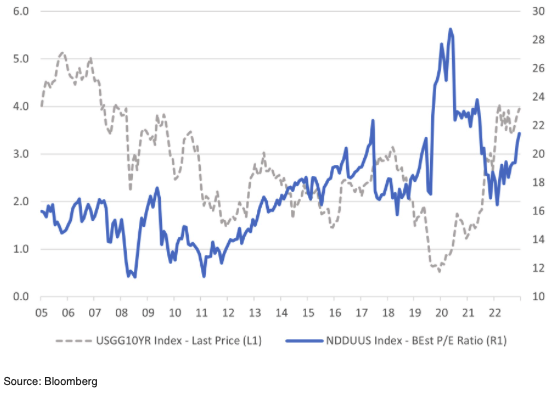

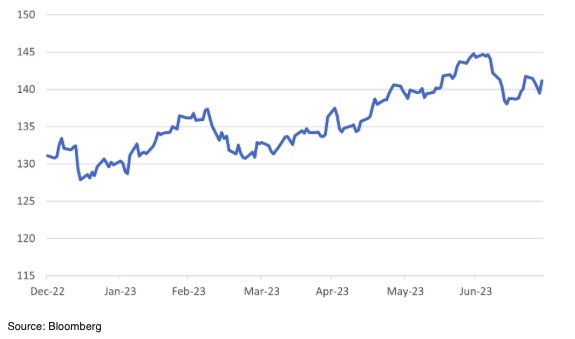

Elements of the European economy are weaker than thought but it’s probably already reflected in equity prices

A slew of industrial confidence surveys suggests significantly downbeat economic activity in the euro area at present. That said, the 10% relative underperformance of the European equity markets against their global peers since mid-April appears to already discount the poor economic news. If anything, there was a silver lining to last week’s weak economic data in that the ECB appeared less emphatic about following up on its rate hike announcement with a further rate increase in September. Also, this week’s eurozone retail sales growth data may show that consumer spending is regaining some momentum.

Chart 2: MSCI Europe Versus MSCI Global Equities ex Europe

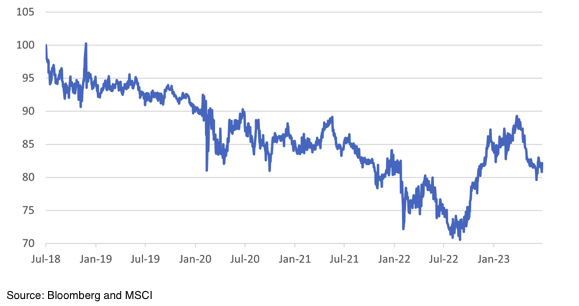

Japan has moved along the long path towards policy normalisation

To be fair Governor Ueda was careful in not recognising the near-term tightening of monetary policy as akin to normalisation. However, this is probably the closest we have been to policy normalisation in many years. The shift in policy reflects the increased risk of inflation reinforcing itself – all of which would be a positive for the economy. The new world is, however, challenging for the JGB market, which is having to contemplate a level for the 10-year yield of around 1.0% – the highest in a decade!

The BoJ, while leaving the policy framework largely in place (at +0.5/-0.5% for the 10 year), it lifted the upper limit for the 10-year JGB yield to 1.0%. The policy shift allows the Japanese central bank to step back from some of its regular intervention and allow JGB yields to rise over time. They seem to be trying to maintain the longer term framework for policy while accommodating the recent marked increase in inflation.

Chart 3: 10-year JGB Yields Potentially Moving Back to the Highest in a Decade

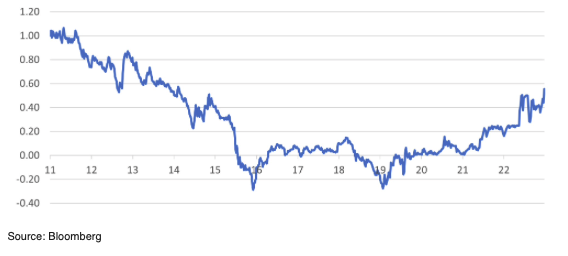

The headlines from the BoJ meeting give the impression of being positive for yen, however given that despite increasing their near-term inflation forecast the BoJ cut its longer-term inflation forecast the yen weakened against the dollar.

Chart 4: Yen Weakens after BoJ Cuts its Longer-Term Inflation Forecast

SDAX Investment Deals

Related Article

Trending Articles