Goldilocks faces off to the Fed Wolf

- Financial Insights

- Market Insights

- A strong US labour market raises hopes of a soft landing

- However, while the market disagrees, we expect the Fed to react by raising rates still further – maybe as early as this month

- If a Fed rate increase were to not materialise in June, economically sensitive equity sectors could rally further

- The bond market is more in tune with the risks of a persistent inflation, forcing a terminal interest rate higher than the equity market currently wants to discount

- Geopolitical challenges still abound as Ukraine’s counter offensive likely starts and the US and China clash in Asia

Gary Dugan

The Global CIO Office

Investors’ interpretation of current economic data has been rather perverse. Equity markets have surged as market bulls have argued that a slightly slower wage inflation (though still running at twice the level we saw between 2010 and 2019) and a stronger-than-expected US employment growth were evidences of a soft landing. However, it is difficult to see how the ongoing job growth will lead to anything other than an increase in wages that further fuels the inflation problem. The resolution to the debt ceiling negotiations, meanwhile, has removed one of the overhangs that had the market worried.

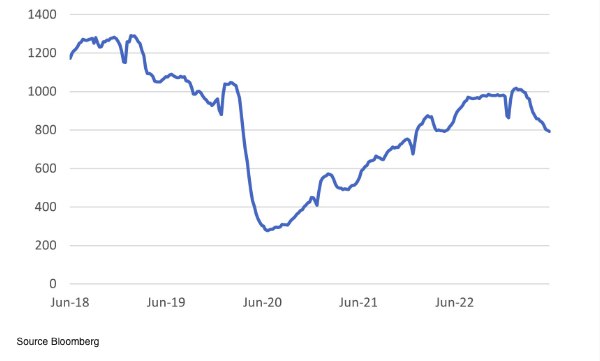

We wonder if the Fed will be entirely happy with what it sees. Fed policymakers reconvene for their next meeting on June 16th. The market is currently pricing only a 30% chance of a rate increase at the meeting, with the view that the Fed would prefer to skip a meeting before tightening further. We wonder how the Fed will keep its credibility if it doesn’t stay the course and raise rates further in June. Since the US central bank’s last board meeting, core inflation has surged above expectations, and the number of jobs created in the past two months has been 40% above market expectations.

To be honest, it doesn’t matter whether the Fed raises rates in June or July. The market’s pricing of the Fed funds rate level at end-2023 is back to its recent peak of 5.0%. However, given the recent global as well as US economic data flows, the chances of an imminent recession have markedly receded – putting extra pressure on central banks to do more. It remains fanciful that the Fed’s year-end policy rate could be at or below 5%. The Fed and other central banks are likely to have to do more.

Chart 1: Market pricing of where the Fed funds rate will be as of December 2023

The increasing fear will be that the terminal or ‘normal’ policy rate will be at a level well above the past. Higher terminal rates lead to lower valuations of risk assets. Let’s think of it this way – when short-term interest rates were perennially close to zero there was an enormous volume of cash that chased (higher) returns offered by other assets. When cash offers a higher yield of 3-5%, investors get tempted to leave larger balances on the side-lines away from asset classes such as equities, bonds, and venture capital.

The US bond market understands the challenges better than equities. The US 10-year bond yield was back to the 3.70% level by the end of last week, having briefly touched a low of 3.60%. The most significant repricing in the past month has been the 70bps rise in the two-year bond yield to 4.50%, underscoring the view that Fed rates will stay higher for longer.

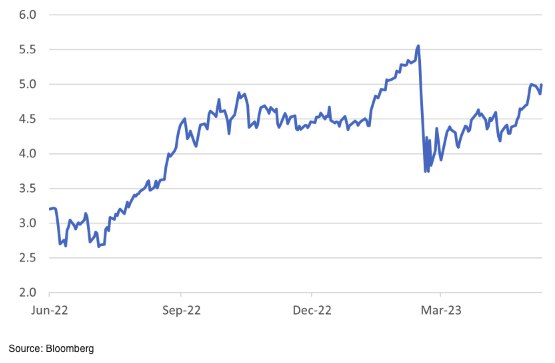

Sector rotation took hold in the US equity market last week. The tech sector index took a backseat as economically sensitive materials, industrials, and consumer discretionary sectors staged stronger performances. One can almost overlook the stellar showing from some of the cyclical sectors after their recent sharp underperformance. The strong performance at the end of last week is hardly discernible in the context of such marked underperformance since the start of the year.

Chart 2: S&P Materials Sector versus S&P Information Technology Sector

The tactical risk for equity investors in the very near term is that the Fed indeed skips a meeting and raises rates in July and not June. The vibrancy of growth, the debt ceiling as an issue out of the way now, and a slow-moving Fed might just trigger a further rally in equities.

Geopolitical Challenges – Ukraine’s challenges and Asia’s concerns

The geopolitical challenges to the markets have continued in the background. Although Ukraine continues to talk of a counter-offensive, analysts are increasingly concerned about how long Ukraine can hold out before running out of soldiers and munitions to keep its stringent defensive campaign going. Such an outcome may sharpen minds to find a negotiated solution; however, it may also lead to more desperate measures by the West to keep Russia at bay. The most worrying statistic for Ukraine is that an estimated 31% of its population has been displaced by the war. The country already had very poor demographics; war has compounded that problem (Please contact us for a copy of our note Russia-Ukraine War, What’s Next?).

In recent months, we have noticed a marked increase in concerns about the Taiwan situation, mainly out of Asia. The annual Shangri-La Dialogue in Singapore brought some strident speeches from Pentagon Chief Lloyd Austin and Chinese Defence Minister Li Shangfu. However, the general view across the sessions was that both sides were at least talking and that there was a genuine effort to ensure that the Taiwan situation didn’t morph into another Ukraine-like crisis.

Oil is well

Oil prices are rebounding from their recent weakness. At the OPEC+ meeting in Vienna, Saudi Arabia announced a voluntary 1 million barrel per day (m b/d) production cut starting this July. The move will bring the kingdom’s voluntary production cuts to 1.5m b/d, but it is still a question as to how long Saudi Arabia will maintain the voluntary cuts. In early trading in Asia, oil prices were up around 2%. Brent crude futures were at $77.60. The price increases extended gains made on Friday, which helped lift the equity sector by 3%.

Saudi Arabia’s announcement of production cuts comes on top of the broader cuts in production previously agreed by OPEC+ with a view to limiting supply in 2024.

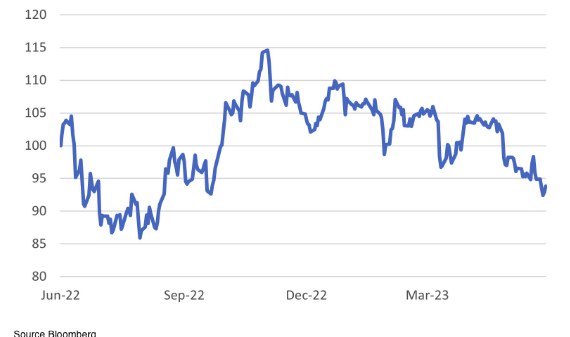

As oil prices have slipped lower, the global index of oil stocks has been experiencing a lean patch since the start of the year (Chart 3), implying the sector has room for a rebound. Longer term, the lack of investment in productive capacity increases the risk of oil prices surging significantly higher, which could help arrest the fall in the sector’s performance. Just last week, Baker Hughes announced that the oil rig count in the United States had fallen to the lowest in 18 months.

Chart 3: Global MSCI Oil Sector (TR) versus MSCI World Index (TR)

Chart 4: Baker Hughes US rig count retreats