Geopolitics to the Fore Again

- Financial Insights

- Market Insights

- Geopolitics continues to unnerve markets globally

- US dollar, gold, and the bond market likely to be the kneejerk assets of choice

- UK MPC sprang a surprise and raised rates by 50bps

- UK longer dated gilts hold in but two year bond yields spike

- European growth tips down and may take the equity market with it

- Hopes that China’s Poliburo will deliver a fiscal boost in July

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

The events unfolding in Russia over the past few days have highlighted the fragility of global geopolitics. In what can be termed as one of the most remarkable moments since the Russian invasion of Ukraine began, thousands of mercenaries, led by a rogue leader, threatened to take control of Moscow. Although the rebellion eventually fizzled out, it was nonetheless a grim reminder of what unfolded at Capitol Hill in the United States, where a few hundred protestors stormed the seat of the U.S. government, exposing its vulnerability and demonstrating that nothing was as secure as once thought. While Putin may have gained an upper-hand currently, the events have left Russia somewhat destabilised, with the president evidently feeling less secure than before. The markets may hold a glimmer of hope that the events over the weekend will persuade the Russian President to scale back his “special operation” in Ukraine, but this remains uncertain.

Now, to the more mundane aspects of the global financial markets. Investors continue to hope that inflation will eventually lose its teeth. Currently, however, it is continuing to surprise by beating consensus expectations. Last week, UK inflation surprised significantly on the upside, leading the UK Monetary Policy Committee (MPC) to raise rates by an unusually high 50 basis points (bps). While the UK may be viewed as an outlier in this regard, even as it grapples with structural inflationary pressures stemming from the effects of Brexit, it joins the Reserve Bank of Australia and the Bank of Canada in instituting monetary tightening measures that have surprised the markets significantly.

Headline inflation in the UK came in at 8.7%, well above consensus expectations of 8.4%. Of particular concern to the markets was core inflation, which surged to 7.1% from 6.8%, prompting the MPC to vote 7-2 to raise rates by 50 bps instead of the previously signalled 25 bps. Market expectations now point towards UK policy rates peaking at 6.25% by the end of the year, which is an increase of nearly 50 bps from the level anticipated just a week ago. Despite the prospect of higher interest rates, the British pound depreciated against the dollar, declining by a cent to 1.2617. The argument put forth is that elevated interest rates could pose challenges to economic growth and potentially push the UK into a recession, with a peak policy rate of 6.25% risking a 2% decline in UK GDP.

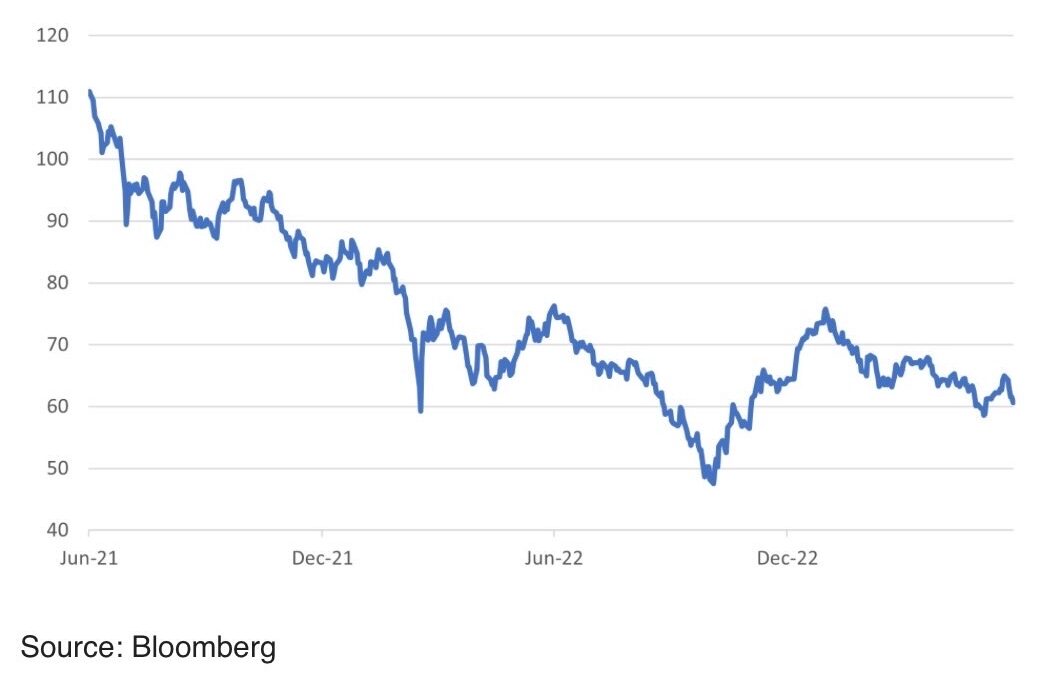

The UK inflation shocker had a negative impact on short-dated gilts, making them the weakest performer of the week, with two-year yields increasing 10 bps to 5.14%, to a level comparable with that of Brazil. However, in what can be seen as preserving the credibility of the monetary authorities, the yield on the UK 10-year bond drifted lower, suggesting that the actions taken by the MPC will have desired effects in the long run.

Chart 1: UK two-year gilt yield rises on poor inflation news, 10-year gilt yield well anchored

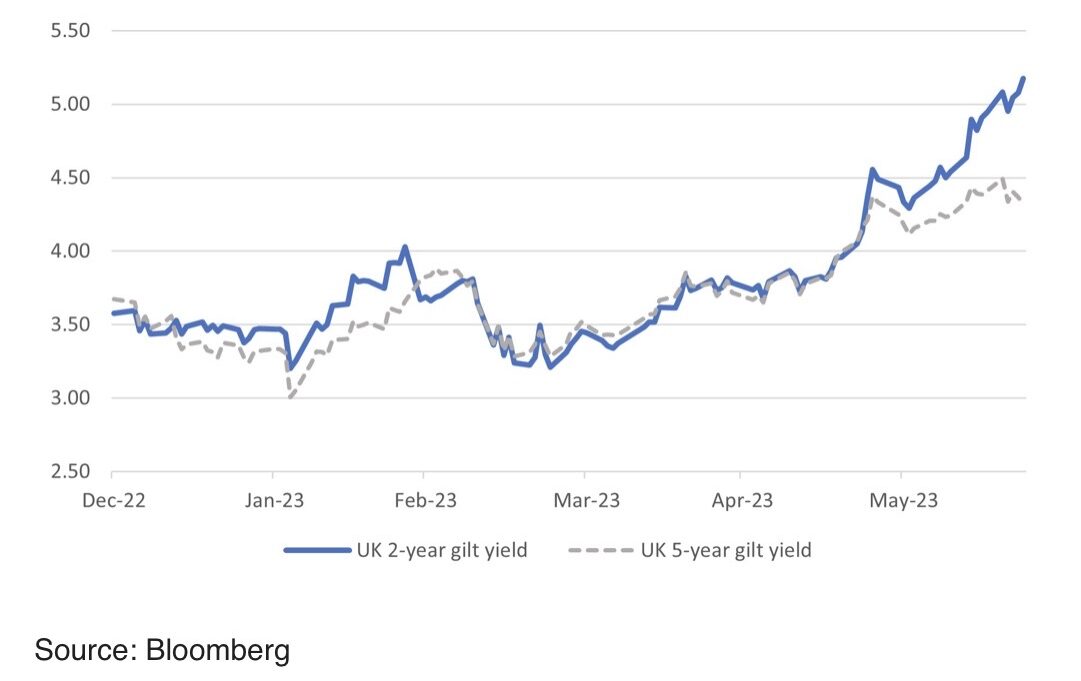

In a broader sense, the financial markets are grappling with growing concerns shared by central banks regarding the pace of economic growth and lingering inflation. Last week, global equities experienced a 2% decline as investors acknowledged the global slowdown in growth in the backdrop of the ongoing inflationary challenges. From a technical standpoint, it is worth noting that the US equity market, represented by the S&P500, would need to decline an additional 3% to breach the current uptrend that has been in place since mid-March. On a technical breakdown the market could be sliding towards its March lows.

Chart 2: S&P 500 tops out on growth and inflation concerns – 3% downside to key support

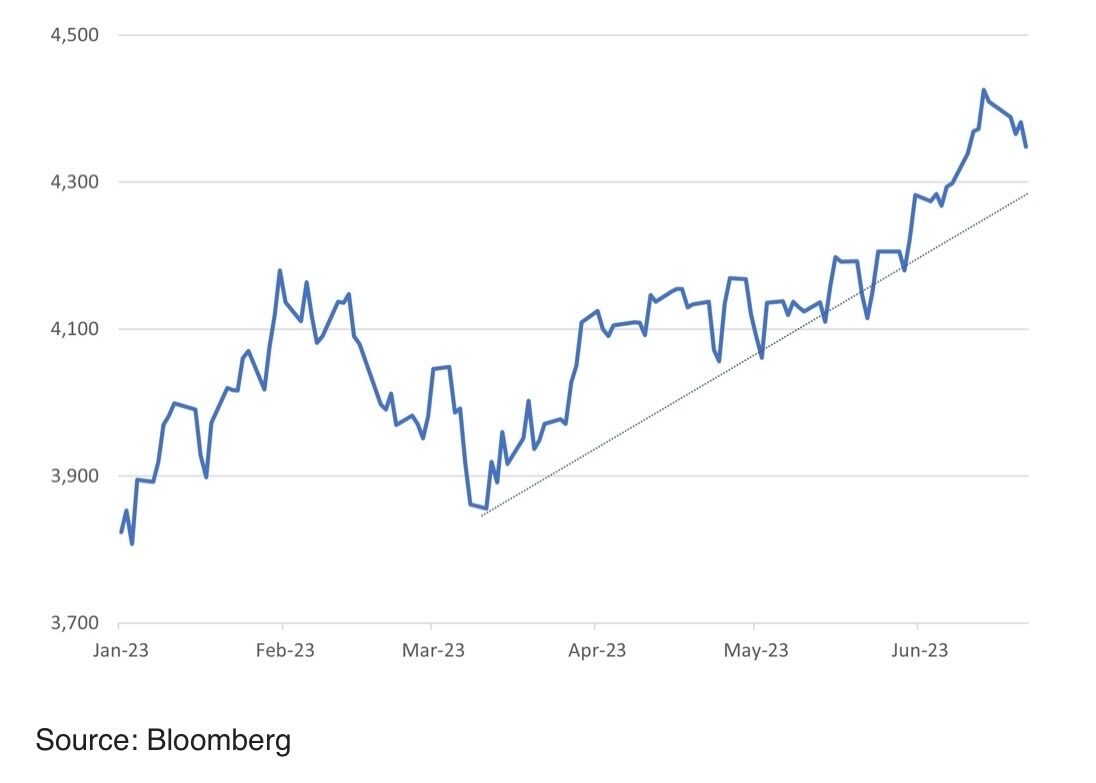

European economy tips down and may take the equity market with it.

Market concerns regarding growth are particularly focused on Europe, as indicated by last week’s array of economic data pointing to a loss of momentum. The composite Purchasing Managers’ Index (PMI) for the eurozone declined to 52.8 in June from 50.3 in May, reflecting a continued drop. The weakness remains concentrated in the manufacturing sector, with the PMI falling to 44.1 from 46.4. The services sector PMI also showed signs of weakness, declining to 52.4 from 55.1, but remaining above the crucial 50.0 level, indicating that the sector is still expanding.

There is a silver lining in the data, however, as it provides evidence of abating inflationary pressures, albeit at a faster rate in the manufacturing sector compared with services.

The European equity market has moved sidewards in recent months as the global focus has been on technology and the US equity market. It’s difficult to see much near-term performance given the headwind of further ECB rate rises and the prospect of some downside to corporate earnings forecasts given the loss of growth momentum.

Chart 3: European equity markets may start to reflect the fact that corporate earnings forecasts have downside risk

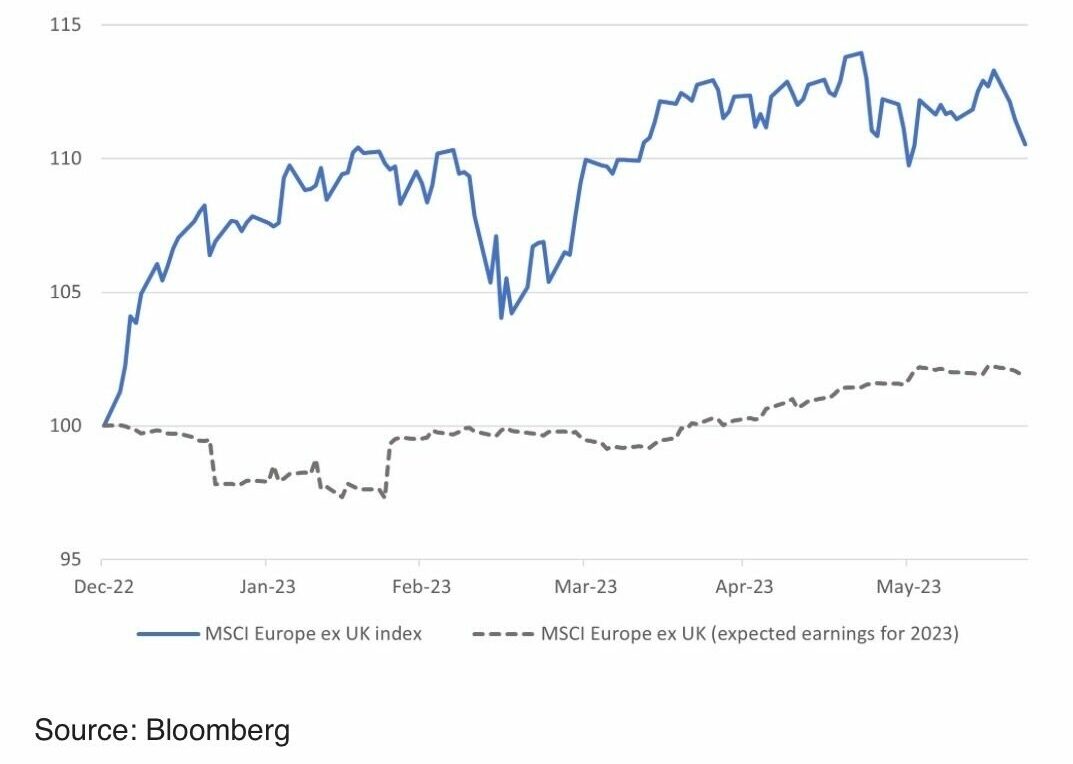

China needs to the Politburo to deliver a fiscal stimulus at July meeting

As we approach the July Politburo meeting, China watchers will be hoping for a amore meaningful stimulus to the economy than we saw last week from the central bank. Many an investor is waiting on the Chinese authorities to adjust policy to provide a more significant boost to growth. Last week’s official rate cut and subsequent 10bps cut in the 1-year and 5-year loan rate were seen as adjustments to policy as opposed to a structural shift to easing. Many economists now don’t believe we will see any major shifts of policy until the Politburo meeting in late July. Commentary from the government on the policy shift have been in short supply of late as some of the recent Politburo meetings (most recently May) have had no readout of what was discussed. The July meeting is seen by analysts as key as it probably reflects on the performance of the economy for the half year and should lend itself to decision making.

Chart 4: MSCI China has lost around half of its gains from the lows of 2022