Sticky Inflation Challenges the Bond Markets

- Financial Insights

- Market Insights

- Inflation still a headache for global markets and central bankers

- Last week’s US PCE data points to pockets of a re-acceleration of inflation in the service sector

- Since Q4’23 the global trend has been of a stickiness to inflation

- Recent research reports question whether long-term US bond yields are structurally headed higher

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

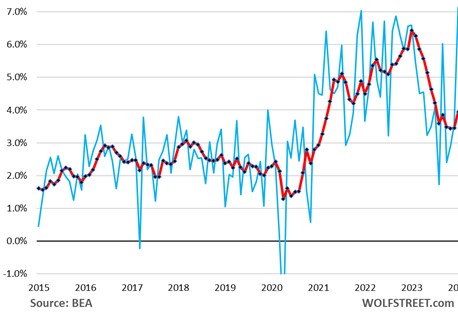

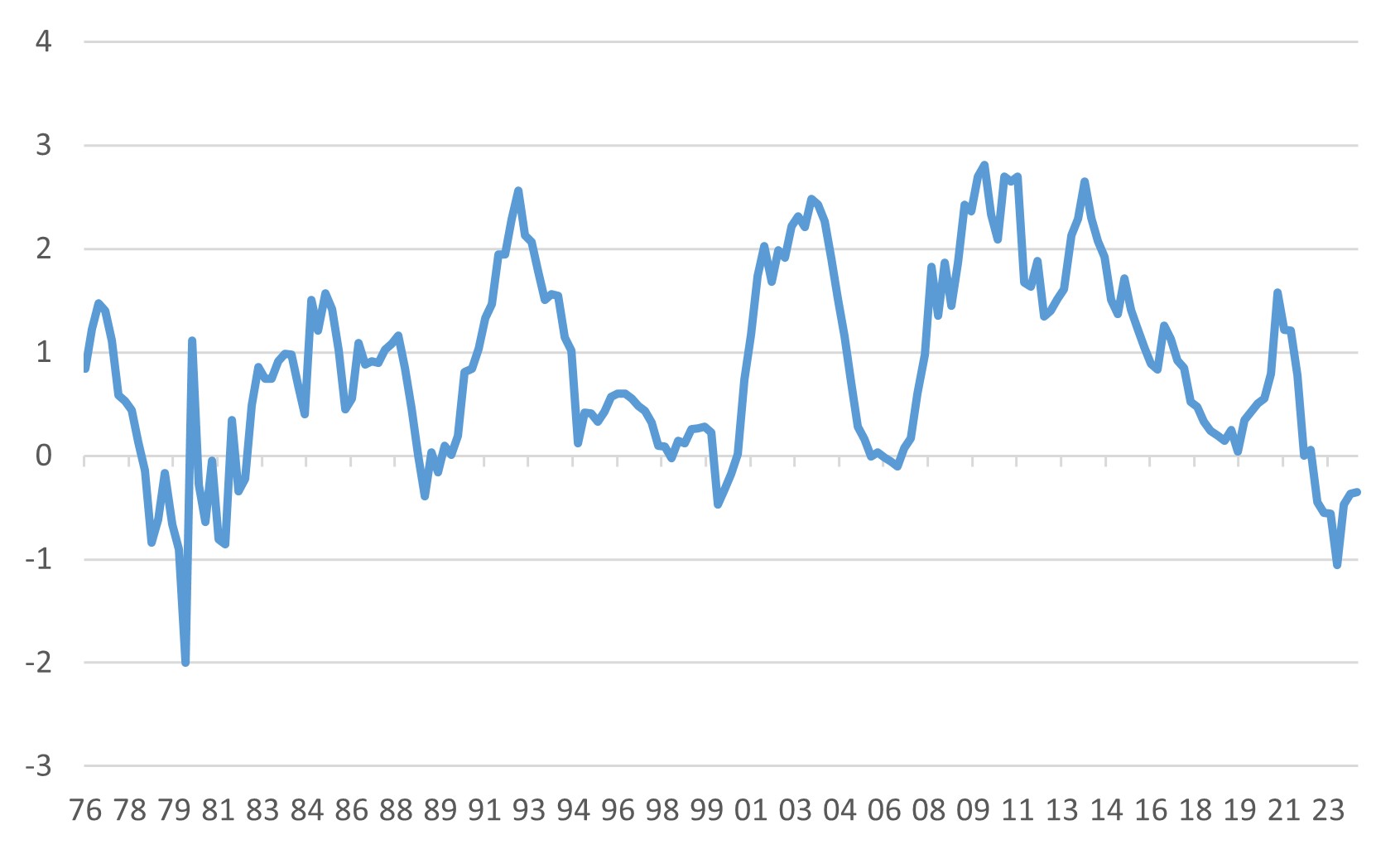

A lot has been said and done but US inflation remains sticky and is simply not slipping back into the Fed’s comfort zone. PCE data released last week by the Bureau of Economic Analysis showed that the “core services” PCE price index spiked to 7.2% annualized in January from December, the worst month-on-month jump in 22 years (blue line; see chart below).

Chart 1: Core Services PCE Price Index Monthly, 6-Month Moving Average

Price increases across service sector

A detailed analysis of the inflation report reveals that the current inflation trajectory is not simply because of a few rogue sectors. We get the sense that managements of several service sector companies see price rises as a regular event to protect (or indeed enhance) margins. The high inflation in Recreation and Other, for instance, is a reflection of ‘sub-sub sectors’ showing a behaviour that would worry me as a central banker. Price increases have become de-rigueur. Companies will only likely back off from increasing prices if demand weakens – but the dialogue in the market is that the Fed should reduce interest rates if there is any sign of economic growth.

Table 1: Subcomponents of Service Sector Inflation Show Some Worrying Trends

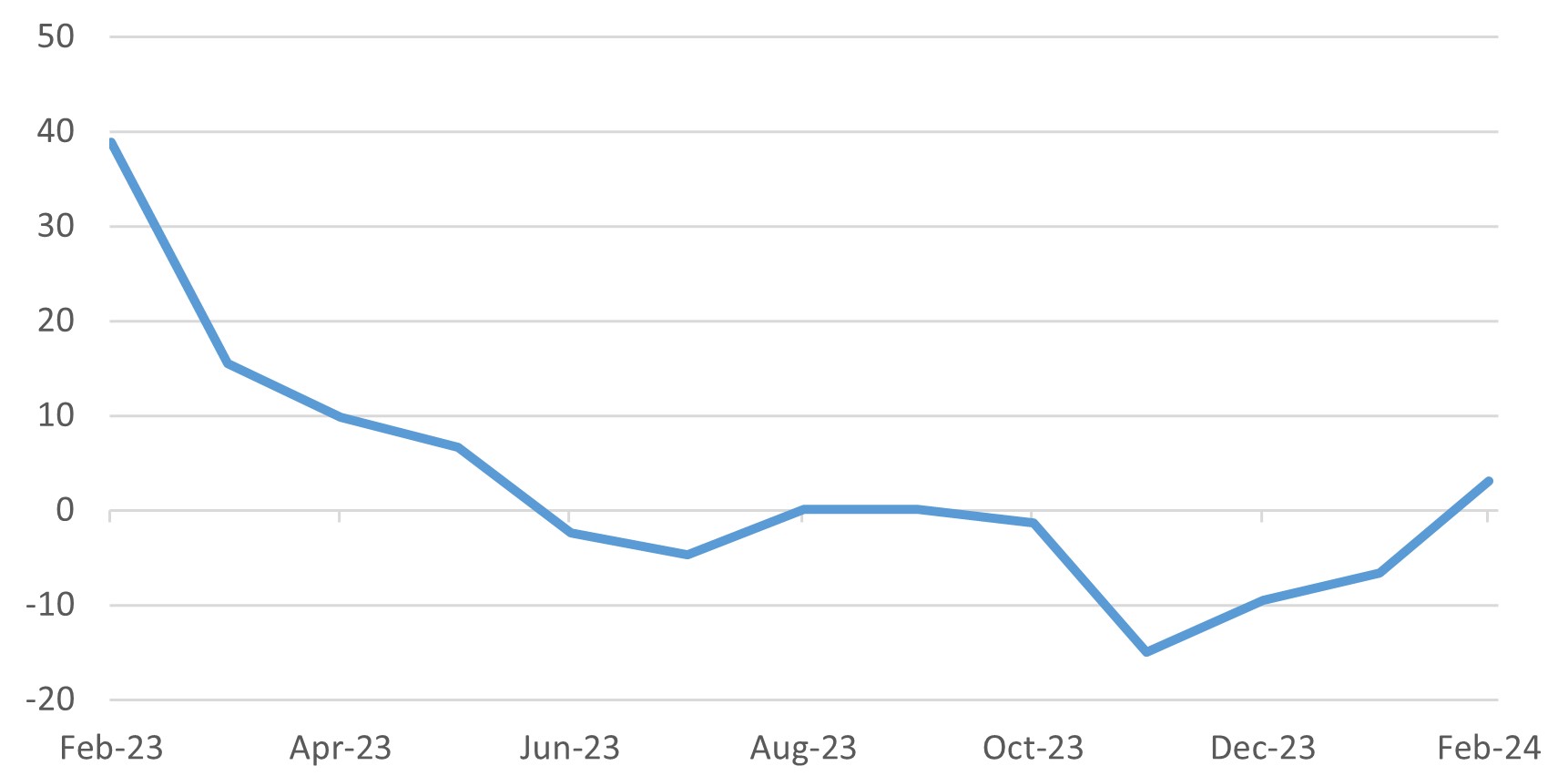

The markets benefitted last year from a trend of a peaking of inflation risk. By the second half of the year, inflation began to moderate across major economies, generally coming in below market expectations (Chart 2). However, since the start of the new year, economists have generally underestimated the stickiness of inflation.

Chart 2: G4 Inflation Surprise Index Trending Higher

Source: Bloomberg

Europe – hope

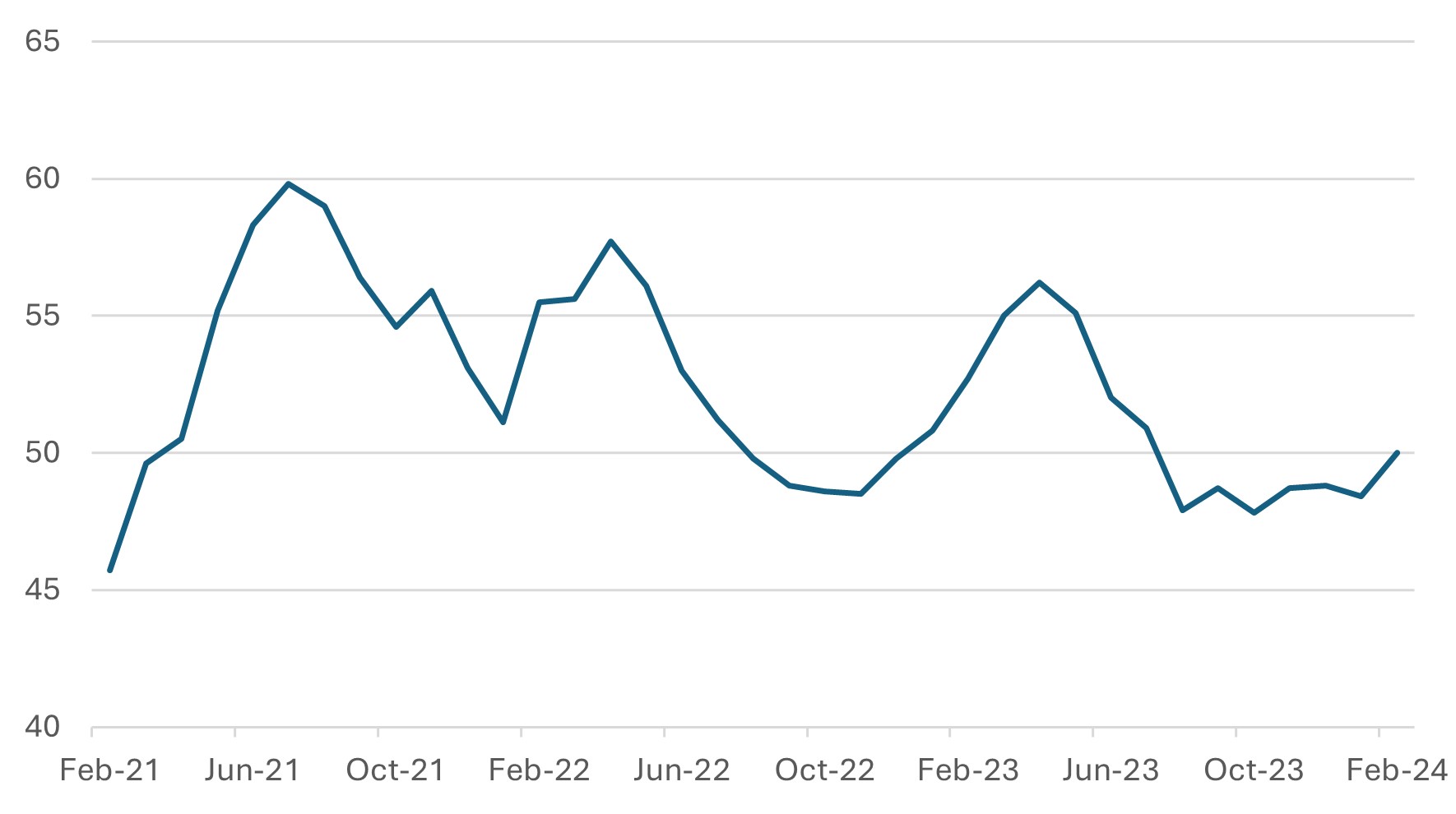

In Europe there’s an increasing hope that the region is beyond the worst and that growth can improve from here. Also, expectations have grown that the ECB will be cutting interest rates at around the same time as the Federal Reserve. Last week’s euro area industrial surveys showed that the manufacturing sector is still challenged but that the service sector is recovering at a faster pace than previously thought. The PMI for the services sector rose to 50.0 in February, up from 48.4 in January and ahead of expectations.

The German economy remains Europe’s weak spot. The Bundesbank last week cut its GDP forecast for the German economy to just 0.2% for 2024. Germany is facing some particular challenges after the German courts last year severely reduced the government’s scope to increase spending to support the economy. The hope for Germany and indeed the whole of Europe is that, an improvement in consumer confidence will unlock the large pool of savings that households accumulated in the Covid period that could eventually lead to a burst of consumer spending growth.

Chart 4: Eurozone PMI Shows Signs of Life

Source: Bloomberg

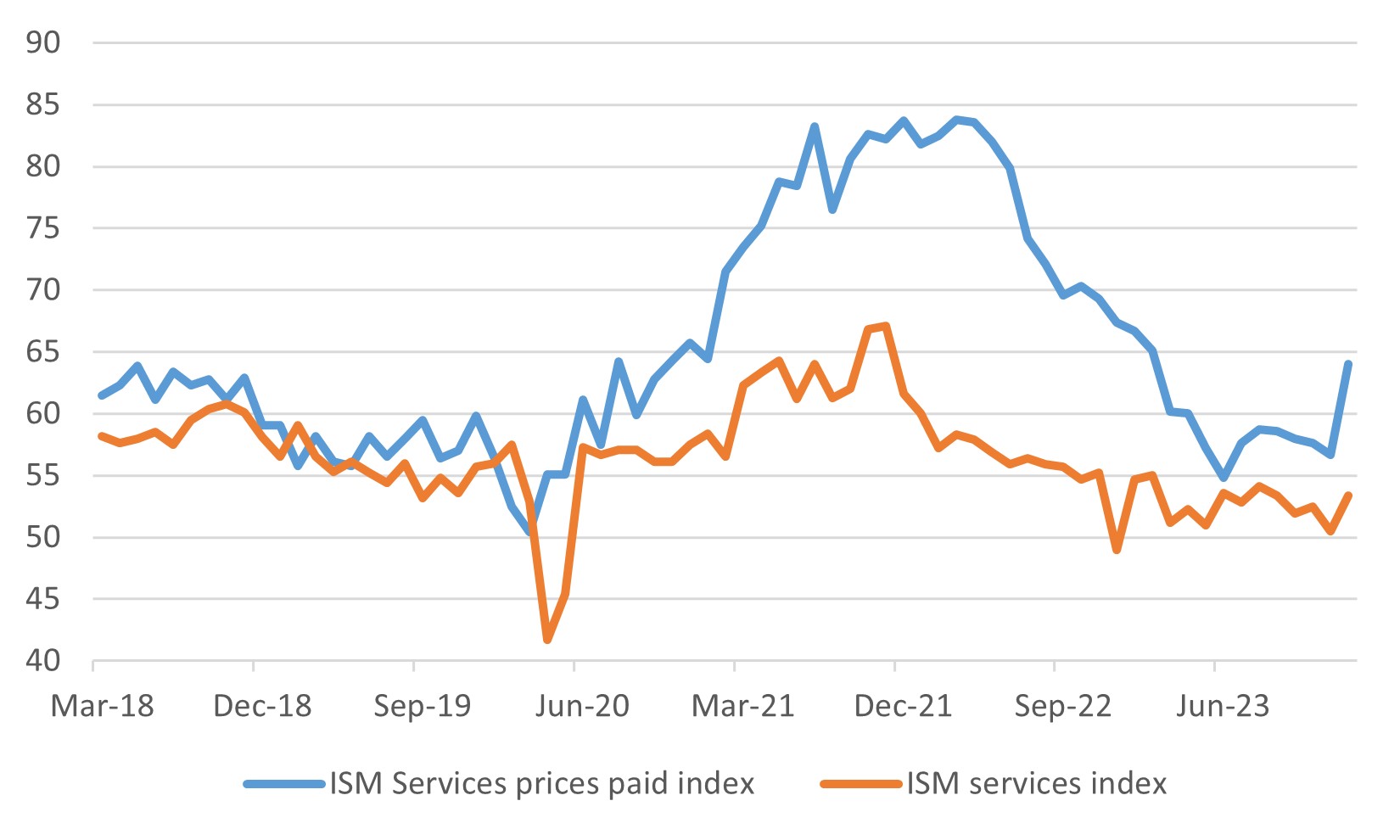

Some economists argue that a slowdown in GDP growth will bring about a softness in prices, but that appears not to be the case. Last week, we saw the ISM survey of the US manufacturing sector. While the aggregate confidence level fell below 50, implying a contraction of output, the prices paid index rose. The index of prices paid remained above 50 at 52.5, implying that prices are rising more than usual.

This week sees the release of the more critical ISM service sector survey. Consistent with the PCE deflator, the service sector prices paid index has been around the 64 mark, suggesting more significant pricing pressures. The consensus amongst economists is that service sector price pressures will remain at the same intensity as we saw in January, which, consequently, presents an ongoing headache for the Fed.

Chart 3: ISM Services Sector Indices Show Prices Paid More Vibrant Than Activity

Source: Bloomberg

Despite the worries surrounding inflation, the bond markets performed well on the week. US 10-year bond yields fell 10bps to 4.18%, down from a recent high of 4.32%. US 2-year government bond yields experienced a more significant 19bps drop after comments from one of the Fed governors, Chris Waller, that the Fed might shift its purchases to more short-dated bonds.

The US curve remains significantly inverted despite the recent rise in 10-year yields relative to 2-year yields. The assumption is that 2-year yields will continue with a marked fall in short-term interest rates. However, if inflation does not improve at the pace expected by the market, 10-year yields will surely rise.

Chart 4: US Yield Curve Remains Inverted Despite Recent Drop in 2-Year Yields

US 10-year yield less the US 2-year yield

Source: Bloomberg

The long-term perspective for US government bond yields has been the topic of several longer-term studies on the bond market. Analysts are finding more and more reasons why the average level of long-term interest rates could be higher in the longer term than in the past. In a report released last week, ‘bond house’ PIMCO stated that “we are at a moment when the term premium could start to reverse the 40-year downtrend,”. Term premiums reflect several factors related to macroeconomic and market conditions. In the case of the US, many of those factors are seeing reversals of previous favourable tailwinds.

US debt, average inflation, and government deficits are trending markedly higher than we have seen even after the Global Financial Crisis (Table 2). For some analysts, there might be a one positive takeaway: foreign ownership of the US Treasury market has fallen markedly since 2009. However, the drop from 50% to 28% also means that the US will have to either fund from its private markets or rely on the quantitative loosening in the form of Fed buying.

Table 2: Marked Deterioration in US Economic Fundamentals Argues for Higher Risk Premium

Source: Bloomberg

China – Watch for a potential revision to the long-term growth forecast

The markets will be watching China’s National People’s Congress for clues as to the possibility of further policy shifts to stabilise the economy. The formal sessions are mainly ceremonial, but there will be meetings behind closed doors that could have a bearing on future government policy. The government will announce its long-term growth target on Tuesday. Also, the foreign minister will give a speech that should provide an update on China’s position concerning the tensions with Taiwan and the difficulties with the US on trade. Hence, aside from the update to growth targets, the public output from the meetings may be very nuanced and may only provide a further update on the long-term dynamics of the country.