Probably not Neutral

- Financial Insights

- Market Insights

- With US economic surprises close to neutral the markets are looking for new trends

- We suspect that markets are mistakenly pricing a soft landing

- US economic growth momentum may depend on a resurgent consumer

- Taiwan’s not for turning – near-term challenge from China should already be discounted

- China has growth, but there’s little investor interest at the moment

- Eurozone economy stabilising, but showing little in the way of growth momentum

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

After an apparent winter hibernation, upcoming global economic data releases should start dictating some direction to asset prices. US economic data could be robust but may still indicate weakness. Economic data in China has been strong, but it is not generating the hype that it normally did. And in the eurozone, one hopes it can only get better.

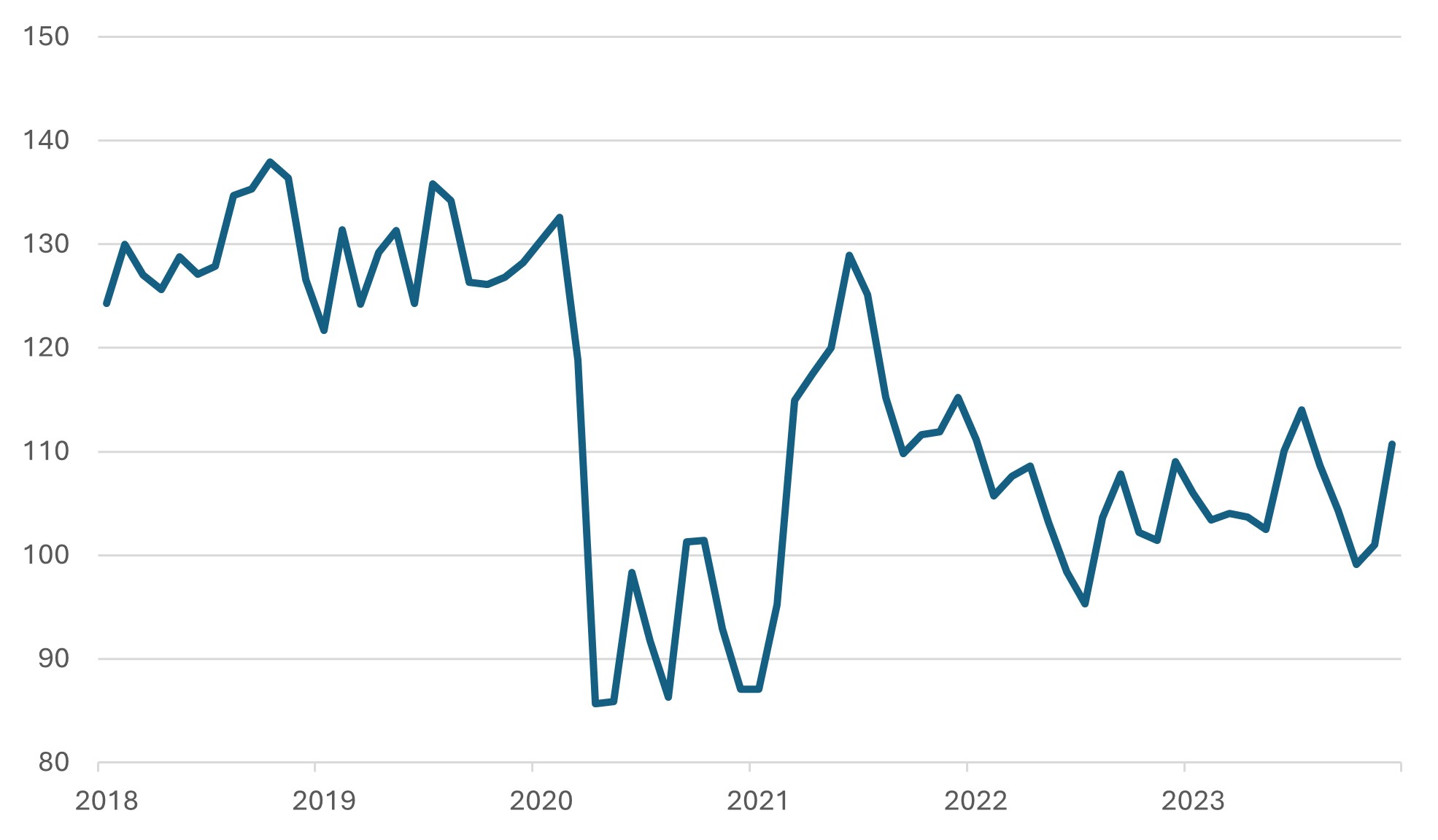

We believe the pricing of the US asset markets remains mistakenly anchored on beliefs that the US will experience a soft landing, facilitating a significant cut in interest rates through 2024. The market currently prices close to seven rate cuts this year. If such a scale of Fed rate cuts was to materialise, it will need the economy to show some early signs of weakness. While US economic data releases in the fourth quarter have not been as positive as they were in the third quarter, they have not disappointed either. The US economic surprise index (Chart 1) most recently bounced off the zero line, suggesting that the data releases are, at worst, in line with expectations. The indicator measures the degree to which US economic data has come in above or below expectations.

Chart 1: US Economic Surprise Index Still on the Positive Side

Source: Bloomberg

With retail sales and industrial production reports due this week, focus will be on the US real economy. Better news will likely come from the consumer sector—-vehicle sales alone account for about 6% of consumer spending. Since sale of vehicles rose more than expected in December at the second-best monthly figure of 2023 after April’s 15.91 million pace, it could be good news for the overall consumer sector. The Bloomberg consensus is looking for a 0.4% month-on-month increase after a 0.3% rise in November. The US consumer could still be a source of upward surprises.

The latest employment report showed that average hourly earnings grew at 4.1%, beating inflation and boosting consumers’ real spending power. The decent growth in income may be a factor behind the recent sharp increase in consumer confidence (Chart 2). The sharp drop in energy prices and mortgage rates likely also helped lift sentiments. The average 30-year mortgage rate is down to 6.93% from 8.0% in November. The average gasoline price across the US has fallen to $3.07 from $3.88 per gallon in October.

Chart 2: Conference Board Consumer Confidence Rebounded at the end of December

Source: Bloomberg

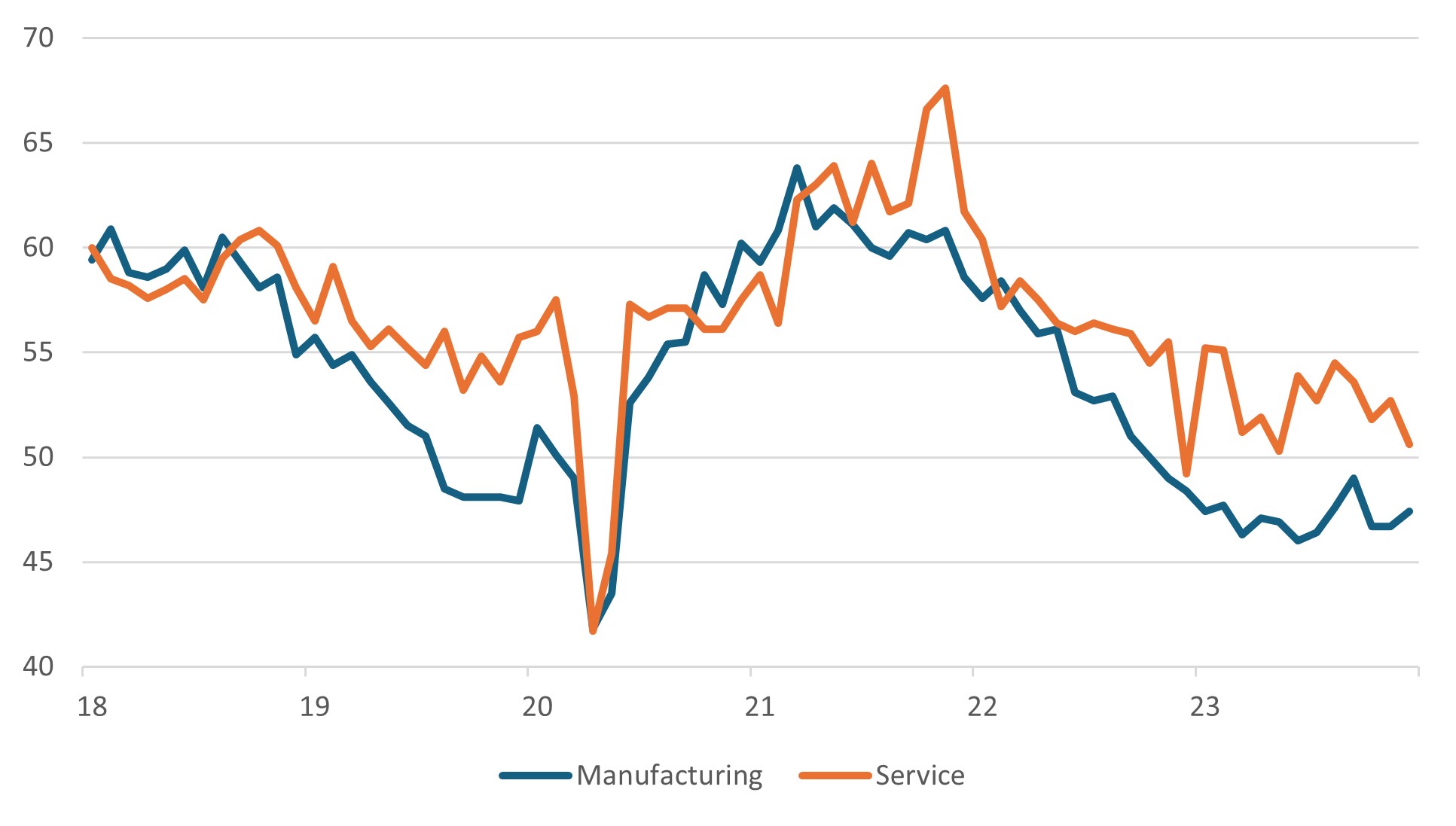

Weakness in the US economy may be evident in the industrial production data. The market expects a flat reading for December. The ISM confidence data showed ongoing weakness in the manufacturing sector and a blip in the service sector; indeed, the two surveys have not been collectively this weak in some time – except for the COVID-induced dip in 2020.

Last week’s December US inflation report had something for both the bulls and the bears. Headline CPI was worse than expected at 3.4% versus consensus expectations of 3.2% year-on-year growth. The core measure excluding housing – the gauge that some Fed officials including Chairman Powell prefer, surged 3.9% year-over-year versus expectations of 3.8%.

Chart 3: US Industrial Confidence has Waned

Source: Bloomberg

Taiwan’s not for turning

Despite what many in Taiwan considered was a significant pressure from China for the Taiwanese electorate to vote for a more pro-China candidate in the K.M.T., the ruling Democratic Progressive Party prevailed at the elections. Lai Ching-te, the current vice president, will be the new president. The antagonism between Taiwan and China will remain, least helped by the election outcome. Nevertheless, while China will want to show its displeasure at the election results, we will likely see a hiatus in its’ threats to the island over the next few weeks. The US, meanwhile, has sent a high-level delegation to reinforce its commitment to a democratic Taiwan.

The Taiwan stock market has drifted lower since the start of the year on some foreign selling. Foreign investors, including those from mainland China, were net sellers of 27.15 billion New Taiwan dollars ($878.56 million) worth of Taiwanese equities in the first eight trading days of the year, according to Taiwan Stock Exchange data. The Taiwanese stock market saw a 5% to 10% rally after the previous seven presidential elections. Hence, there could be a snapback from the recent weakness. However, investors are probably cognisant of the elevated geopolitical tensions in the region.

Taiwan bellwether TSMC continues to trade below the 2021 highs, with the stock having suffered a sharp derating in the past three years. The P/E multiple of the stock, in essence, has halved as analysts have re-assessed the long-term growth of the company. Taiwan now accounts for about 15% of the emerging markets index, now surpassed by India (17%).

The challenges in China’s economic malaise, and the ever-present governance challenges in Korea add up to the trouble in 50% of the MSCI emerging markets basket. The MSCI emerging market equity index is off about 3% since the start the year. China alone accounts for about half of those losses.

China – some things going right

There may be some hope that the Chinese asset markets will find some elements of good news.

China will be the first large economy to report Q4 GDP in the days ahead and despite the malaise plaguing the economy, it is not collapsing. In fact, it is growing faster than Japan, eurozone, and the UK combined. That is not too bad for a country whose economic model, many western commentators claim, is failing.

Three highlights from the Chinese economy will take centre stage in the coming days:

- The Chinese central bank, the PBOC, will likely cut the rate for the one-year Medium-Term Lending Facility from 2.5%.

- China, the world’s second-largest economy, will report Q4 2023 GDP numbers. The consensus view is that growth may have slowed to a 1% quarter-over-quarter pace from Q3’s 1.3%. However, it would still amount to growth of 5.2% for 2023.

- China reports economic details from last month. Of particular note, among calls for China to boost consumption, retail sales are rising double the pace of fixed asset investment (capex). The latter is running at a pace slightly below 3%, while the former rose by 7.2% in the first 11 months of 2023, compared with the same period in 2022.

Eurozone – can only get better

For investors Europe still provides little in the way of positive surprises. The heavy weighting of energy stocks didn’t even work last week despite the continuing geopolitical challenges in the Middel East. Oil prices drifted lower. This week there will be a focus on domestic growth. However, it feels that it is still too early to hope that the eurozone can spring a positive surprise. The only feelgood to emerge may be a sense that the worst is behind the region. Aggregate November industrial production should show small gains in Germany and France but some loss of momentum in Spain and Italy. On trade there should be better news. In the first ten months of last year, the eurozone reported a healthy trade surplus of EUR 28.75 billion. Despite the trade surplus the euro may remain under modest downward pressures against the dollar given that the market assumes a 45% chance of a rate cut in March.