No Cold Turkey

- Financial Insights

- Market Insights

- Extraordinary rally in risk markets over the month

- Equities look vulnerable to profit-taking

- Complacency evident in the equity market with VIX at 3-year low

- US 10-year bond yield looks to have bottomed out ahead of Treasury auctions this coming week

- German budget is disarray – eurozone growth at risk

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

The financial markets have maintained their recent upward run, which has been fueled by a stream of seemingly positive developments that have boosted equities and high-yield bonds. However, we caution against the current wave of optimism, which could face a sharp reversal if the widely anticipated gentle economic deceleration fails to materialise.

The markets appear to have largely shrugged off developments that undermine the soft landing narrative. The recently published Federal Reserve minutes reveal a central bank that expects interest rates to remain high, with the inflation trajectory still fraught with uncertainties.

Contrary to their typical contrarian stance, even the usually cautious investors are seeing merit in the prevailing market uptrend. According to Nicolas le Roux of US Group AG, Commodity Trading Advisor funds, known for their counterbalancing role during asset rallies, have invested more than $60 billion in global equities in the past fortnight.

The upward drift in long-term inflation expectations among households has added to the Fed’s concerns. Notably, the final October figures from the University of Michigan’s survey of consumer sentiment indicate that the 10-year inflation forecast has climbed to 3.2%, marking an 11-year peak. Moreover, the short-term, 12-month inflation outlook has surged to a seven-month high of 4.5%.

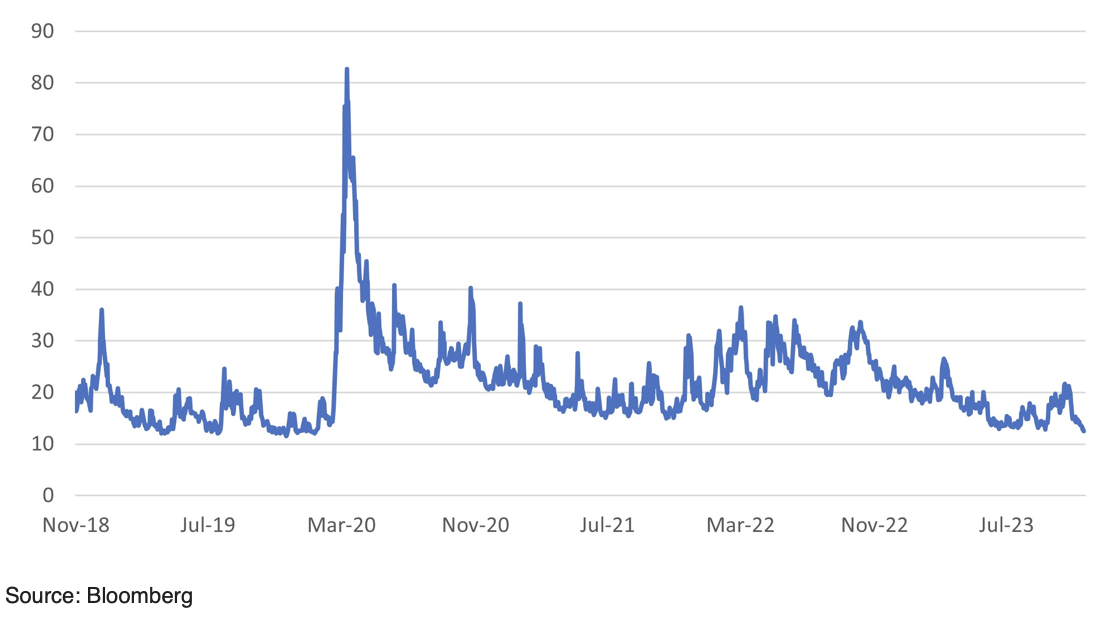

Interestingly, while inflation keeps policymakers and investors on their toes, complacency appears to have crept in in the markets. The VIX index, a barometer of US equity market volatility, has dipped to its lowest since January 2020. This has coincided with a significant influx of mutual fund investments into the equity market, totaling $40 billion over the two weeks leading up to 21st November. This represents 28% of the year-to-date total, potentially overstating the market’s positive performance.

Chart 1: VIX index – a measure of US equity market volatility – drops to its lowest since January 2020

Equity markets – a potential reversal on cards?

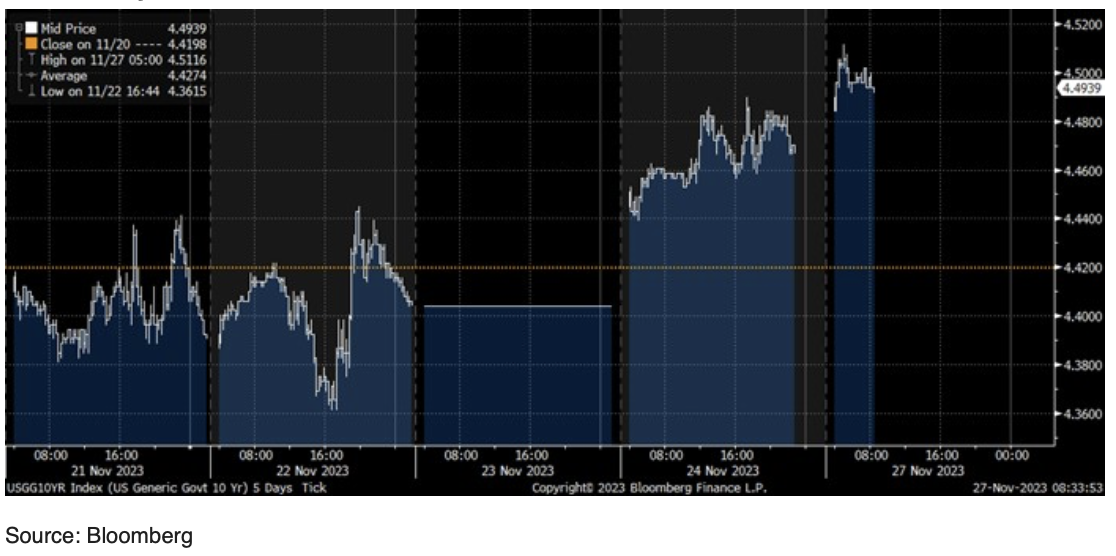

Recent optimism aside, the equity markets face a potential reversal of some of the recent supportive positives in the coming days. The US 10 year may have reached the limit of its rally. Late last week, the US 10-year bond yield started to drift higher. The bond market will be challenged in the coming days by a heavy load of Treasury auctions; on 27th November the Treasury will sell $54 billion of 2-year notes and $55 billion of 5-year notes. On 28th November the Treasury will sell $39 billion of 7-year notes.

Fed Chair Jerome Powell is due to speak this week ahead of the blackout period for the 13 December FOMC meeting. He may allude the manner in which the markets have given back 60% of their previous tightening since July. Remember commentators had previously argued that the Fed didn’t need to raise rates still further as the market had done to the tightening for them through higher long term interest rates and wider spreads.

Bond yield reversal evident

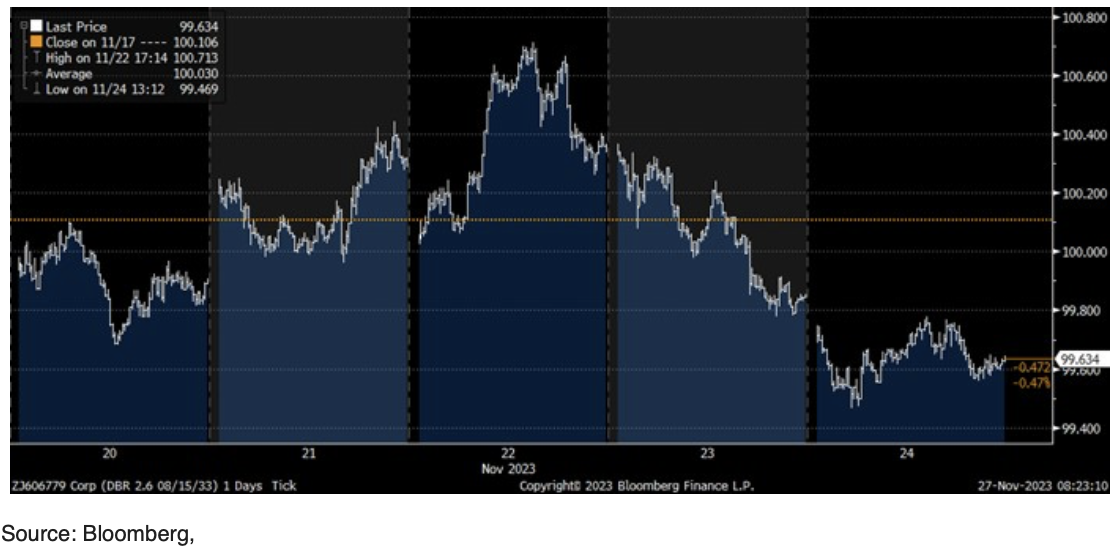

While equity markets have rallied, bond markets have struggled to keep pace. Global bond markets had a testing time last week, which serves as a stark reminder of the challenges posed by the accumulated burden of unsustainable sovereign debt. European bond markets, in particular, felt the impact, with bond prices dropping and yields climbing following a decision by a German court to suspend a constitutional debt brake for the fourth consecutive year.

Chart 2: Intraday US 10 -year yield – yields pick up from their lows and threaten the equity market rally

German government’s predicament – a lesson for the US?

The German government’s pledge to adhere to a debt ceiling was a key factor in containing the rise in eurozone bond yields. However, undermining this commitment was the court’s direction to the government to retroactively include at least €37 billion of off-budget expenditures, primarily related to subsidies aimed at mitigating the surge in energy costs following the Russian invasion of Ukraine.

The court’s ruling has significant implications, particularly as it pertains to previous governmental spending programmes that were not traditionally factored into budgetary considerations. With the altered dynamics of government expenditures, Germany now faces the prospect of curtailing various planned spending initiatives. This fiscal tightening will likely dampen GDP growth, with some economists projecting a potential contraction of 0.5% in the coming year’s economic output.

Chart 3: 10-year German bund price

The criticism aimed at the German government often overlooks the broader fiscal realities and is not entirely justified. Suggesting that governments should continue spending without restraint is a flawed strategy. There’s no one-size-fits-all approach and it paints a somewhat misleading picture when some analysts cite the U.S. Inflation Reduction Act as a paragon of fiscal management. While the U.S. administration’s expenditure on renewable energy and generous financial incentives might be popular, they are also contributing to an economy increasingly reliant on debt and foreign borrowing. A projected budget deficit amounting to 8% of GDP, coupled with a government debt-to-GDP ratio soaring to projected 135%, should not be viewed favourably. Sustainable financial governance isn’t akin to possessing an endlessly forgiving credit card. Germany’s recent experience is a testament to this, and it serves as a cautionary example for the United States, which appears to be treading a similar path.