Markets Enjoy the Growth and Hope for Lower Rates

- Financial Insights

- Market Insights

- Combination of good growth and market hopes for rate cuts underpins markets

- US inflation data this week sees headline inflation likely drop back but there are still pockets of inflation strength

- US CRE problems not helped by Chinese dumping of US assets – however the US problems don’t translate into a big problem for Asia

- UK equities may have a catalyst for a recovery from rock bottom valuations

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

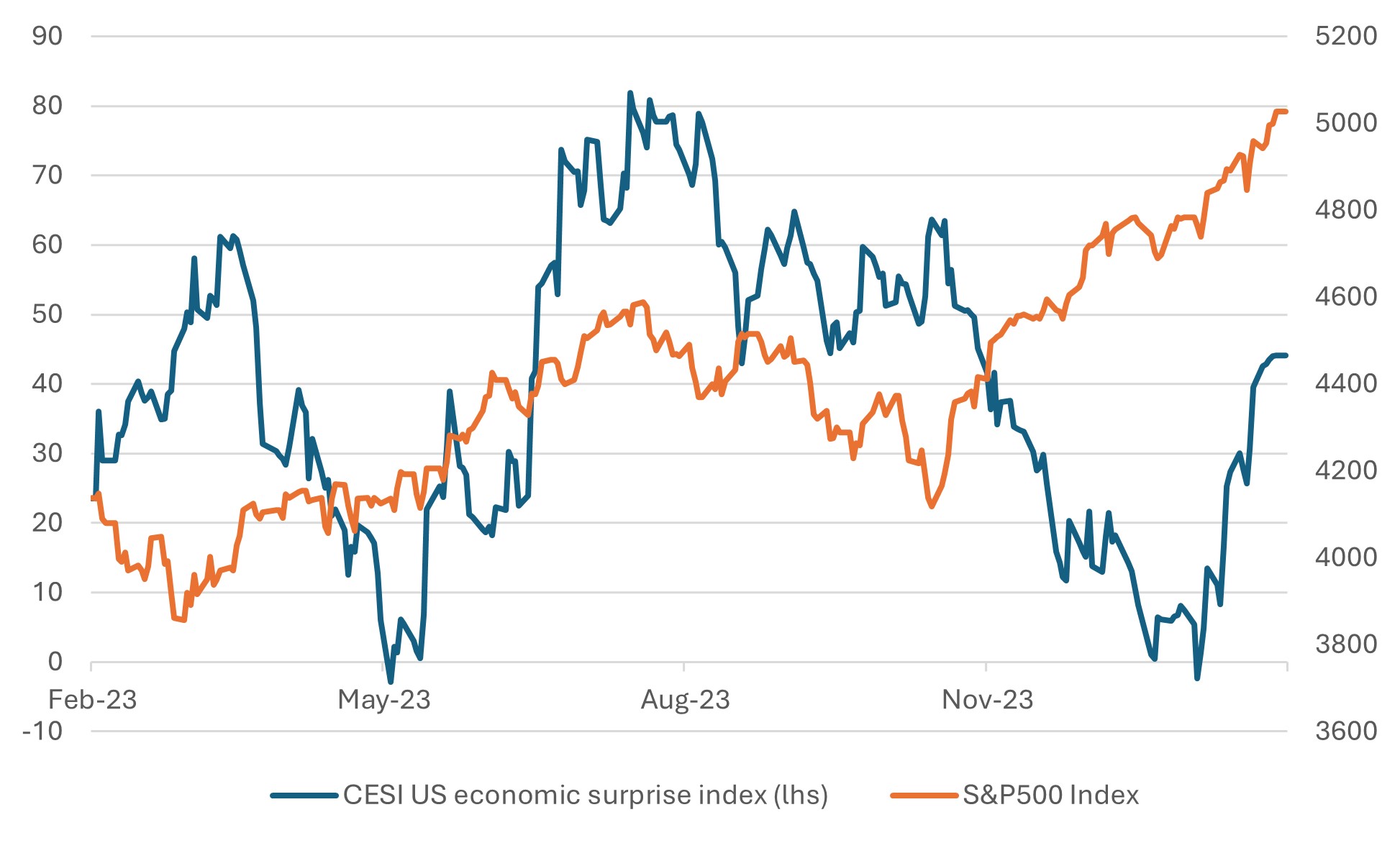

Equity markets continued to have a positive tone in the past week. Markets, though, are not getting carried away. The market moved higher in the fourth quarter despite worsening economic data as hopes built that the Fed must cut interest rates sooner. Based on recent financial data, Nowcast’s estimate indicates that a first-quarter US economic growth of as high as 3.5% provides further support for the market. A move or no move by the Fed notwithstanding, the market appears reasonably content with the current growth rate. We, however, choose to remain a bit more circumspect – the positive mood in the market will continue if the markets can see line of sight of a rate cut sooner rather than later.

Chart 1: US Equity Market’s Initial Run was Based on Assumptions of Lower Rates; it’s Built on Better-Than-Expected Growth Now

Source: Bloomberg

US inflation has a slight bias to disappoint the consensus this coming week.

This week’s US inflation news is not expected to challenge the positive mood in the equity market, but be mindful that there are some odd spots of inflation in food and energy prices, as we saw last month.

In the market’s eyes, strong GDP growth and diminishing inflation risk have been an intoxicating cocktail that propelled equities higher in the early weeks of 2024. The market expects headline inflation to fall to 2.9% from 3.4%, although core inflation should ease to 3.7% from 3.9%. Investors should remember, though, the previous inflation report, which reported a surge in inflation to 3.4% against market expectations of 3.2%.

There are several ifs and buts, making it difficult to gauge precisely the trajectory that future inflation would likely take. The burst of growth we have seen over the past four or five months references an economy that is clearly using up more of its spare resources, hence the still low levels of unemployment. The recent ISM survey showed the largest monthly increase in the service sector prices paid index since 2012. Oil prices have started to move higher but were flat in January compared with the previous month. A recent report by JPMorgan alluded to the low inventories of crude oil and products, which could easily lead to a $10 per barrel price spike.

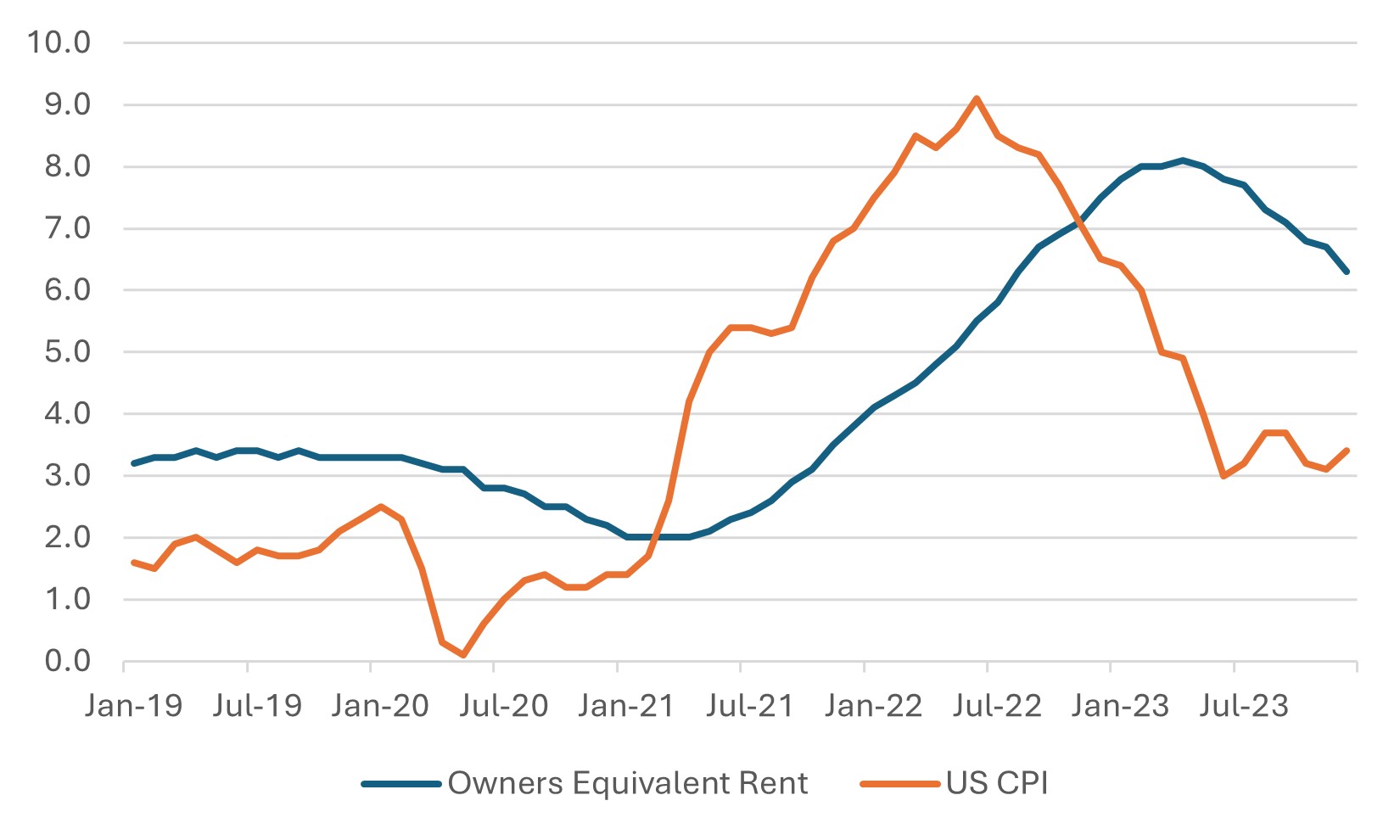

One underlying inflation component to watch out for over the medium term will be the owners’ equivalent rent (OER), which is quirky and not always in sync with other components of the inflation basket. OER accounts for 24% of the inflation basket and is one of the most important but controversial inflation elements. When inflation was bubbling in the United States, OER was slow to rise. However, when headline inflation has declined sharply from its peak, OER inflation has been equally slow to recede. Nevertheless, I would refrain from reading too much into this because one may argue that inflation is currently overstated due to the influence of a high OER. We would also have to accept that US inflation peaked at 10%, not at the officially reported 9%. The truth is that the reported headline inflation anchors the market rate and is not a read-through of all sorts of judgements around numbers that should be higher or lower.

Chart 2: Owners’ Equivalent Rent Inflation Out of Sync with Headline Inflation (% Change Year-on-Year)

Source: Bloomberg

Some international factors exacerbate the US Commercial Real Estate problems, but not all. The recent problems witnessed in the US commercial real estate sector are already well documented. COVID has left its legacy of diminished office space demand, with around 20% of the workforce working from home. The persistence of high interest rates has left real estate companies vulnerable as they face what is, in essence, a massive wall of refinancing due in the coming four years.

Last week’s news of Aozora, a Japanese mid-tier lender, getting into some difficulties because of its exposure to US commercial real estate raised the fear of the problems spreading beyond the US’ shores. Foreign investors were heavy US commercial real estate buyers from around 2014, seeking to boost yields amid low interest rates, particularly in their domestic markets. In 2014, a JLL report found that foreign buyers outstripped US investors by accounting for 50.2% of the purchases of trophy office buildings in the US’ biggest markets in 2013. The buying in 2013 was nearly double the level of 2012. Chinese-based investors accounted for a significant chunk of that buying frenzy between 2013 and 2018. According to Statista Market Insights, commercial real estate prices are estimated to have surged 30% on average between 2017 and 2023, thus reducing the potential scale of mark-to-market losses.

A study by Fitch ratings released last week allays fears that write-downs of US CRE could hit Asia. The study showed that APAC banks’ exposure to US property, including commercial real estate, is generally less than 2% of their overall lending. Even that exposure may not be as problematic as some headlines suggest.

The mega problems facing the Chinese real estate market can potentially cause more selling pressure on the US CRE as Chinese companies seek to prop up their balance sheets by making distressed sales of US CRE. Mind you, selling has been prevalent since 2019, when the Chinese real estate problems became more widespread.

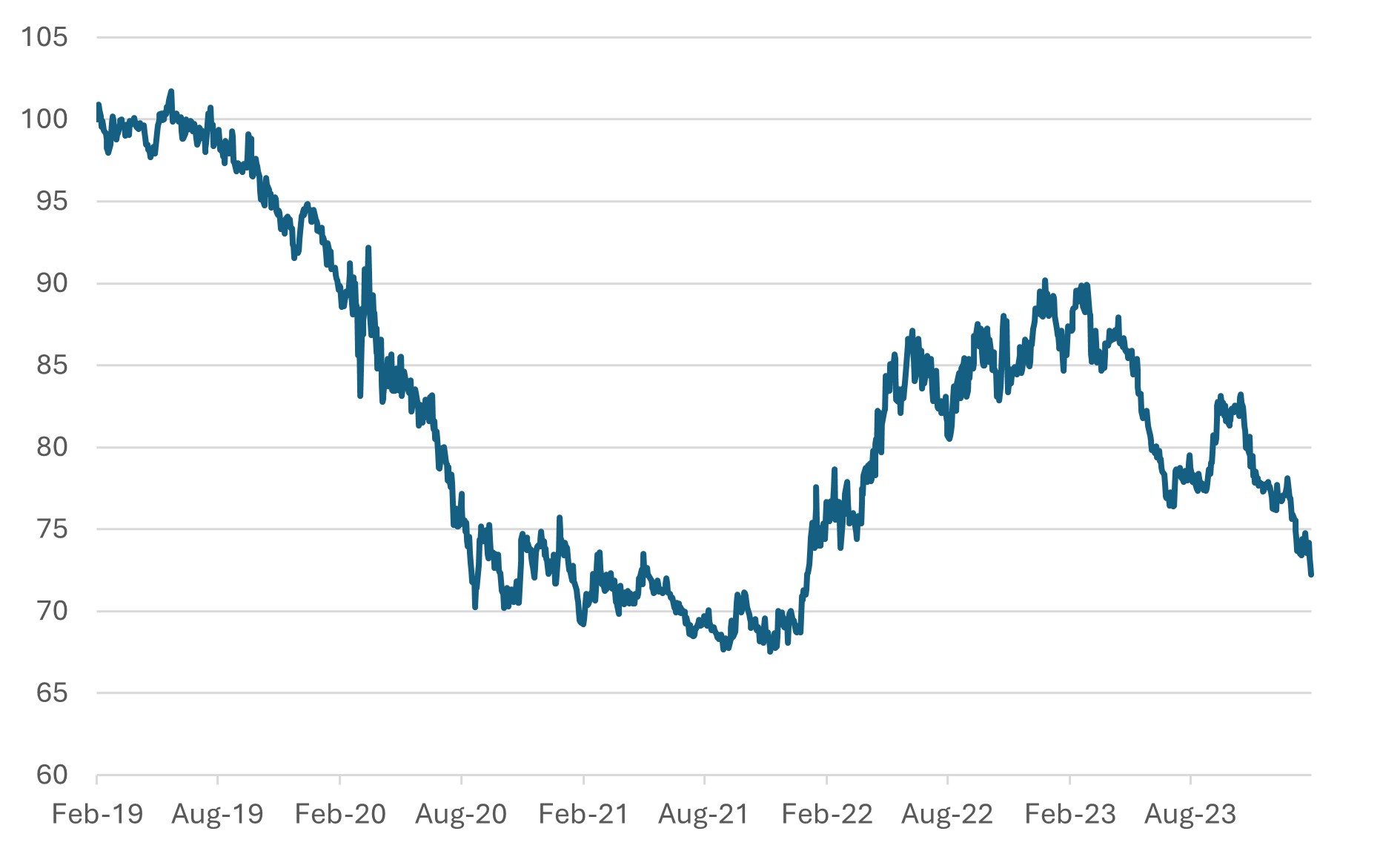

UK equities cheap and with a possible catalyst.

Could the UK equity market be set for a period of better news? Last week data suggested that the underlying unemployment rate may already be falling. Recent industrial confidence data has improved, suggesting some recovery may be under way. In the real estate market, the RICS survey showed a surprise increase in new buyer enquiries; the impact of lower rates on new mortgage offers is positive. The pricing of a new 2-year fixed-rate mortgage has dropped 160bps over the past six months. On the surface, this week’s inflation report will likely not look good; however, at the core, there are signs of moderating inflation pressures that may impress the Bank of England. However, many global investors may wonder these days why they need a dedicated allocation to the UK market. Nevertheless, a forward P/E multiple of 10x earnings suggests that UK stocks may suffer from just being associated with the UK. The UK factor discount might materially diminish if the UK economy can show it is back on a better footing.

Chart 3: UK Equity Market’s Poor Relative Performance Over the Past Five Years

UK equity market net total return index relative MSCI World I local currency

Source: Bloomberg