Living with US Inflation

- Financial Insights

- Market Insights

In Summary

Inflation in the US remains a persistent issue and cannot be easily dismissed. The once hopeful scenario of the Federal Reserve implementing gradual rate cuts throughout 2024 now appears overly optimistic. It’s increasingly probable that the Fed will make minimal adjustments to rates – or perhaps none at all. There is also a growing likelihood that the Fed will avoid adopting an overly hawkish tone, even amid high and sustained inflation. Equity markets might interpret this as an indication of robust nominal growth, which theoretically benefits corporate profits. However, this could lead to higher long-term interest rates, posing challenges to the valuations of US equities. Our main forecast for bonds and credit suggests that returns may be limited primarily to coupon yields for the remainder of the year. In terms of equities, we prefer the European market, where potential rate cuts and unexpected growth could occur with reduced inflation risk.

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

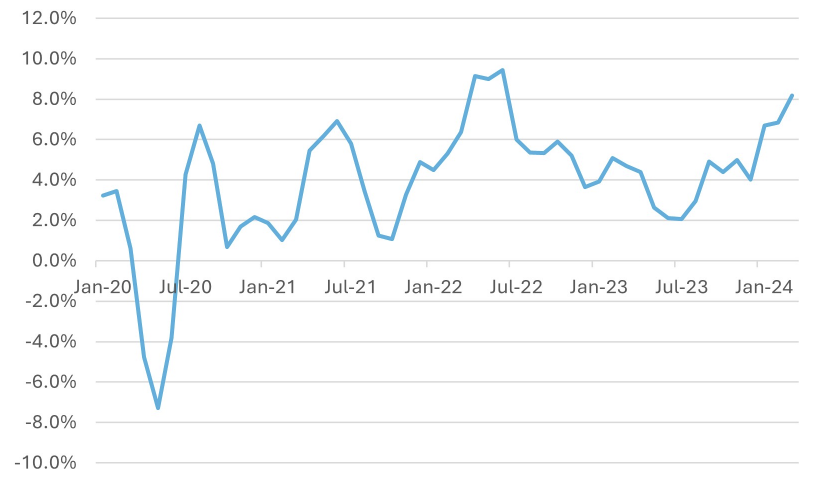

US Inflation still a distraction

There can be no doubt that US inflation is not on track. Last week’s inflation report showed consumer prices increased more than expected for the third month in a row. In fact, inflation is not just sticky, it’s rising. The three-month annualised super core inflation is running at 8.2%. When headline inflation hit 9.1% in June 2022, little did we know back then that nearly two years later we would still be talking about a major US inflation measure being that close to double-digit growth.

Chart 1: US Supercore Inflation Trending Higher

Source: Bloomberg

Theories galore on why the Fed would be reluctant to raise rates

Discussions in the financial markets continue to revolve around when the Federal Reserve might reduce interest rates, rather than contemplating any potential rate hikes. It appears the U.S. has grown increasingly tolerant of higher-than-expected inflation rates.

With inflation remaining sticky, market participants of late have also wondered if there’s a remote chance of a Fed rate hike. We rule that out, however. There are several theories that explain the Fed’s reluctance to increase rates. First, with the presidential election looming, the Fed is likely aiming to avoid the controversy that a rate hike could stir during such a critical period. Additionally, raising rates could escalate the cost of servicing national debt. The Treasury has recently issued a significant amount of short-term debt, anticipating that short-term interest rates might soon peak, which would enable refinancing at more favorable rates. Historically, the Treasury has avoided issuing long-term debt to prevent locking in high financing costs, hoping instead for a decrease in inflation and subsequent rate cuts by the Fed that would lead to lower long-term interest rates. Contrary to these expectations, the current situation sees a strong likelihood that the Fed will avoid rate hikes, as doing so could cause a uniform increase across the U.S. yield curve, thereby raising the government’s funding costs. The year 2024 is pivotal for U.S. government debt refinancing, with about 30% of the debt stock due for refinancing.

Bonds – concerns may build about Central Bank accommodation of inflation

US bonds had a tough last week with yields moving up across the curve – US 10-year yields rose 10bps to 4.52%. Spreads also widened (US high yield +12bps) as the markets interpreted the repercussions of higher-for-longer rates as challenging for credit markets.

The three- to six-month outlook for US bonds is tricky. While on the one hand the market does not see that inflation is getting out of hand, on the other the lack of rate cuts and the Fed potentially going soft on current inflation could put more of a risk premium into government bond yields. Again, the coming rise in headline inflation due to the rise in energy prices will likely lead to significantly unnerving spikes in headline inflation through the current quarter. Also the more that the Fed appears to be accommodating higher inflation the more there is a risk that longer dated US government bonds may see higher yields.

While the US will internalize its debate about the appropriate path for interest rates, there are international repercussions that add complexity to global markets.

What will Europe do?

Last week, the ECB kept interest rates unchanged but indicated for the first time in this cycle that it was prepared to cut rates if inflation continued improving.

However, the stickiness of high US inflation and rates could limit the amount of any future ECB monetary loosening. A rate cut in June looks likely, however the market is becoming concerned that events in the United States may limit the scope for any rate cuts beyond June. The performance of the euro during this period will be critical. A marked weakness in the euro would precipitate inflation concerns at the ECB. There are already some concerns that the eurozone still has relatively strong service sector inflation and that wage growth is accelerating.

Chart 2: US 10- year Bond Yield Spread versus German 10-year Bund Yield (%)

Source: Bloomberg

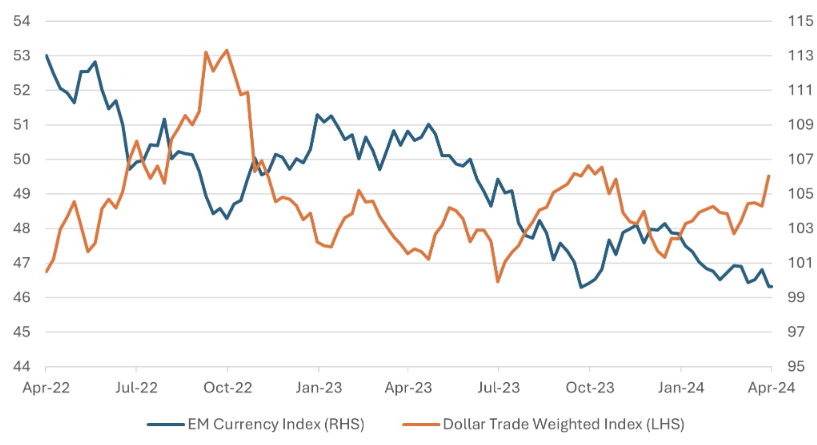

Emerging Markets challenged

Many emerging market countries may be inclined to cut interest rates through 2024. However, the challenging inflation in the US and signs of some currency weakness is making several of these economies reconsider an early move to trim rates (Chart 3). Central banks in Thailand and Korea, for instance, appear to have pushed back their rate cuts until the second half of the year. We would note that the dollar strength is not just against the emerging market block but, as the chart shows, it is evident against the yen and euro, too.

Chart 3: Emerging Market Currency Index Biased to Weakness as Dollar Gains against the Majors

(Index)

Source: Bloomberg

In aggregate, we see EM Debt collecting its coupon for the balance of the year with limited scope for any further spread narrowing and little help from lower yields in the US Treasury market. The very narrow spread of emerging market USD debt versus US Treasuries probably leaves little room for further improvement given limited policy flexibility at many EM central banks. The one area where we may see further rate cuts is in Brazil where inflation has surprised to the downside. However, persistent service sector inflation and the strength of the dollar may push the Brazilian central bank to consider relatively moderate 25bps moves rather than the 50bps moves seen since the third quarter of 2023.

Chart 4: Narrow Emerging Market Bond Index Spread Leaves Little Room for Further Performance

(%)

Source: Bloomberg