How Should We Invest in Equities

- Financial Insights

- Market Insights

- US economic data surprises to the upside

- Fed likely to signal that rates may have peaked but it is likely in no rush to signal a cut

- US politics looks dysfunctional and worrying for the longer term

- Investors should question why they allocate 60-70% of their equity exposure to a country at war with itself

- Allocations to markets with better prospects than the US such as Japan and India should not be so heavily anchored on (low) MSCI index weightings

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

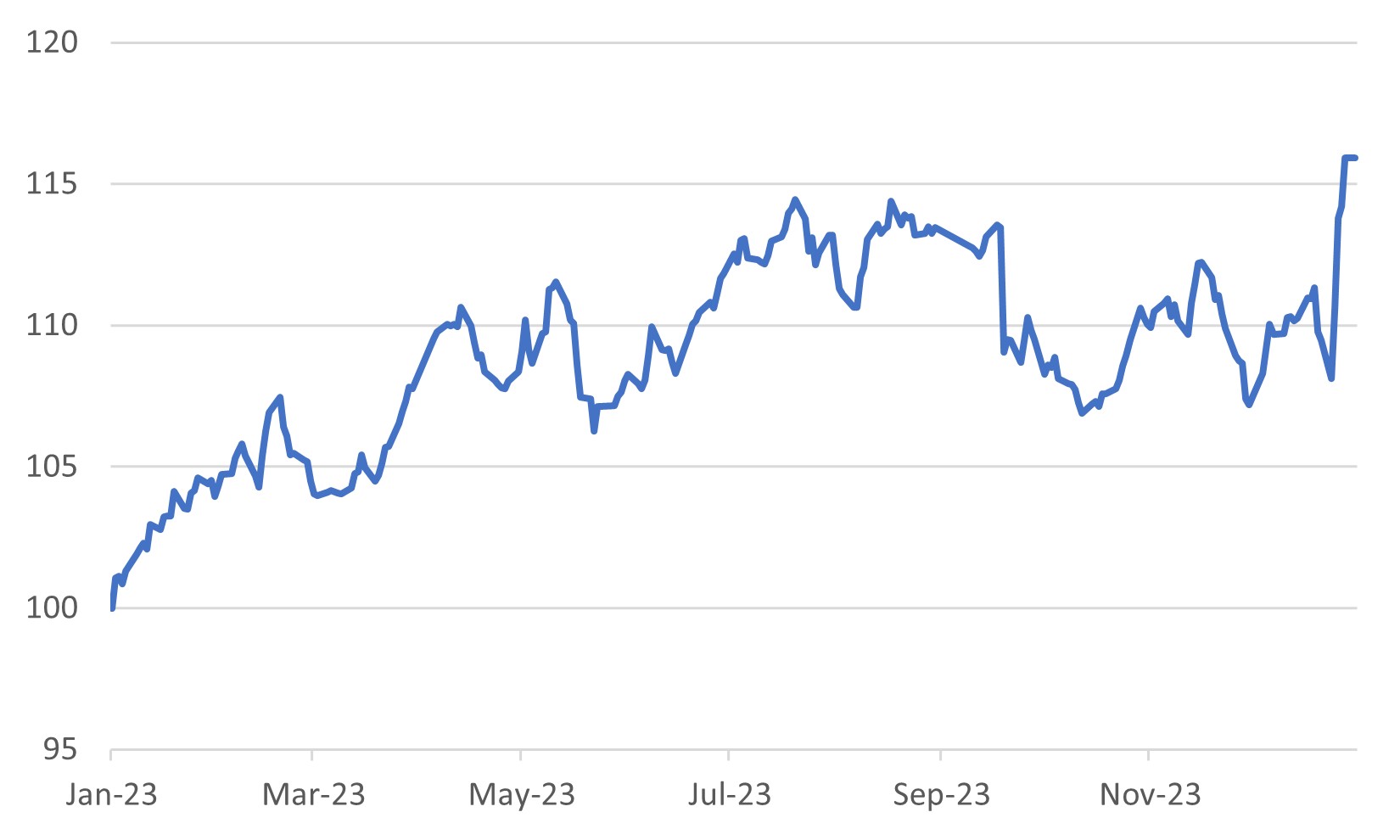

U.S. economic indicators continue to trend positively. As we had noted in our previous issue, the decline in inflation, driven by falling oil prices, has put more money in the hands of consumers, sparking a notable increase in spending. The U.S. Economic Surprise Index has seen a rebound in recent weeks, dispelling earlier concerns about a recession. A key highlight was Thursday’s Q4 GDP report, which significantly exceeded forecasts with an annualized quarterly growth of 3.3%, surpassing the consensus estimate of 2.0%. While this growth rate was partly inflated by inventory accumulation, the underlying figures remain robust nonetheless.

Contrary to expectations, the GDP deflator was surprisingly low at 1.5%, compared with the anticipated 2.2%. However, this subdued inflation rate is unlikely to significantly alter the Federal Reserve’s stance in the upcoming meeting. The Fed is expected to signal that though interest rates may have reached their peak, but the central bank is not in a hurry to reduce them. A resurgence in economic growth could further strain the already tight labor market, potentially driving wages up.

Chart 1: US Economic Surprise Index Strengthens

Source: Bloomberg

US Politics—A Source of Concern?

While the US economic data has been better than expected, it is the country’s politics that is starting to worry foreign investors. The current negotiations in the House of Representative and Senate over a compromise resolution around the immigration issues shows ongoing, highly political posturing that resolves nothing. Meanwhile the odds of former president Donald Trump being the Republican’s party’s choice for presidential nomination have increased, although he has also lost another round in court. US politics appears dysfunctional at present and is certainly a cause for worry.

Given the current political backdrop, pertinent questions arise for the asset management industry regarding its strategy of continued heavy investment in the US equity market. There seems to be a notable disparity between what the MSCI indices suggest, i.e., allocating 62% of global all-country equity exposure to the US, and the long-term economic fundamentals of the country. The global dominance of the US, both in terms of market influence and other important parameters, appears to be waning. Notably, the US does not represent a significant portion of the global population, and its long-term potential GDP growth has decreased to around 1.5%, a marked reduction from the previously expected range of 2.5% to 3.5%. Furthermore, instances where the US has exceeded this 1.5% growth threshold have often been accompanied by an increase in national debt. For example, during the-then president Trump’s tenure, the country’s debt-to-GDP ratio increased by 22 percentage points. This trend prompts a re-evaluation of the traditional investment strategies that heavily revolve around US markets, considering both the shifting global economic landscape and the evolving dynamics within the country itself.

Table 1: Dominance of US in MSCI Equity Indices Doesn’t Square With Some Fundamentals

While there is no denying the global reach of the US corporate sector, it’s also important to note that approximately 60% of their revenues are derived from the domestic market. Additionally, of late, there’s been a noticeable trend in the US corporate sector becoming more domestically focused, showing less inclination towards engaging with a growing number of overseas markets and counterparts.

We Prefer Japan and India

As we continue to pursue innovative strategies in strategic asset allocation modeling, we’re shifting our focus more towards equity markets that demonstrate a strong long-term growth narrative. This approach has led us to significantly increase our investments in markets like India and Japan. We’ve observed a trend among some forward-thinking wealth managers who are allocating up to 10% in Japan and 5% in India, breaking away from conventional investment norms. Japan presents an attractive opportunity, especially with the ongoing corporate restructuring and its potential for a significant re-rating. This is evident when comparing the price-to-book ratio of the TOPIX index at just 1.4x, against 2.7x for the global equity index. In India, the compelling case for a 7% GDP growth compounding in the background presents a substantial case for a meaningful exposure.

For investors concerned about reducing or rejigging their US market exposure, we recommend considering specific opportunities in the US tech sector through the NASDAQ. This strategy offers a chance to capitalize on a market segment that is less affected by the broader fluctuations of the US economy.

China, meanwhile, has seen its tactical appeal grow as the government implements emergency measures to bolster market confidence. The dichotomy of capitalist markets within a communist system continues to be a complex issue for many investors. However, recent discussions with a manager of Chinese equities suggested growing confidence in the government’s initiatives. These initiatives include incentivizing the senior management of State-Owned Enterprises (SOEs) through their compensation structures to enhance return on equity. Such capitalist-leaning strategies are beginning to positively influence share prices, evidenced by the recent performance of the SOE sector

Chart 2: China’s Shanghai SOE Index Relative to Broader Market (Shenzhen 300) in 2023

Source: Bloomberg

One other factor that may help to keep foreign investors engaged is China’s dominance in key parts of ESG technology. A Bloomberg report last week noted that China added more solar panels in 2023 than the United States has in its entire history. Meanwhile, China’s new electric vehicle (EV) sales increased by 82% in 2022, accounting for nearly 60% of global EV sales for the year. The trend continued in 2023 with Chinese automaker BYD selling more EV cars than Tesla in Q4 2023. We expect global EV markets to open to Chinese manufacturers eventually. In the EU, imports from China accounted for only 3% of Europe’s EV sales in 2022; UBS expects this figure to reach 20% by 2030.