How Can 0.1% Feel So Good?

- Market Insights

- Financial Insights

- US CPI data beats expectations by 0.1% and markets rally

- The markets have almost priced a perfect outcome of a soft landing and unwinding of inflation

- It’s too early to judge how things will work out, but the loosening of monetary conditions could lead to an unwanted rebound in inflation

- The rest of the world enjoys the moderation in US monetary policy and dollar risk

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

Last week witnessed a notable boost to investor sentiments as the 0.1% outperformance of U.S. inflation data versus expectations prompted a discernible uptick in risk appetites. The impact resonated through the global bond markets, with a significant decline in yields—U.S. 10-year notes receded by 20 basis points (bps), paralleled by a steeper 30 bps reduction in New Zealand. Equities, too, ended the week on a high, with markets generally advancing 2-4%. European and Japanese indices, in particular, benefited, eclipsing gains in the U.S. and capitalising on a concurrently retreating U.S. dollar.

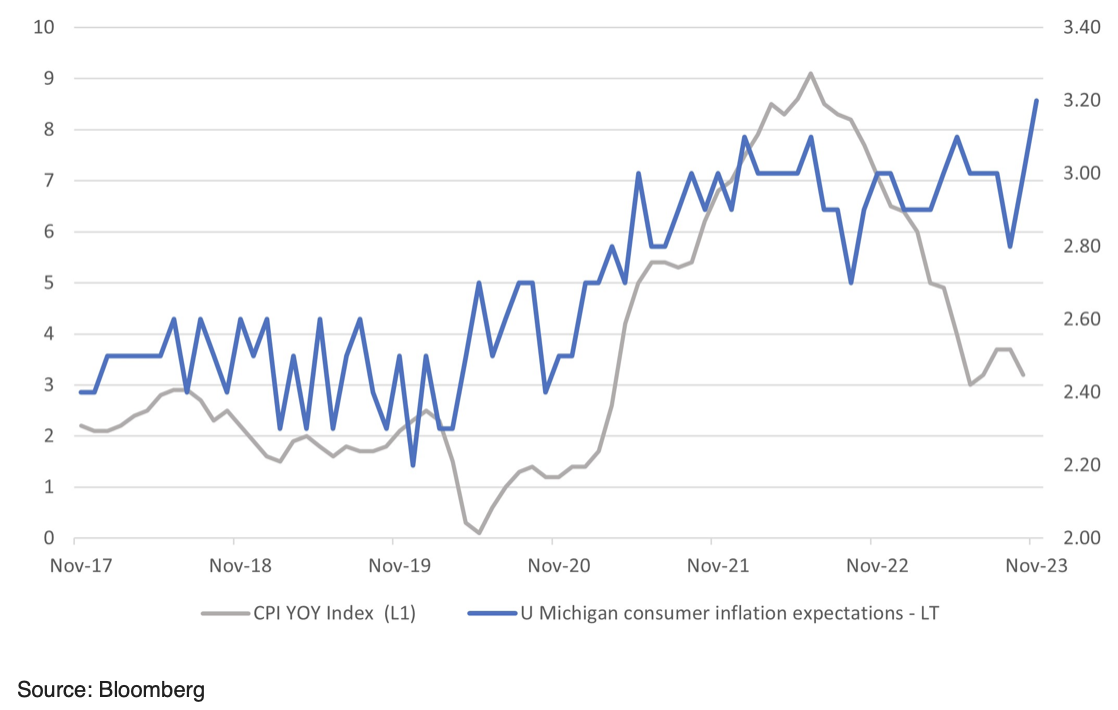

The static U.S. headline inflation figure, against the forecast of a 0.1% rise, seemed to uncork a reserve of latent optimism, despite core inflation inching up 0.2%, or an annualised 4.0% rate. Nevertheless, when weighing a solitary data point, exercising caution is of utmost importance, especially in the wake of heightened household inflation expectations—now at a decadal zenith (Chart 1).

The decline in the value of the dollar, which plunged 1.9% in the past week alone, aptly underscores the shift in investor sentiment. Equity markets beyond American shores seemingly present more compelling valuations, especially when considering the broader implications of subdued U.S. inflation on global currency and price stability.

Chart 1: Trend in five-day change in US 10-year bond yield

If we take the current inflation data at face value or assume that it might moderate in the coming months, then, in our view, markets outside of the US offer better value rather than just tactically adding to US equities per se. A lower US inflation risk – again, a solitary number may not indeed reflect a trend – significantly diminishes the general global risk of a higher dollar and an increase in general global price levels. Dollar strength last week was in complete abeyance, and the trade-weighted dollar is now down 2.7% from its early October peak.

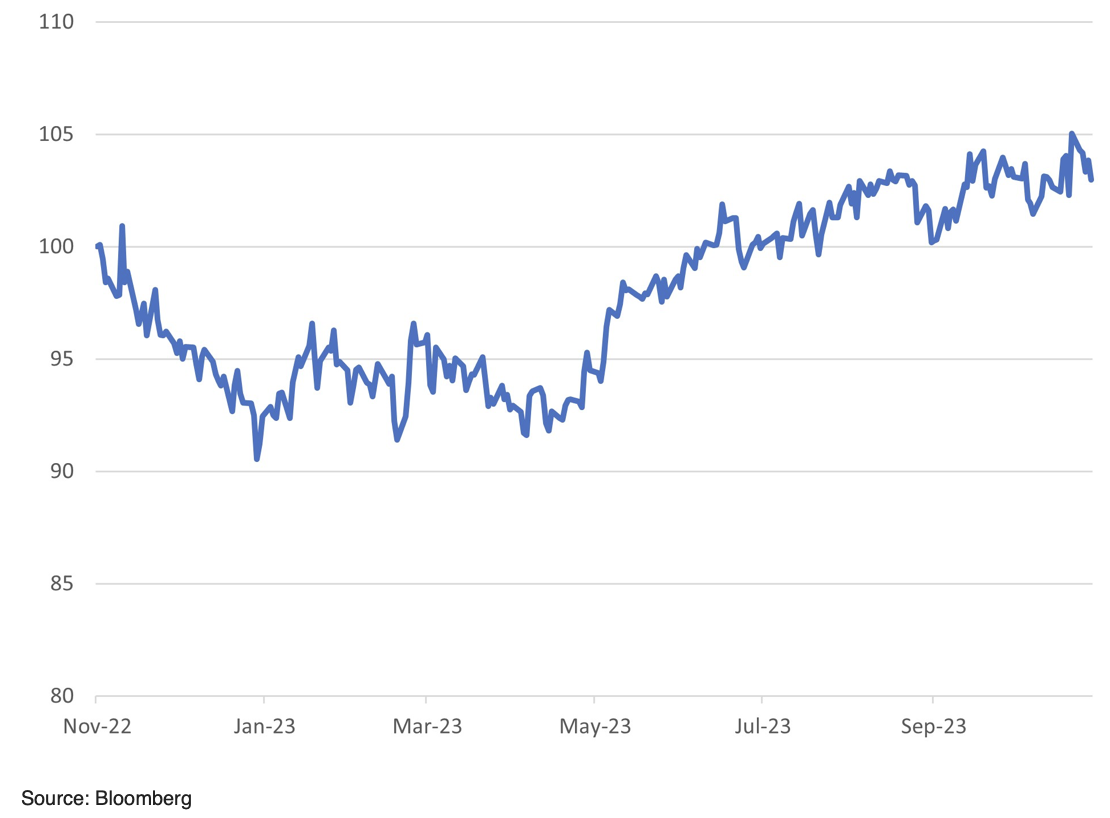

A broader argument has gained ground that the MSCI World ex US equity markets could do relatively well at this juncture. The US equity market has outperformed markedly since May when the economy and inflation both were showing signs of a re-acceleration. Back then, the rest of the world, though, was fretting about how high US interest rates might go and how strong would the dollar be. With the markets now suspicious that growth is on a lower plane and inflation dipping back to what can be called a comfort zone, other parts of the world could present more attractive opportunities.

Chart 2: MSCI USA relative to the MSCI World ex USA (rebased to -1Y =100)

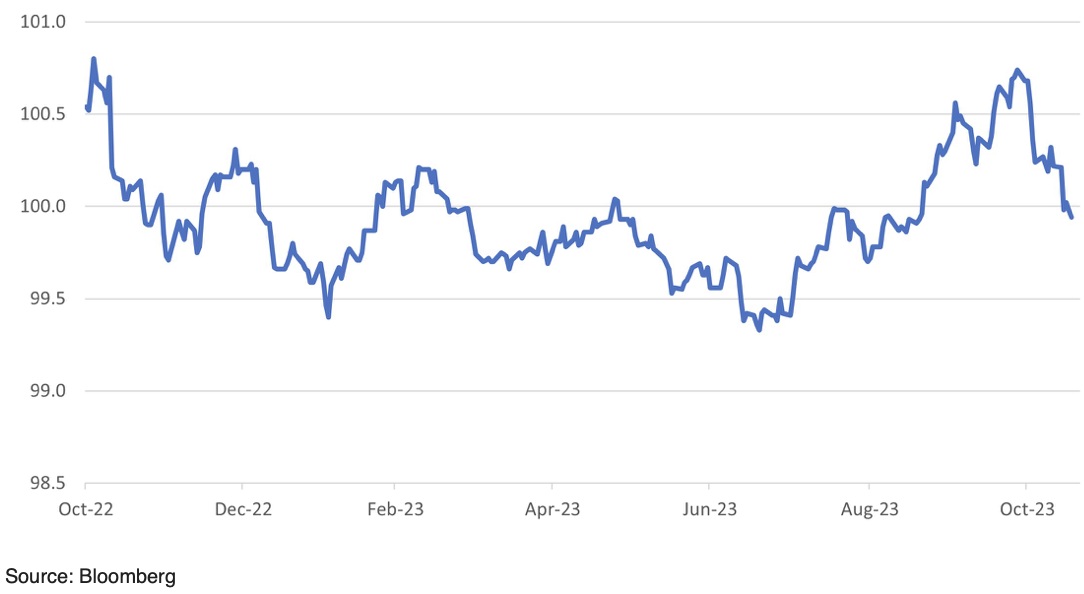

Chart 3: Goldman Sachs US Financial conditions index

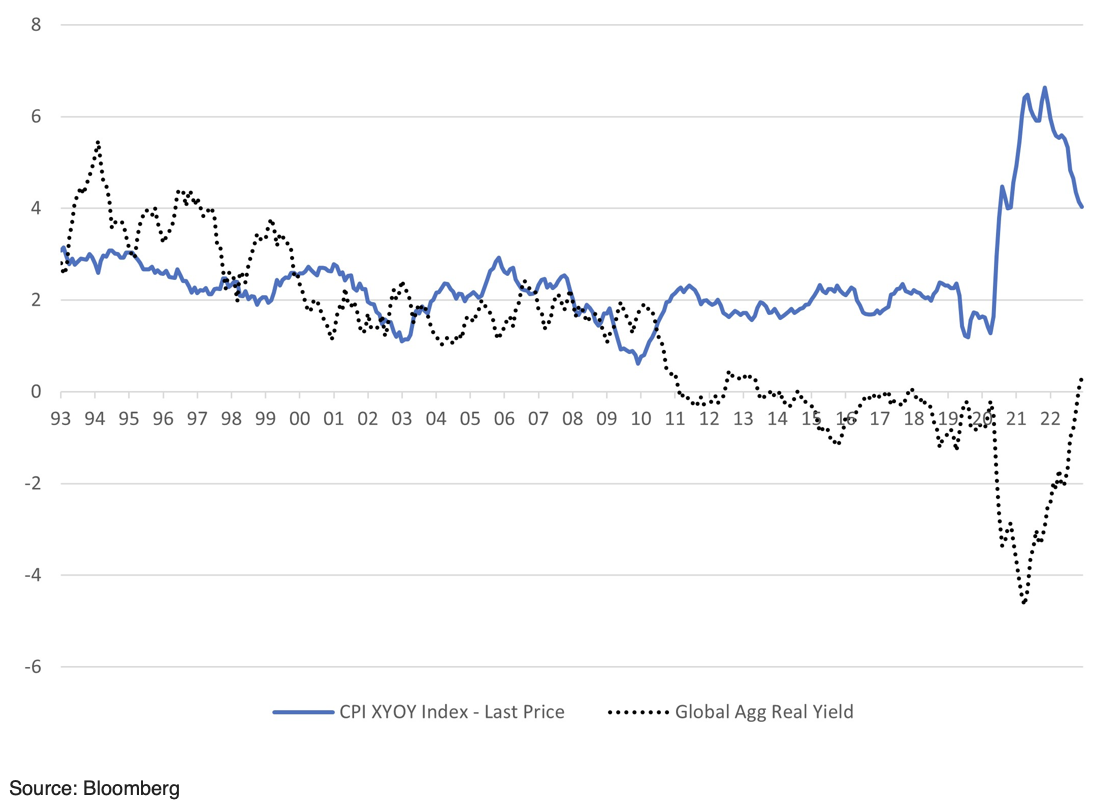

In the wake of the recent market rally, an assessment of the investment-grade bond market reveals a return to pre-pandemic real yield levels — yet the specter of a bond market correction looms should inflation revert to a normative 2%, potentially heightening real yields significantly. Presently, bondholders might anticipate returns scarcely exceeding coupon rates, a stark reminder of the ongoing correction from previous bond market exuberance.

Chart 4: Global aggregate real bond yield (adjusted for core US inflation) and core inflation

We reiterate our preference for markets that offer value and a catalyst for better than average performance. Asian equities remain attractive. In bond land emerging market debt and preferred debt are our choice sub asset classes.