Doves in the Ascendency

- Financial Insights

- Market Insights

- A dovish Fed meeting drives lower bond yields across tenors and countries

- However economic data not universally supportive

- Japan’s economy shows strength, but the BoJ still unlikely to materially move their current policy stance

- Be careful in bond markets, limited near term value after the strong rally

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

The doves at the Federal Reserve were in the driver’s seat last week as the central bank’s statement and dots boosted hopes for significant policy rate cuts in 2024. The Fed is signalling three rate cuts next year; the market is pricing around six. Although the Fed has not entirely ruled out the possibility of raising rates again, the market is clearly of the view that rates have peaked and that there may be a good reason to cut rates earlier than the central bank indicates.

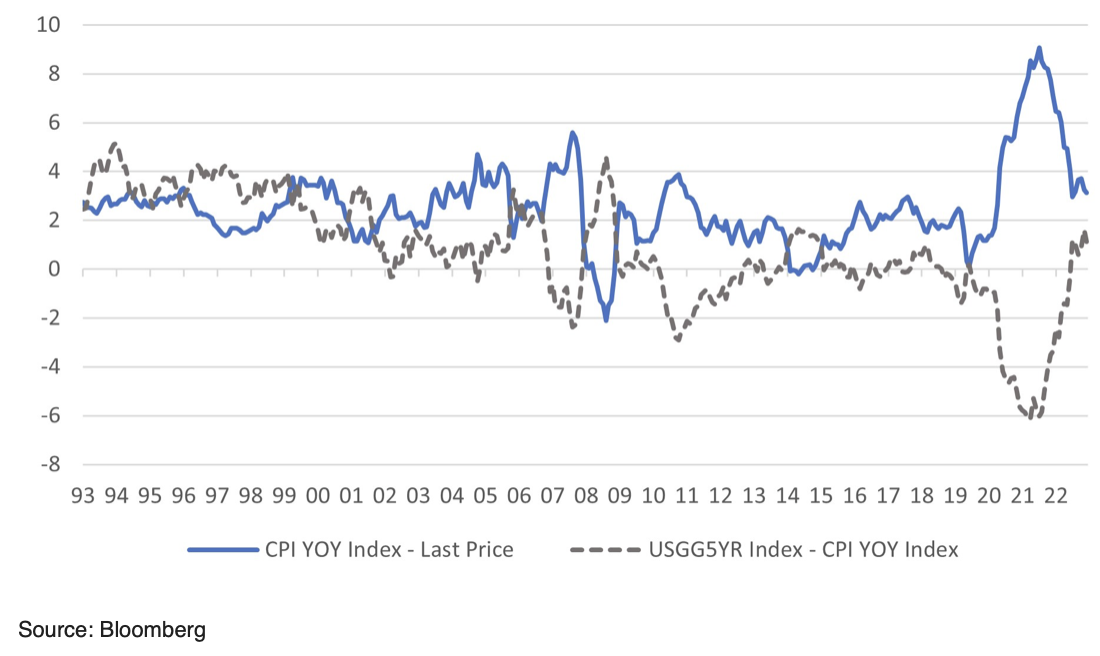

Meanwhile, policymakers now appear more sanguine about the inflation outlook as the sharp drop in oil prices has helped tame inflation somewhat. Between September and October, oil prices zoomed to $96.5 amid escalating concerns about the military action in Gaza and worries that the conflict would spread. Oil prices have since tumbled almost 21% in two months, plunging to as low as 7% below their 200-day moving average – a true disinflationary force for good.

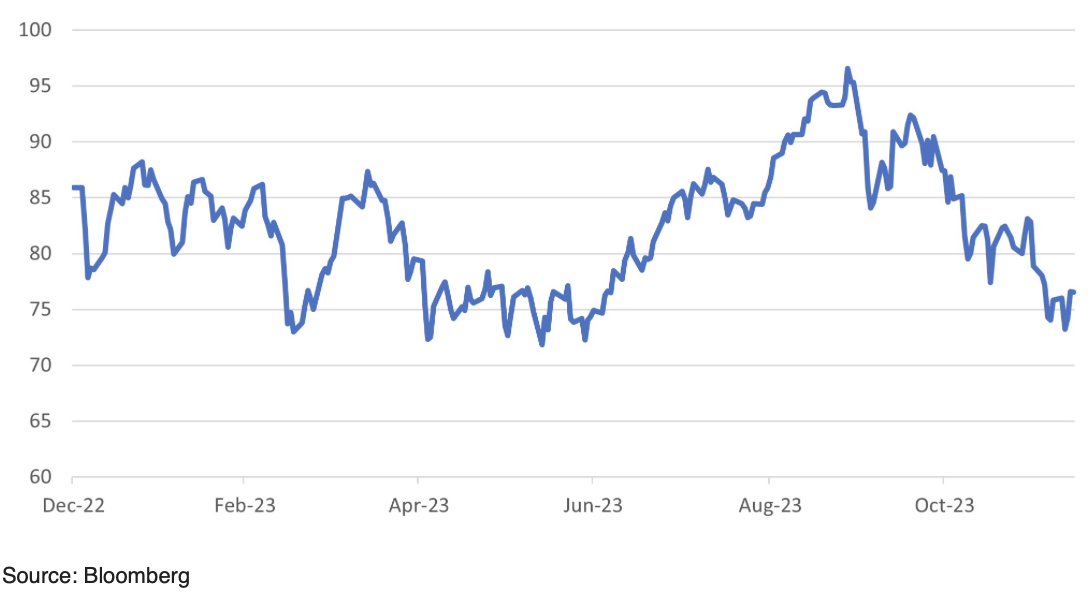

Chart 1: A 21% fall in WTI oil price in two months—a disinflationary impulse

The markets’ initial reaction to the outcome of the Fed meeting last week was positive, although they lost some momentum as the week closed out. Given how stellar the performance of the markets has been over the past six weeks, there is probably limited upside now. It’s also worth noting here that it was not that only the Bulls were calling the shots last week. The solid US retail sales report that exceeded expectations (+0.3% compared with +0.1% expected) shows that the US economy isn’t simply rolling over. Other data showed that manufacturing was weak but that the services sector may be re-accelerating.

Where to from here?

Given the overall better news, we are more inclined to stay with the markets rather than take profits aggressively here. For those investors trying to put cash back to work, it is better to turn to markets that have underperformed.

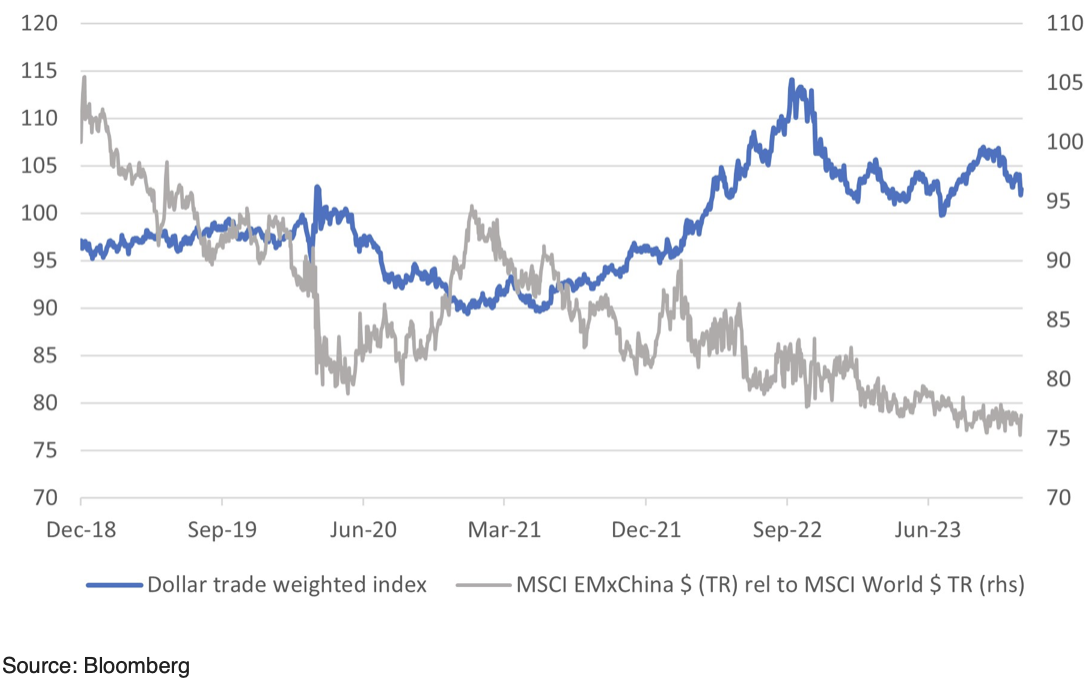

We reiterate our positive view of emerging markets ex-China, where the relative performance of the markets remains rock bottom (Chart 2) despite the central banks there having greater freedom for rate cuts after the recent bout of dollar weakness. The dollar trade-weighted index is down 7% from its recent peak over just a matter of weeks.

Chart 2: Relative performance of EM ex-China should get a boost from weakness of the dollar

China—measured optimism

China may not have a problem with a more expansive monetary policy stance given the clear signs of deflation afflicting the economy again. Last week’s CPI data showed a sharper-than-expected fall in prices (-0.5% year-on-year). However, the policymakers continue to remain measured in their efforts to stimulate the economy. While the markets expect aggregate monetary and fiscal policy to remain stimulative, it is not building into a narrative that will likely bring back foreign investors. Domestic investors will be cognisant that the Chinese markets are prone to a solid start on the new year. Hence, there is scope for a smart rebound through the end of the year and into the new year. The Hang Seng index, in particular, ended last week on a solid note. We continue to advocate a total exposure to emerging market USD debt. The current yield to redemption of 7.12% denotes a solid spread of 300bps over Treasuries.

Japan—all good news

We retain our positive view of the Japanese equity market and we do not see this week’s Bank of Japan meetings presenting a challenge to that view. While the market continues to wait for a further modest tightening of monetary policy, in the vent, we do not expect any change in policy. Hence, the risk markets such as equities will continue to benefit from the ultra-loose monetary policy. The domestic economic news is positive. The Bank of Japan’s Tankan survey of the corporate sector showed excellent momentum. The all-industry sentiment indicator rose 3 points to 13, the highest since Q4 2018. Encouragingly, the CAPEX plans of larger firms continue to go from strength to strength, with companies projecting a 13.5% increase in CAPEX for the current year. The industrial survey also leads economists to believe that there is a more substantial prospect of a good wage increase in the first quarter, given ongoing profitability and labour shortages.

Bond markets

There’s a general feeling that, after witnessing sharp drop in yields in recent weeks, conventional bond markets are up thanks to the events of late. US 10-year government bond yields, for instance, are down more than 30bps in a week and 62bps in a month. While the market has had a steady stream of encouraging news, it’s not all one-way good news. This week’s inflation report, for example, was higher than expected; as already mentioned, retail sales were ahead of expectations. In Europe, the Norges Bank raised rates, and the ECB and the Bank of England delivered hawkish messages. However, even if the statements in Europe were more hawkish, they didn’t stop bonds in the respective territories from rallying in line with the US. European yields fell 25-30bps on the week.

The bond markets are now pricing rate cuts a good measure greater than even the Federal Reserve or ECB seem prepared to seriously contemplate at this stage. For yields to fall much further, there will need to be a vindication of the expectation that inflation would ease and/or US economic growth would decelerate.

Take the US 5-year government bond as an example. Today’s real 5-year government bond yield is 1.1% based on the current headline inflation rate of 3.1%. The consensus forecast is that inflation will be down to 2.4% by the end of the year. Hence, a similar real yield would equate to a target yield of 3.5% for the 5-year bond compared with 3.9% today. Such a drop in yield provides an opportunity for an approximate 1.6% capital gain on the bond to enhance the return. Or you could stay in cash for a few months, accruing an annualised 5.25% yield!

Chart 3: Real US 5-year government bond yield and inflation