A Split View

- Financial Insights

- Market Insights

- The FOMC is evenly split between those seeing only modest rate Fed rate cuts and those the expecting far more

- The market believes the dovish view of a soft landing and reversion of inflation to target

- SNB cuts rates – MPC and ECB to follow through the summer

- Be careful with US high yield it offers a good yield but a poor risk premium

- Oil price risks to the upside with consequent challenges for inflation and bonds requires the portfolio hedge of holding the oil equities

- China’s asset market stabilization helped by better than expected economic data

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

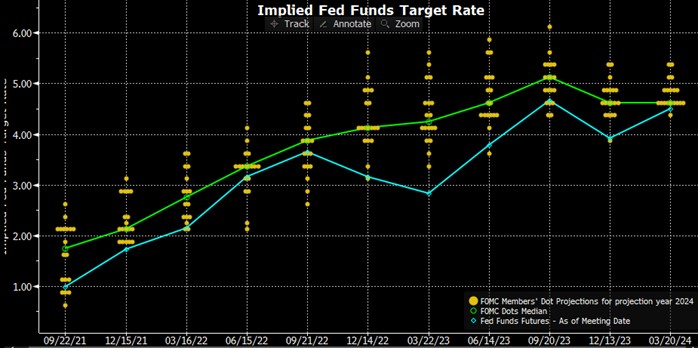

The surprise from the Fed meeting statement, at least on the surface, was that they were sticking to their view that inflation was under control and that they intended to cut interest rates two or three times through the year. However, it became apparent with the publication of the dot plot that those views lacked a broader consensus, with the FOMC’s projections split between dovish and hawkish outlooks. The nine ‘hawks’ believe there may be scope for only modest interest rate cuts in 2024.

Indeed, the last Fed governor to speak last week, Raphael Bostic of the Federal Reserve Bank of Atlanta, commented that it would be a close-run thing as to whether the Fed would cut rates at all in 2024. Bostick evidently sided with the hawks. The ‘doves’ on the FOMC see three or four rate cuts this year.

While the market agrees with the doves and the Fed funds futures price the dovish view (Chart 1), we agree with the hawks. Remember that, as the chart shows, the doves and the market have continually underappreciated the strength of inflation over the past two-and-a-half years.

Chart 1: Fed Dot Plots from the Last and Previous FOMC Meetings

Presented Quarterly

Source: Bloomberg

In recent central bank developments, the Swiss National Bank unexpectedly reduced its interest rate by 0.25%, becoming the first Western central bank to make such a move. Following their recent meetings, the Bank of England (BoE) and the European Central Bank (ECB) appear to be leaning towards rate cuts by mid-year. At the BoE’s Monetary Policy Committee meeting, previous proponents of a rate hike have shifted their stance, now forming a majority likely to favor a rate reduction around mid-2023. However, persistent inflationary pressures may delay this cut until August. The ECB might reduce rates sooner than the BoE, though ECB President Lagarde has advised against expecting significant rate reductions before the year’s end.

The Bank of Japan (BoJ) has raised interest rates for the first time in 17 years, aligning with market expectations and signaling a move towards economic normalization. However, the decision was not unanimously supported by the BoJ’s board members, suggesting future monetary tightening might proceed with caution. This cautious stance has contributed to further weakening of the Yen.

The bond markets put a generally positive blush on the Fed meeting, preferring to believe the doves on the committee. Credit in the form of high yield and emerging market debt performed well over the week. A soft landing is well-priced, with credit spreads close to their one-year lows. The relatively high valuation of the credit markets is of concern if the US economy ever slips into a recession. We accept that the nominal yields look high. US high yield at an index level offers a yield to maturity of 7.6%, but the spread over Treasuries at around 300bps is half the level seen at times of economic stress (Chart 2).

Chart 2: US high yield offers 7.6% yield, but an historically very low spread over Treasuries.

OAS spread over US Treasuries

Source: Bloomberg

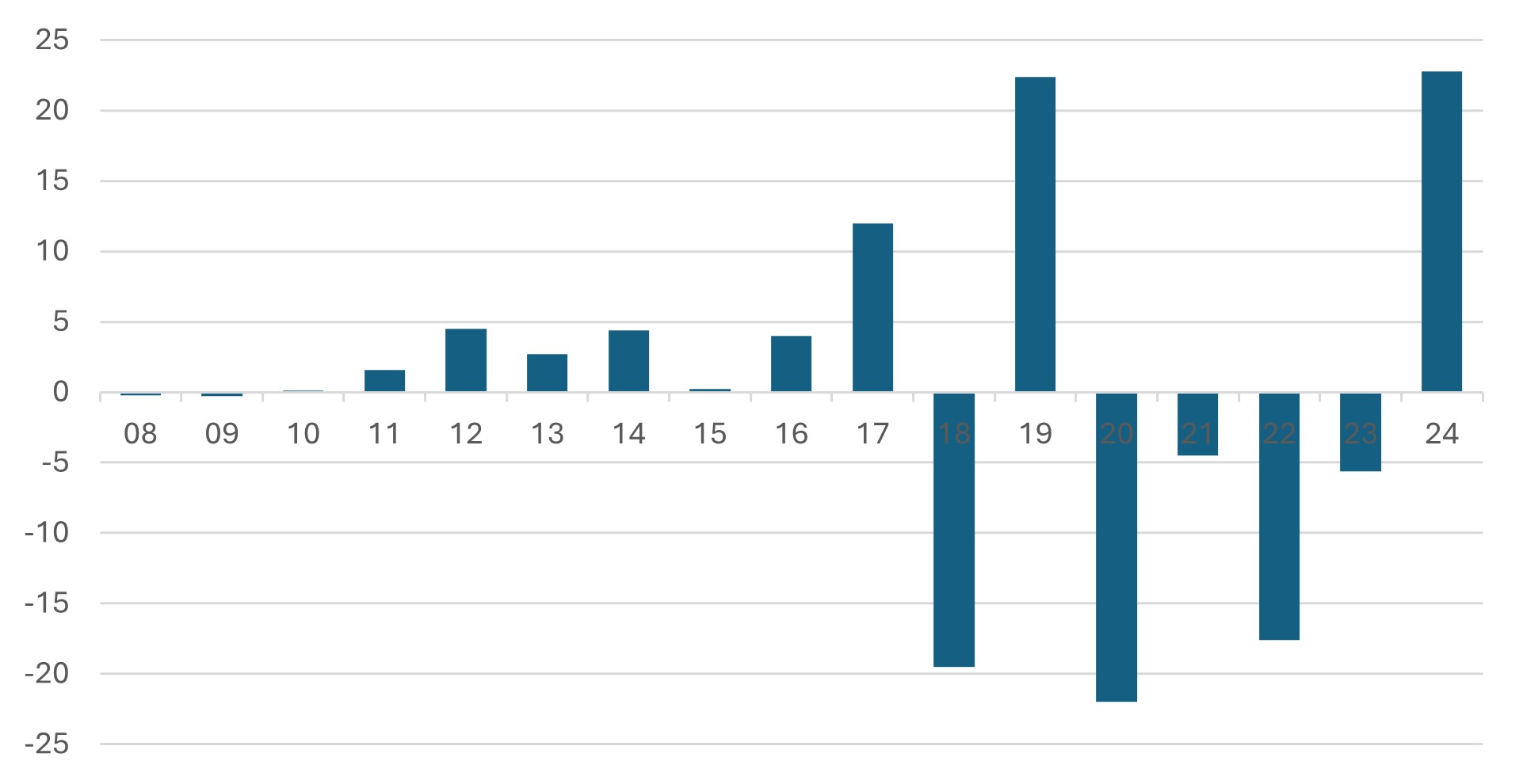

Liquidity is undoubtedly supportive of bonds at this point. Retail investors’ appetite for bonds is hitting its highest levels. According to EPFR, inflows into US corporate bond funds are, at this point of the year, the highest since 2019 and far surpassing almost all years in data dating back to 2008. High-yield debt has also benefitted companies by allowing them to refinance. Year-to-date US high-yield bond issuance is up 64% year-on-year to $64bn, the highest in three years.

Chart 3: Year to date Flows into US Corporate Bond Mutual funds

Year to date inflows compared to other years as at March 19th

Source: EPFR

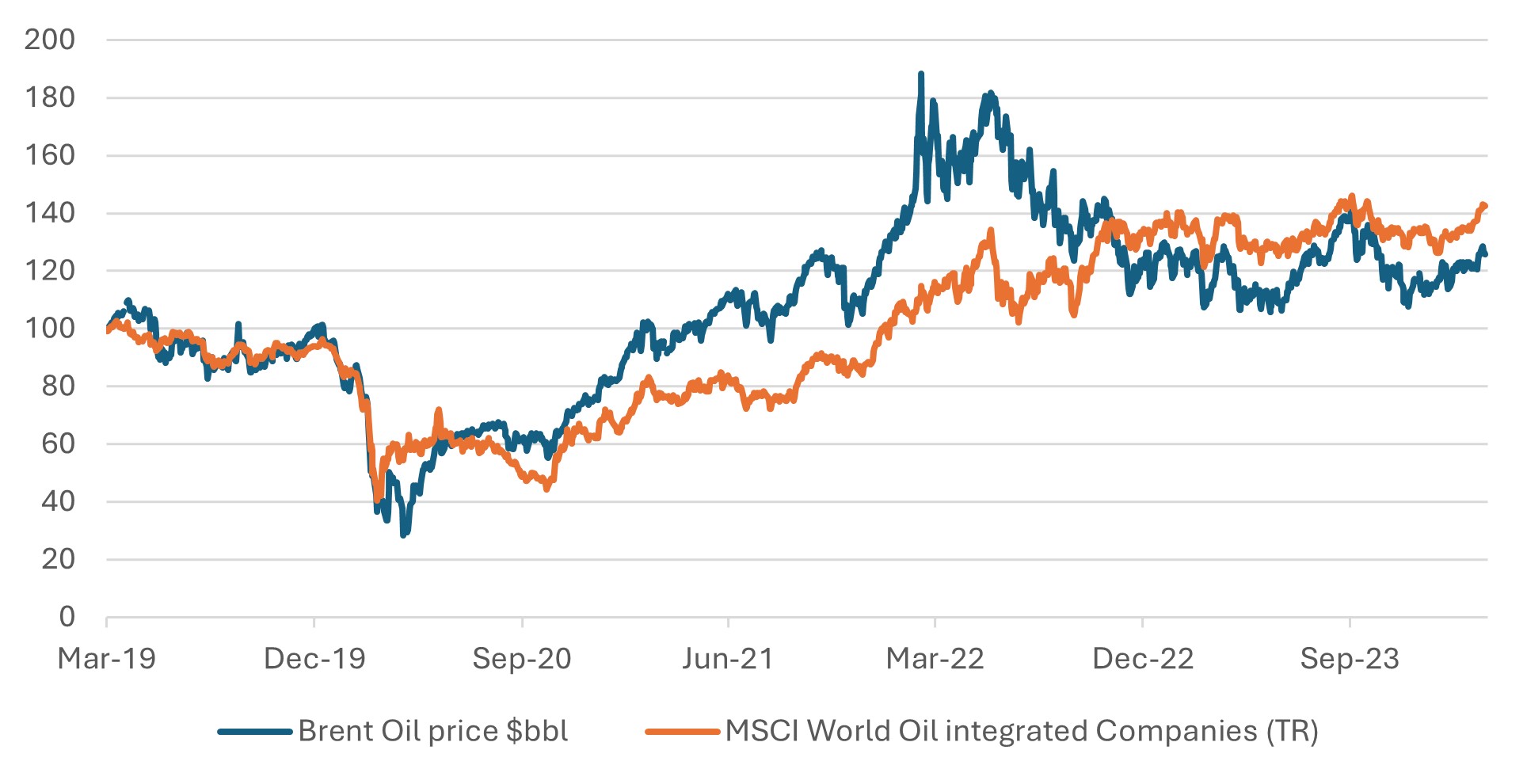

Oil prices were flat last week, but the risks remain to the upside. The sharp drop in oil prices in October and November had reinforced the hope that inflation was on a trajectory back to target. However, the ongoing strength in the oil price, particularly the spike in recent weeks, creates an inflation headache for central bankers.

The recent increase in oil price, although not back to the lofty heights of last September, still creates a problem for central bankers and asset markets. The dynamics of the oil market continue to create upside risk for prices. Falling US inventories, Ukrainian drones disrupting Russian oil and product supply, and most recently a tightening of sanctions on the shipping companies moving Russian oil around the world have all combined to lift oil prices higher. On a longer-term note, spiralling concerns about the slow growth of the EV market recently has some commentators worried about peak oil prices and the likely peaking of oil supply before EVs and other energy-saving technology is sufficiently deployed to reduce aggregate demand in tandem with the dropping away of supply.

The oil market presents investors with one of the critical risks for the future. Investors should hedge higher-than-expected oil prices, which may lead to the persistence of inflation and a slow path of lower central bank policy rates, via a good weighting in the equity market oil sector through an ETF.

Ironically, one of the chief architects of the ETF market – Blackrock, were disappointed to hear that the Texas Permanent School fund had announced it was divesting $8.5bn of Blackrock investment products due to Blackrock’s alleged anti-oil stance!

Chart 4: Higher than Expected Oil Prices still a Challenge for the Central bankers and Markets

Source: Bloomberg

Inflation watch this week

With the monthly PCE data (a preferred measure of the Federal Reserve) due this week, US inflation will be in focus. The consensus view is that the data will be stronger than the previous month, lifting headline annual inflation up to a tenth to 2.8%

China’s reinforced stability

Last week’s better than expected Chinese economic data, reinforced the recent theme, of the stabilization of China’s economy and financial markets. The primary data releases – Industrial production +4.2% year-on-year, retail sales +5.5% year-on-year and industrial production +7.0% year-on-year beat expectations.

Chart 5: Chinese equities stabilize helped by macro data

Source: Bloomberg