A New Realism taking Hold

- Financial Insights

- Market Insights

- The US employment report shows the economy is running hot

- US government bonds take fright as US 10-year yields surge to 4.40% and high-yield bonds show some vulnerability

- European and emerging debt markets somewhat decouple from the US trouble

- Gold still preferred as a way of de-risking dollar cash holdings

- Oil prices pushing higher; risk creating further inflationary pressures in the coming months

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

It took yet another stronger-than-expected US economic data for the market to finally come the realisation that the chances of significant Fed rate cuts this year are substantially down. The optimists’ view that the Fed could cut interest rates aggressively through the second half of this year has finally been laid to rest. The market now prices between two and three rate cuts by the end of the year. At the beginning of this year, the market expected five to six cuts.

An economy running hot

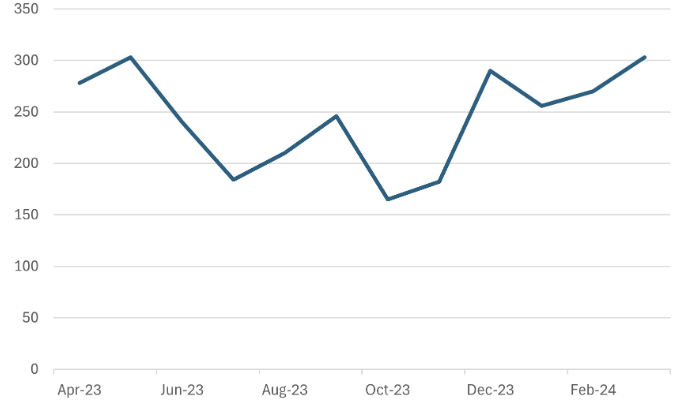

The US economy generated 330,000 new jobs against expectations of 214,000. Compared with previous employment reports, last month’s data needed to be revised significantly. Also, there was little sign of any significant new entrants to the labour force as the unemployment rate fell to 3.8% from 3.9%. To be fair to those who argue that the US employment report overstates the US economy’s underlying strength, the Challenger jobs survey showed a 120% increase in planned job cuts in the first quarter on the fourth quarter of 2023. However, the absolute number of planned job cuts at 287,00 is low by historical standards.

The US bond market cracked last Friday after the stronger-than-expected employment report.

The US 10-year government bond yield rose to 4.40%, the highest closing since November 2023. On the other hand, US equities managed to rally on Friday. There is some logic behind the rise in the equity market, but it has failed to convince us. A strong labour market should naturally lead to more robust growth than expected, which is generally positive for US corporate profits. However, that assumption presupposes that we are in a goldilocks scenario with good growth without sparking a surge in inflation.

Chart 1: US Monthly Employment Data – No Signs of Weakness

Source: Bloomberg

There are conclusions to draw

Interestingly, the US high-yield market did witness some reaction in the form of widening spreads. We don’t want to read too much into just a day’s trading, but, noticeably, US high-yield bond spreads widened last week by 5bps, against a 5bps narrowing in European high yield. The read-through here is that US rates staying higher for longer could cause some damage to the US high-yield sector. By contrast, the European market can look forward more confidently to an ECB rate cut in the middle of the year.

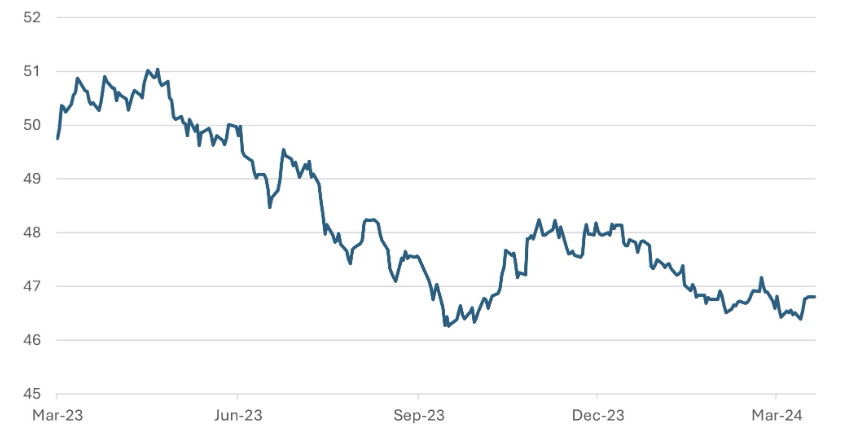

The persistence of high US interest rates could create a problem for emerging markets, but, to date, the re-pricing of the timing of US rate cuts has not done too much damage to the value of EM currencies. Also, emerging market debt (EMD) performed along expected lines last week. Like European high-yield debt, EMD spreads remained virtually unchanged. Fortunately for the rest of the world, the dollar has stayed in its recent trading range. The greenback did initially rally as a knee-jerk reaction to the strong employment data, but the gains quickly unwound in intra-day trading.

Chart 2: Emerging Market Currency Index

Source: Bloomberg and JPMorgan

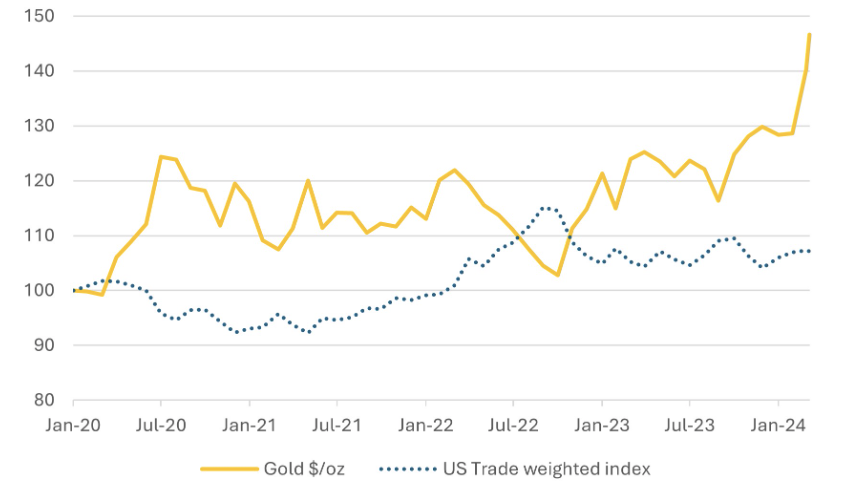

Hide in Gold

Our preferred portfolio strategy involves allocating a portion of cash holdings to gold. Given the current geopolitical risks, it is difficult for investors to effectively hedge against potential losses. Gold, however, offers some degree of protection against such risks. In recent months, gold has performed exceptionally well, outpacing the trade-weighted dollar even as the dollar has remained relatively stable. This has more than compensated for any lack of income.

Chart 3: Gold Price has Outpaced the Trade-weighted Dollar

Source: Bloomberg

Oil presents some headwinds

The unexpected surge in oil prices created by the lingering geopolitical angst in the Middle East and the ongoing attacks on Russian oil production facilities present a risk of a further sharp increase in headline inflation in the coming months. Come May and June, inflation readings courtesy the higher oil prices will likely see the sharpest year-on-year surge since 2022 (Chart 5).

Chart 4: Brent Oil Price Surge Creates a Potential Problem for May and June Inflation Readings (US$/bbl)

Source: Bloomberg

Chart 5: Brent Oil Price Year-on-Year Could Push Through 20% in May and June, Boosting Headline Inflation

Source: Bloomberg