A World of Contrasts

- Financial Insights

- Market Insights

- Stagflation alarms in the US as household confidence drops sharply but inflation expectations inch up

- Europe’s building growth story – strengthening consumer spending could pull the economy out of recession

- China’s growing list of positives: (a) possible government stimulus, (b) potential QE, and (c) a sharp increase in share buybacks

- Elections in India – An unfavourable outcome?

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

Last week, we discussed the re-emergence of a ‘Goldilocks’ market scenario, which seems less about the United States and more about early potential rate cuts elsewhere in the world, ongoing reforms in Japan, and the prospect of monetary loosening, particularly in China. If anything, the current economic dialogue in the US is more focused on emerging stagflation risks.

While it may be a bit early to make any definitive conclusion, we believe there may be further compelling reasons why the rest of the world could outperform the US equity market.

Stagflation Headlines in the US

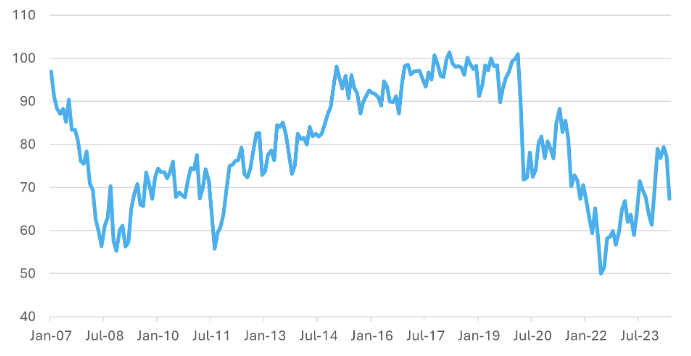

The recent release of the monthly University of Michigan consumer confidence survey highlighted significant weakness in confidence and an increase in anticipated inflation. The aggregate consumer confidence index plummeted to 67.4, its sharpest drop in nearly three years and well below the expected 76.2. Also, this one-month decline is unprecedented, ranking as the fifth largest fall in the index since data collection began in 1994. Both confidence in current conditions and expectations for the future dropped dramatically.

The Federal Reserve Governors are likely to be concerned by the fact that household expectations for inflation in the next 12 months rose to 3.5% from 3.2%, with long-term inflation expectations also witnessing a small increase to 3.1%.

Chart 1 : University of Michigan Household Confidence

Index

Source: Bloomberg

Ironically, just a week ago, Bloomberg reported that hedge funds were turning heavy net buyers of US consumer stocks, reversing their weeks-long stance of selling. We suspect that up until recently, US consumer stocks had been consistently receiving upgrades to earnings forecasts. However, it appears consumers are now feeling financially squeezed by the measures these companies employed to defend their margins against higher input costs.

Opportunities in Europe

There are indications that European consumers could be ready to loosen their purse strings as the European economy – thanks to the resilience in several countries – begins to recover from months of recessionary weakness. European consumers have historically had the savings and increasingly the income growth, but lacked the confidence to spend. For instance, in Germany, the savings rate as a percentage of disposable income was 21.1% in the third quarter of 2023, compared with 10.6% in the United States. Despite this, as Bloomberg recently reported, the German retail federation HDE’s gauge of consumer confidence rose to its highest level since November 2021.

China’s List of Positives

In Asia, the China recovery story is gaining traction, with us highlighting several positive factors supporting the market.

Potential central bank support for government spending: The crisis in the real estate sector has created a significant financial gap in the economy. Comparisons have been drawn with how the US handled its real estate crisis back in 2008 by bailing out the banking sector and issuing government debt that the central bank then lapped up. Speculations abound on why China may or may not take similar actions. For one, China’s inflation rate, at just 0.3% year-on-year, does not pose a challenge to an expansive monetary policy, unlike other parts of the world where inflation is still a significant issue.

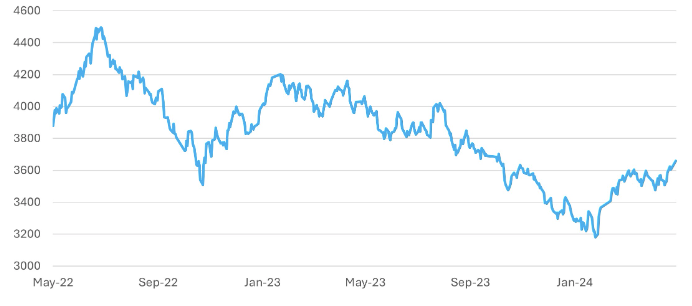

Share buybacks: Chinese A Share companies have been active in buying back equity, with Rmb73 billion bought back in the first four months of the year compared with just Rmb21 billion a year ago. Notably, a record high of 34.4% of Chinese corporates have engaged in share buybacks.

The announcement of the long-delayed Third Plenum of the 20th Central Committee of the Chinese Communist Party: This has raised market hopes for more aggressive government action to support the economy.

Valuation: The market is considered inexpensive relative to its historical levels. While it’s unlikely to return to peak valuations, even a move back to a reasonable valuation could potentially lead to double-digit returns for the rest of the year.

Chart 2: A Record Percentage of Chinese A Share Companies Buying Back Shares

Source: Bloomberg

Elections in India – An ‘Unfavourable’ Outcome?

Indian equities have consolidated a bit in recent weeks and largely traded sideways since March. While we wouldn’t claim to be experts, we certainly consider ourselves as more informed observers. We would like to point out here that there is an air of uncertainty surrounding the election results, which has begun to affect sentiments of late. The challenge of course lies in cutting through the emotional bias that often surrounds commentary on elections.

There are contrasting perspectives. While a coalition of opposition parties is going all out to ensure Modi does not return to power, let alone win a super majority of 400 seats, the lower-than-expected turnout in some states indicates voters’ belief that a Modi win is inevitable. This suggests that there could be some surprises on a state-by-state basis.

However, if, as is most likely, Modi remains prime minister but with somewhat less power and certainly not with a super majority, investors will probably collectively breathe a sigh of relief. The market can then refocus on the undeniable positives.