Central Bankers Still Hard at Work

- Market Insights

- Financial Insights

- Central bankers continue to fret about the persistence of inflation

- Markets continue to underestimate the likely tightening in monetary policy ahead

- US 10-year government bonds look likely to break through the 4% mark

- Bank of Japan may have to fight inflation with a little more vigour, which could arrest the weakness in Yen

- Japanese equities continue to see a flow of supportive news

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

It was amply clear from the speeches at the ECB’s annual policy conference in Sintra, Portugal that the battle against inflation is far from over. Speakers after speakers were unanimous in their views that a lot was required to be done.

Speaking at the conference in Sintra, the deputy head of IMF, Gita Gopinath warned of an “uncomfortable truth” as she commented that “we are getting into a period where we have to recognise that inflation is taking too long to get down to target – that is my first uncomfortable truth – and that means that we will risk inflation getting entrenched.” She was of the view that there might be an inordinate burden placed on central banks to solve the problem. “When governments lack fiscal space or political support to respond to the (inflation) problem, central banks may need to adjust their monetary policy reaction function to account for financial stress.”

ECB President Christine Lagarde was more forthright in her comments as she noted, “I think we have to be as persistent as inflation is persistent…We have to be resolute and decided and determined in reaching the target we have set.”

Meanwhile, at a Bank of Spain conference on financial stability in Madrid, Federal Reserve Chair Jerome Powell signaled that the US central bank would revert to the rate hike campaign sooner. “A strong majority of committee participants expect that it will be appropriate to raise interest rates two or more times by the end of the year… The process of getting inflation back to 2% has a long way to go.”

What has been worrying markets the most is the persistence of high core inflation at a time when the economic data indicates that growth in the United States is beginning to appear stronger than expected. Last week saw a revision up to first quarter GDP growth to 2.0% from 1.3%, well ahead of market expectations, implying there was less spare capacity in the economy now. The revised GDP data was only consistent with indicators of industrial sentiment, which had suggested consistent good growth during the first quarter, particularly in the service sector. Monetary policy, the mini financial crisis aside, has had little effect in meaningfully slowing the economy. Core inflation remains high, and the labour market is tight – justifying chairman Powell’s commitment to keep raising the Fed funds rate.

As central bankers provided the sobering policy message to the markets, last week’s global inflation data largely conveyed the same message – that despite a drop in headline inflation, core inflation remains resilient at levels double the central bankers’ target.

The Fed’s preferred measure of inflation, the core PCE deflator data, was broadly in line with market expectations at 4.6%. In essence, despite all the rate increases of late, the Fed’s preferred gauge of inflation has remained largely unchanged since the start of the year.

Last Friday’s euro area inflation report was largely in line with expectations – with core inflation edging up to 5.4% from 5.3%, and headline inflation declining to 5.5% from 6.1%. However, the outcomes varied widely by country. German inflation hit 6.8% for June as against just 1.6% recorded by Spain. Worryingly for the ECB, German core inflation rose to 5.8%, up from 5.4% in May. Spain, meanwhile, became the first European country to bring its inflation below the ECB’s 2% target. The market remains of the view that the ECB will raise the benchmark interest rate to 4% at its next meeting in September.

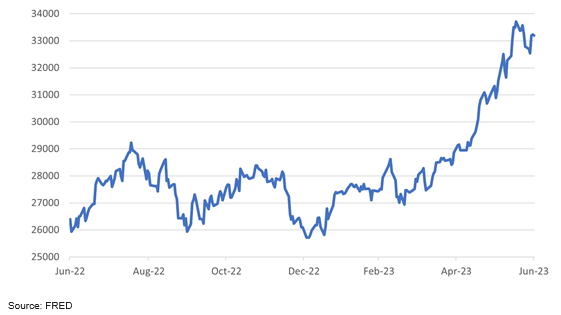

We have argued for some months now that US government bond yields will not be quite back to good value until they pushed through the 4.0% level. Last week, the 10-year bond yield surged past 3.80%, at the top end of a recent trading range (Chart 1). Several fixed income experts are increasingly worried that bond yields might surge past the 4% level given the Fed’s commitment to higher policy rates and how robust growth has been of late. Market positioning by traders also suggests that there is a risk of a spike in yields. Last week, JPMorgan expounded the view that with too many bond specialists remaining positive on the asset class – long positions are too frequent – a market squeeze on the optimists was likely. In the bond bearish camp, PIMCO reiterated its view that it is positioning for a hard landing in the US as the Fed raises rates to a level that will be high enough to deter households and industrial companies from consuming or investing. Put simply, the US economy needs to hit pause to enable it to build some spare capacity, to allow inflation to retreat.

Chart 1: US 10-year government bond yield headed to 4.0%?

Inflation developments in Japan are not isolated from the global trends. Last week’s data release for inflation in the Tokyo area showed inflation at close to 4% year-on-year. Meanwhile, inflation pressures have been exacerbated the persistent weakness in yen, which has pushed through 145 against the dollar. Although the Bank of Japan at its most recent meeting didn’t appear to be in any hurry to adjust policy, the central bank did intervene last year when the Japanese currency had declined to a similar level.

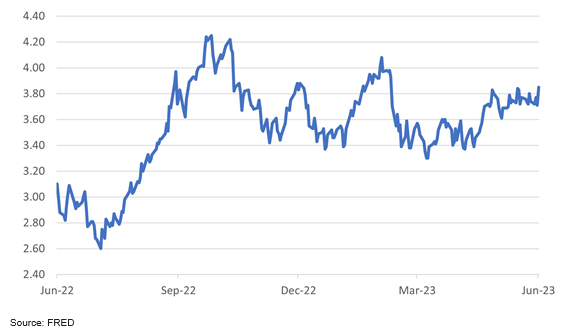

The Japanese equity market has continued to perform well in local currency terms helped by the weakness in yen that historically provided a boost to the market’s performance. On this occasion, even if the actions of the central bank lead to a correction in yen’s weakness, we expect investors to remain positive on the equity market in light of the ongoing corporate restructuring and renewed strength in the economy.

Chart 2: Nikkei 225 still has good support