A Wake Up Call from the Fed

- Financial Insights

- Market Insights

- US Fed signals the need for further tightening and the persistence of high rates

- US 10-year government bond yield is still vulnerable to spiking to as high as 5%

- With the Central Bank of Brazil in easing mode, Latam debt remains well supported

- Bank of Japan on hold, but may be forced to raise rates soon

- India debt on the brink of becoming more mainstream post inclusion in leading bond indices

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

The US and, to a large extent, the world economy are finally coming to terms with the somewhat perplexing reality of resilient growth and persistent inflation. While markets have long wished for interest rates to decline, the Fed has found little room to maneuver in the face of rebounding growth and an improving unemployment situation. Last week, the US central bank yet again had to reiterate that it was not ruling out another increase this year and that interest rates will remain elevated for an extended period.

Evidently, we have been (half) vindicated on our call that the US 10-year yield may rise to 5% before this economic cycle rolls over. Last week, the 10-year bond yield touched 4.50%, the highest since 2007.

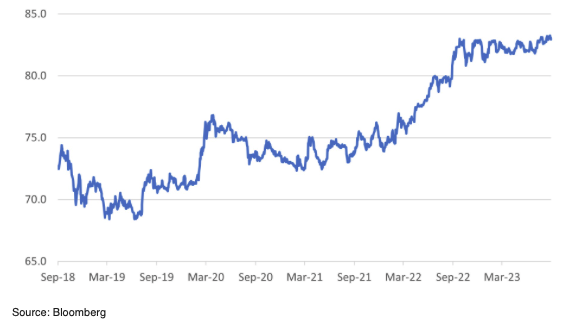

Chart 1: US 10-year government bond yield (%)

We continue to believe that the current real 10-year bond yield is not delivering the value that it should (see Chart 2) and at a meagre 44 basis points (bps), it pales in comparison to the historical levels of 200-400 bps. We, therefore, maintain our view that the US 10-year bond yield could edge past the 5% level.

A real yield of 44 bps hardly seems like an adequate premium considering the current inflation rate. Investors, on their part, seem stuck in the notion of persistently low inflation, but reality tells a different story. The Fed remains deeply concerned about inflation and has been pulling all the stops to keep it in check. While inflation may eventually dip, the market’s ability to predict its trajectory has been undoubtedly shaky over the past two years. We must therefore prepare for the possibility of a 5% US 10-year bond yield.

Chart 2: US Real US 10-year yield (adjusted for headline CPI inflation)

Chart 3: US 2-year and 10-year Government Bond Yields to Hit Short-Term Peak

US government bond yields continue to increase, with the 10-year yield reclaiming its one-year high of 4.33%. The introduction of the Fed forecasts for 2026 that are likely to show the Fed reaching its 2% inflation forecast might just help arrest the short-term increase in yields.

The spike in US bond yields has resulted in a reasonably consistent reaction from the US equity market, with the interest rate-sensitive sectors such as technology, real estate, and consumer discretionary leading the sell-off.

Table 1: S&P500 Sector Performance month-to-date

| Utilities | 1.2%% | |

| Energy | 1.2% | |

| Financials | -1.7% | |

| Healthcare | -2.0%% | |

| Consumer staples | -2.8% | |

| Consumer services | -3.3% | |

| S&P500 Index | -4.2% | |

| Industrials | -5.6% | |

| Consumer Discretionary | -5.8% | |

| Real Estate | -6.3% | |

| Info technology | -6.8% | |

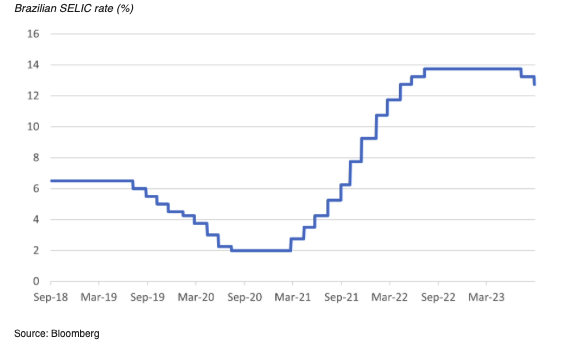

Latin America leads emerging market policy rates lower – good news for selective EM debt

The emerging market bloc has the greatest opportunity to cut interest rates in the coming quarters. Last week, Brazil’s central bank cut the SELIC rate by 50bps, although it cautioned the market to not expect rate cuts in quick succession. Latin American countries could be easing well before many other parts of the world. Such central bank action is likely to support debt funds’ performance in Latam. Year-to-date, these funds have delivered a solid 3.5% in dollar terms, a credible outcome considering the Global Aggregate index is down 1.3% year-to-date. Outside of Latam, we would advise investors to keep an eye on the National Bank of Hungary and other Eastern European central banks such as in Czechia; they could be the next to follow.

Chart 3: Brazil continues its steady easing of monetary policy

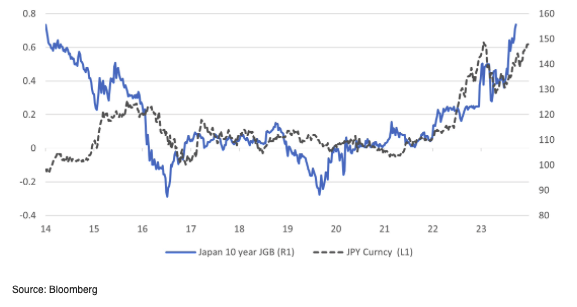

Bank of Japan keeps policy on hold but may be forced to tighten if JPY continues to sell off

The Bank of Japan, after last week’s policy meeting, signalled that it would continue with its ultra-loose monetary policy. The BoJ remains concerned that it has yet to anchor inflation at the 2% level and remains worried about the growth outlook. The last significant change in monetary policy was to allow long-term interest rates to move higher. Although long-term interest rates moved higher, the JPY has lost value. Should we witness a pronounced and sustained breach of the 150 level in the JPY’s value, it could serve as a catalyst for the Bank of Japan to expedite its tightening efforts. One compelling argument in favour of such a move is Japan’s sustained inflationary streak, with inflation remaining above the 2.0% target for 17 consecutive months, culminating in an impressive 3.2% figure for August. This achievement allows the central bank to assert that it has effectively rekindled an inflationary mindset within the Japanese economy, reinforcing its credibility in pursuing its monetary goals.

Chart 4: Japan’s higher 10-year government bond yield fails to stem the loss of value of the Yen

India’s journey into Emerging Market debt indices

JP Morgan’s announced inclusion of Indian debt in the JPMorgan emerging market indices was another step up in India’s increased engagement with foreign investors of late. The announcement had a few important elements:

· 23 Indian Government Bonds (IGBs) with a combined notional value of $330 billion, all of which fall under the “fully accessible route” for non-residents are eligible.

· India’s weight in the GBI-EM Global Diversified Index is expected to reach the maximum threshold of 10%, and approximately 8.7% in the GBI-EM Global index.

· The inclusion in the indices will start on 28 June 2024.

Analysts expect around $30bn of new foreign investment in eligible Indian debt, with approximately $10bn relatively soon. Before the announcement, foreign investor buying in Indian bonds had remained modest, with net purchases of $3.4 billion in 2023. Foreign investors are understood to own less than 2% of outstanding government debt.

Other indices could follow suit and include Indian debt in the coming quarters. FTSE-Russell, for instance, should announce its deliberations on such a move by 28 September. Inclusion in the Bloomberg Global Aggregate Index is possible, too. The index manager will assess the merits of India’s entry into the index before year-end, with an announcement likely in January. Analysts estimate that if all the realistic, potential index inclusions occur, the Indian bond market could see a $50bn foreign capital inflow, which is significant.

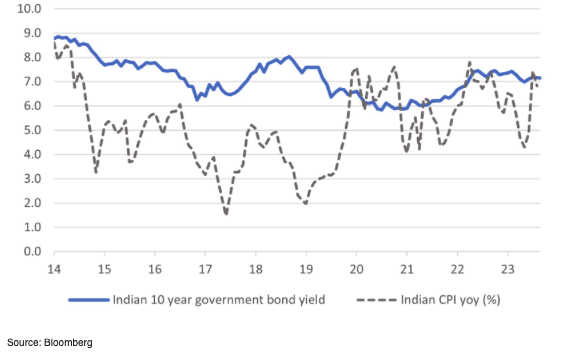

There was a modest fall in Indian government bond yields as prices rallied; however, such a rally is constrained by the current level of inflation (6.8%). We must note here, though, that the consensus view is that inflation will retreat to around the 5.4% mark next year.

Chart 5: Indian 10-year government debt rallies modestly constrained by current level of inflation

Over the medium term, the bond market developments should help the INR but, in our view, only in arresting the pace of INR depreciation against the USD, largely keeping to the path seen over the past year.

Chart 6: INR/USD