- Financial Insights

- Market Insights

Someone Turned Up the Political Noise and Markets Heard It

Gary Dugan, Michael Chu and Bill O'Neill

The Global CIO Office

- UK fiscal inconsistency pushes gilt yields higher and sterling lower

- Elements of the US president’s popularity base begin to peel away

- Protest participation is approaching levels where institutional actors start exhibiting a shift in behaviour

- US data blackout impairs monetary policy visibility and raises policy error risk

- Nvidia, major retailers, and delayed jobs data anchor the week ahead

- Japan’s weak Q3 GDP unlikely to jeopardise the equity rally

UK: Fiscal Credibility Under Strain

Political pressure has intensified in the UK, and markets are reacting. In these times when central banks across the globe appear constrained, fiscal clarity should take utmost precedence, yet the UK government’s pre-Budget communication has become increasingly incoherent. Officials initially floated one consolidation package only to abandon it later under political heat, leaving investors unsure about which framework remains operative.

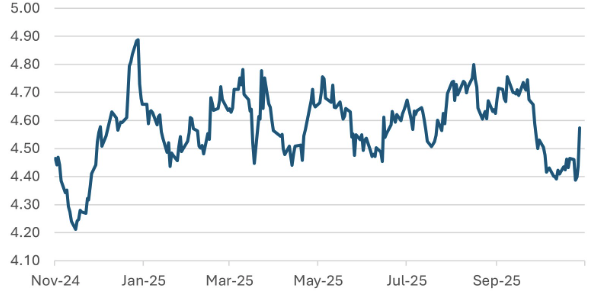

Evidently, the market response was swift. The 10-year gilt yield jumped about 13 basis points to 4.58%; the 20-year moved toward 5.2% and the 30-year edged above 5.3%. These moves matter in an economy with roughly £1.6 trillion of mortgage debt scheduled to reset over the next two years. Meanwhile, sterling’s drift to around 1.31 against the dollar reinforces the message that investors doubt the Treasury’s ability to reconcile fiscal targets with persistent spending commitments.

A Budget gap of £30–35 billion cannot be addressed through political triangulation. The pattern resembles 2022 in uncomfortable ways: a muddled fiscal narrative, rising yields, a softer currency, and weakness in domestically exposed equities. The pass-through into the real economy is direct. A 50 bps increase in long rates adds significantly to the typical mortgage refinancing costs, with similar corporate impacts. The Bank of England cannot ease amid currency softness and rising import price pressure, so fiscal ambiguity is now generating its own tightening cycle. Without a clear plan on 26 November, when the Budget is scheduled to be announced, this loop will intensify.

Chart 1: Market Questions UK Fiscal Credibility – UK 10-year Gilt Yield Spike

%

Source: Bloomberg

US Politics: Base Erosion and Emerging Policy Volatility

The UK is not alone, though. The US faces its own blend of fiscal stress and political fragility. The shutdowns and a cautious Federal Reserve have raised the stakes for the administration. A more striking phenomenon is the visible decline in parts of the president’s previously solid base. This aligns with long-term political science work on 323 non-violent protest movements showing a behavioural inflection point when roughly 3.5% of a country’s population mobilises.

The US is not there yet, but the trajectory is material. The October No Kings protests drew around seven million participants across more than 2,700 locations, with conservative estimates putting the number of protestors at above five million. A similar movement in June drew about four to six million people. A 30–70% increase in mobilisation over four months equates to roughly 1.5–2% of the US population demonstrating simultaneously. These levels mark the zone where institutional actors—politicians, donors, bureaucracies—start adjusting behaviour. Combined with defections from within the president’s own flank, this produces an environment more prone to abrupt policy shifts, exactly the regime-risk profile markets struggle to price.

US Data Blackout: A Material Loss of Policy Visibility

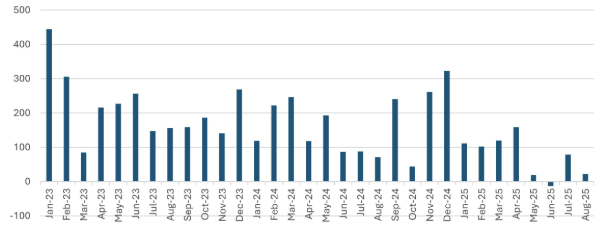

For the markets – and investors – what further complicates matters is the statistical blackout that now threatens to damage the information base of US monetary policy. More than 20 major releases across labour, inflation, income, and production have been delayed or disrupted. September payroll numbers arrived more than a week late. October payrolls and October CPI will almost certainly never be published due to incomplete data collection. That leaves a gap of roughly 300,000–400,000 jobs’ worth of information during a point of labour market deceleration. October inflation data—normally capturing almost $17 trillion in consumption categories—will not exist. The situation is somewhat unprecedented.

Chart 2: US Employment data up to August!

Source: Bloomberg

For the Fed, this is a practical problem. A 25-bp interest rate decision in December requires a reliable view of labour market slack and inflation momentum. Without these, the Fed must lean on proxies, such as ADP payrolls, card spend trackers, and earnings commentary, which are useful but not substitutes. This increases the risk of policy error in both directions—cutting too early because anecdotal data appear weak, or staying too tight because falling inflation cannot be verified.

Markets are already adjusting. Recent Treasury auctions show weaker bid-to-cover ratios and fatter tails. Rate volatility has risen despite minimal macro news, signalling that markets are pricing the absence of data itself.

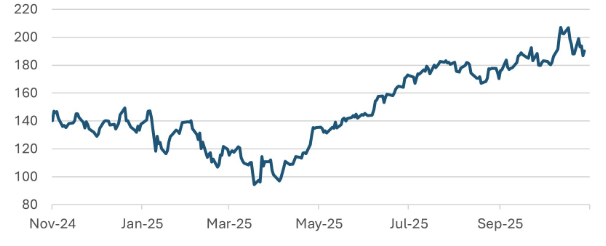

US Earnings and Macro Calendar: Nvidia and Retailers in Focus

Nvidia’s results on Wednesday anchor the week. With the AI trade cooling, investors will focus on whether the company can sustain valuation expectations and its capital spending trajectory through 2026. Earnings from Walmart, Home Depot, and Target this week will offer important insight into the strength of US consumer spending.

The delayed September nonfarm payrolls report arrives Thursday and will provide overdue clarity, though, as stated earlier, the absence of October data leaves the picture incomplete.

Chart 3: Topped-out Nvidia Shares Need a Boost from Quarterly Earnings

Source: Bloomberg

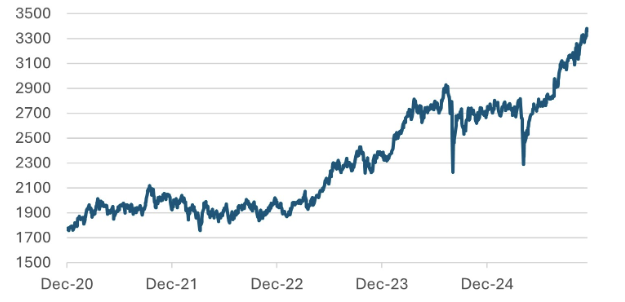

Japan: Q3 weakness may Aid Push for More Policy Support

Japan released its third-quarter GDP figures , which came in a little better than expected economists forecast a contraction of around 2.4% annualised, which would mark the first drop in GDP numbers in six quarters but the actual numbers showed a fall of 1.8%. Business investment sprung a surprise with 1.0% quarter-on-quarter growth. ..With the economy showing some signs of weakness, attention will shift to how strongly this reinforces calls in Tokyo for a fresh fiscal stimulus package. Against that backdrop, the Bank of Japan faces a delicate balancing act: weaker growth argues for easier policy, yet inflation pressures and a weaker yen give the central bank reasons to tread carefully. A downside surprise would likely weigh on the yen and boost speculation of expanded fiscal stimulus support; conversely, a less bad result might slow the rush to additional stimulus but still leave questions about the growth runway. We remain positive on Japanese equities, which should receive a further boost from a re-acceleration in growth in the current quarter.

Chart 4: Nikkei Strikes Higher Despite Weak Q3 GDP growth

Source: Bloomberg