- Financial Insights

- Market Insights

Same Advice, Better Stories

- As we enter a new quarter we see little reason to deviate form our core portfolio advice.

- We expect China’s upcoming fourth plenum to deliver further structral reasons for optimism on Chinese equity market.

- A female Prime Minister in Japan provides further evidence of Japan’s transformation.

- As long as fiscal and monetary policy don’t spring bad surprises, Japanese equities should outperform.

- With asset market volatility low, the markets appear complacent about the geopolitical risks – we continue to advocate for overweight positions in gold and silver.

As a new quarter begins, investors will naturally be looking for fresh themes to chase. We, however, see greater merit in revisiting the old ones, not out of habit, but because there are fresh reasons to believe that those themes are now even more compelling.

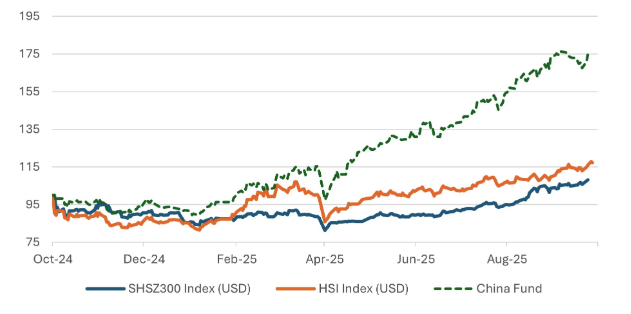

China, where recent policy developments suggest the story is far from over, is a glowing example of this ‘old theme’. Chinese equities had a fantastic third quarter, with a solid 21% return and one of our favourite funds achieving almost 80% gains for the year (Chart 1). China is back on the front foot, both in an absolute and relative sense, particularly versus the US. The upcoming Fourth Plenum of the 20th Communist Party of China (CPC) Central Committee, due 20–23 October, will set out the framework for the 15th Five-Year Plan (2026–2030). The framework is not an administrative ritual but a disciplined exercise in long-term strategy, and the CPC’s priorities are clear: greater technological self-reliance, domestic consumption upgrade, energy transition, and a clean-up of local government finances. Growth for growth’s sake, hitherto the oft-relied-upon strategy despite its shortcomings, has given way to an emphasis on quality, productivity, and resilience. At a time when the West is losing fiscal discipline (US debt is more than 120% of its GDP) and budgets that lack ambition or coherence, Beijing’s structured, multi-year growth plan could be an anchor of predictability. China’s blend of state coordination and market pragmatism could yet underpin a durable re-rating of its equity market, particularly across advanced manufacturing, green technology, and the new-economy consumer space.

Chart 1: China’s Equity Market Rebound Still Has Further Upside

Indicies and fund rebased to October ’24=100

Source: Bloomberg

China’s property sector remains a blot on the landscape, but here too there has been some progress. Credit goes to the authorities: they have acknowledged their mistakes and are dealing with them methodically. Gone are the days of the “big bazooka”, the short-term sugar rush that left behind a hangover of local government debt. This time the authorities have adopted a measured approach: support viable developers, restructure where necessary, and rebuild household confidence without reigniting speculation. It is slower, more precise, but ultimately more sustainable. China is learning the art of economic policy patience, a virtue that, if maintained, could prove the foundation of the next bull phase for its markets.

Another Structural First in Japan

“Fly into the rising sun, faces smiling everyone.” Deep Purple’s 1973 anthem, “Woman from Tokyo”, was never meant as prophecy, yet half a century later Japan finally has one. The country where corporate conformity and political continuity was once the norm now finds itself led by its first female prime minister. Markets, too, are smiling. The Nikkei has surged, the yen is weak, and optimism is quietly taking root. Japan’s transformation is not loud, but it is real, and perhaps, at last, the Land of the Rising Sun is learning a new rhythm led by a different voice.

Japanese equities, another asset class of choice in our model portfolios, should get a further boost from Sanae Takaichi’s election as Japan’s first female prime minister. Her rise to the top breaks a significant political glass ceiling that only a few years ago would have been deemed taboo. Practically, it points to awareness on the part of the ruling party that it must change to survive. While Takaichi’s politics are conservative, her ascent is proof that Japan’s institutions can evolve without crisis. Markets have responded positively. The Nikkei rose on expectations that she will extend pro-growth fiscal policies while working closely with the Bank of Japan to sustain easy financial conditions. Yields have edged higher, but not alarmingly. A weaker yen should further strengthen the export and earnings outlook, keeping Japan a rare combination of value, stability, and reform momentum. For investors, the story is not just about a political first; it is about an economy modernising from within – from boardroom governance to national leadership. Japan’s journey of renewal continues, and we see Takaichi’s victory as another reason to remain overweight Japanese equities. The underlying thesis remains that Japan is changing for good, and those willing to hold through the noise will be rewarded by both earnings growth and valuation re-rating.

Chart 2: Absolute Performance of Japanese Equity Market

(Index rebased to April 2022=100)

Source: Bloomberg

Staying with Precious Metals – Risk is not in Abeyance

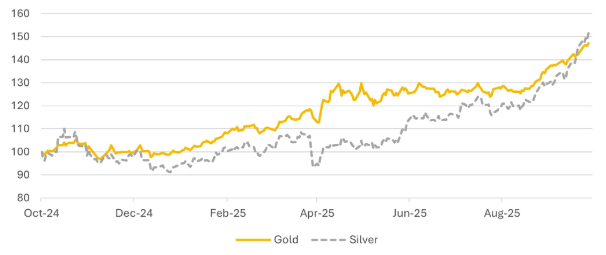

Precious metals have been a standout performer through the third quarter, and we expect them to continue to deliver for investors. We note analysts trying to outbid each other over a target for the gold price one with a target $10,000 per ounce. With global geopolitics being particularly complex and inflation still a concern, we remain big fans of precious metals for portfolio hedging. We also recommend active management of exposures to precious metals. We have seen some precious metals funds provide better returns than a random basket of spot gold and silver.

Chart 3: Gold and Silver Prices

Source: Bloomberg

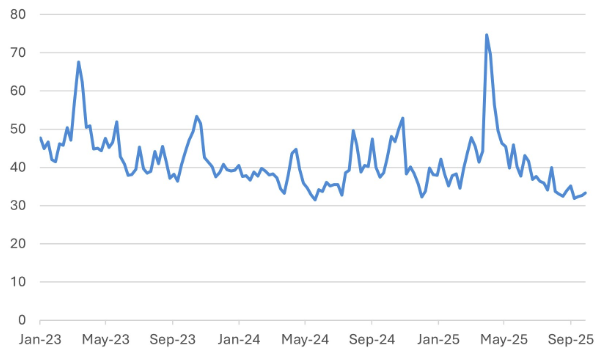

Is complacency creeping in? Are investors becoming complacent? Volatility across equities and bonds has dropped to its lowest combined levels in over four years. The VIX, tracking expected equity market swings, is hovering near levels last seen in the pre-pandemic calm of 2017. MOVE, its bond market counterpart, is equally subdued, pointing to an expectation that yields will stabilise. The mood in markets has turned steadily more relaxed. Inflation appears to be easing, central banks are broadly seen as done with rate hikes, and the macro data has been unthreatening. Add in abundant liquidity and the rise of systematic strategies that dial up risk as volatility falls, and it’s no surprise that hedging activity has diminished. Risk assets are well-owned, protection is relatively inexpensive, and the price of volatility has been steadily compressing.

Chart 4: Equally Weighted Equity and Bond Volatility Indices

Source: Bloomberg

But that very calm may be the source of future instability. Complacency is not easy to spot in real time, but there are signs it may be taking hold. Many investors are effectively short volatility, either directly through selling options or indirectly by leveraging up exposure. If something disrupts the current macro narrative—such as a surprise inflation print, a hawkish policy shift by a central bank, or even a geopolitical shock—the unwind could be severe. Low-volatility regimes typically end not with a gentle drift, but with a sharp repricing as cross-asset correlations rise and market liquidity dries up. The current environment resembles past episodes where a long stretch of calm was followed by sudden spikes in volatility. Investors should be watching for the early signs: widening credit spreads, or rising bond-equity correlations. The longer these benign conditions last, the more fragile the macro narrative becomes. While it may not feel urgent, the risk-reward balance is shifting. Markets rarely stay this still for long without a catalyst emerging to break the complacency.