- Financial Insights

- Market Insights

Risk-off Sentiments and a Case for Consolidation

Gary Dugan, Michael Chu and Bill O'Neill

The Global CIO Office

- Consolidation not collapse

- US Labour market stronger than expected but the Fed may still cut

- Russia/Ukraine talks push weakness into the oil market

- French and UK budget challanges

- Japan keeps pushing with growth

- Rupee weakness has policymakers on the back foot

Equity markets plunged 2-3% last week as investors resorted to profit-taking. US large-cap technology and growth names, which have had a strong run so far, finally took a breather. Nevertheless, the pullback appears more like consolidation than the start of a structural unwind. The fundamentals that facilitated the rally — AI, cloud, automation — remain intact, but the margin for error in expectation has narrowed. Investors are sensibly banking gains, trimming extrapolated optimism, and digesting the possibility that the Fed may ultimately not ease anymore this year. Notable tech companies due to report earnings this week include Alibaba and Dell.

While the pullback isn’t exceptional, the unprecedented sell-off in the crypto universe has left investors wondering if the risk-off sentiment is widening; however, there are reasons to believe that we may have already seen the worst. When Bitcoin drops below $94,000 to assumed cost of production, we typically see a rebound shortly after. However, some technical analysts argue that with key price supports already broken, the crypto currency may test $70,000 before we see a meaningful recovery.

Chart 1: BTC/USD Weakness as a Measure of Profit Taking

Source: Bloomberg

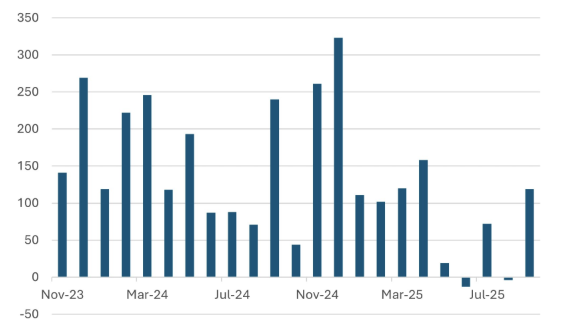

US employment, rate expectations, and a shifting labour market

The latest payroll numbers, which showed 119,000 new nonfarm jobs were added in September, was strong enough to all but remove the chances of a December rate cut. Indeed, a vibrant employment report and a 3% inflation rate do not really strengthen the case for a rate cut. Markets priced only a 30% probability of the Fed easing in December, but comments from one of the Fed governors has pushed it back to 60%. Yet, the more interesting story sits beneath the surface: structural friction in the labour market is building. About a quarter of the unemployed have university degrees, and multiple studies – from the New York Fed to the OECD – highlight the growing gap between the skills firms actually need and the qualifications workers possess. Emerging sectors, particularly tech-related, prize specific skill combinations over credentials, complicating the old relationship between unemployment, wages, and productivity.

Chart 2: US Monthly Employment a Surprise

Source: Bloomberg

This mismatch narrows the economy’s ability to manoeuvre. Monetary policy is a blunt instrument when the constraint is skill rather than demand. The longer this mismatch persists, the more difficult it becomes for the Fed to cut with confidence. Also, skill shortages, even when unemployment is high, could force wage growth to be higher than what was previously the case.

Politics, geopolitics, and oil

Political risks are also drifting into the macro narrative. As we noted last week, support for President Trump is fraying at the margins, raising the risk of erratic policy shifts. His sudden pivot on Ukraine — favouring Russian proposals to end the conflict — has reset expectations around oil supply. For now, softer oil prices offer a modest tailwind to growth, but could chip away at inflation premia in bond markets and add noise to emerging market forex. OPEC+, which has a major meeting scheduled for next weekend, is expected to review and potentially re-establish quotas for each member country.

Consumers: Confidence slipping, spending slowing

The University of Michigan confidence index slipped to 51.0 in November, one of the weakest readings in years. Current Conditions fell sharply while Expectations remain deeply subdued. Households without equity wealth are struggling to balance high prices with weakening real incomes. Although retail sales for September (due out on Tuesday, 25 November) may still register a small rise (around +0.2% m/m), the broader picture is of an economy decelerating from a 4% Q3 pace to approximately 1–2% in Q4.

For investors, weak sentiment sitting alongside low unemployment is a warning: consumption may soften faster than the labour data implies, reinforcing the Fed’s caution.

Europe: Fiscal fatigue

Europe’s fiscal story has deteriorated further. France’s failure to pass the revenue side of its 2026 budget highlights a deeper structural problem: high debt, a deficit still above 5%, and no parliamentary coalition willing to take responsibility. It isn’t a crisis, but risks are compounding. France may either miss its targets or deliver growth-damaging cuts.

The UK faces its own credibility test. With growth stuck near 1.5% and a £20–40 billion fiscal hole emerging from revised OBR estimates, the Chancellor is likely to pair modest tax increases with restrained spending and upbeat talk on investment. Markets, however, will look beyond the rhetoric for substance. A rising tax burden and sluggish productivity may continue to cap UK asset performance.

Chart 3: Has UK Sterling Discounted the Worst?

Source: Bloomberg

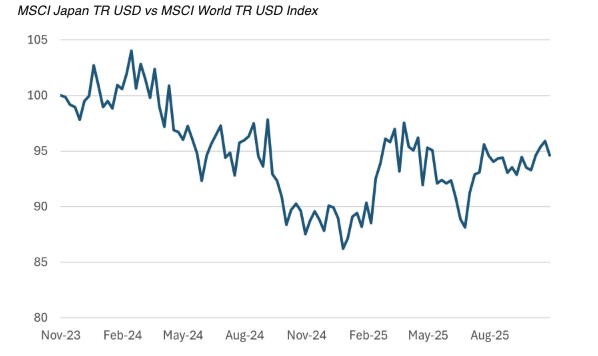

Japan: Fiscal expansion, good inflation, and growth

Unlike Europe, Japan is in a position to continue expanding the fiscal stimulus. The market is now expects a fiscal boost of about 0.4% in the next fiscal year, higher than previously thought by the market. Aggregate GDP forecasts are also on the rise with a projected 0.9% growth next year, two-tenths higher than earlier estimates. If we also consider that core inflation is running at close to 3%, we are observing almost unprecedented nominal growth of 4%. We continue to overweight Japanese equities; however, JGBs will have their challenges. It now seems likely that the Bank of Japan will soon raise interest rates, providing some much-needed support for the Yen.

Chart 4: MSCI Japan has Room to Extend its Recent Relative Outperformance.

Source: Bloomberg

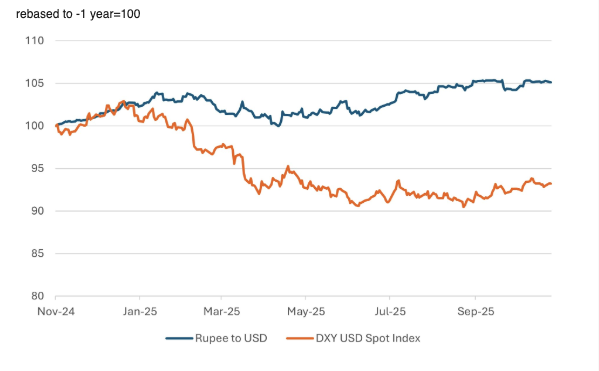

India: Policy on pause, rupee under pressure

Indian policymaking is effectively frozen as tariff negotiations with the US continue. Hopes for an imminent deal have faded, and the rupee has weakened as a result. The RBI’s reluctance to cut rates — despite some disinflation room — reflects the delicate balance between supporting growth and ensuring currency stability. The retreat from the RBI’s long-defended ₹88.80 level signals a shift: the market no longer assumes unlimited intervention by the central bank. Combined with tariff uncertainty, foreign investors have turned cautious again, pulling $16.5 billion from equities year-to-date.