- Financial Insights

- Market Insights

Navigating Growth as Cycles Evolve

Gary Dugan, Michael Chu and Bill O'Neill

The Global CIO Office

- US Consumers give thanks to AI for their holiday spending

- Commodities power on – seek active managers in precious metal

- UK Budget: A case of wrong approach but maybe the right outcome?

- Asian growth consolidates but there are future drivers of a re-acceleration

When discussing US GDP growth, recent commentary has focused heavily on capital investment. The AI boom has driven a sharp rise in corporate capex, with firms racing to upgrade infrastructure and scale new applications. The consumer side of the economy, however, has been more mixed. In fact, consumer confidence has weakened throughout much of the year, yet, interestingly, spending has held up.

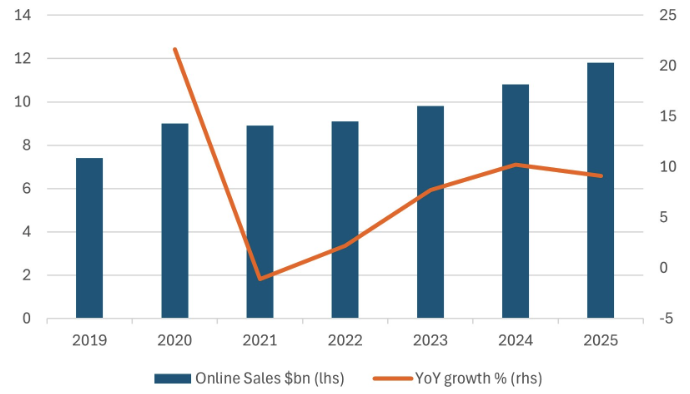

The holiday season, which often reveals emerging trends, has begun on an upbeat note this year, with the Black Friday sales offering a useful and interesting snapshot of US consumer spending. Adobe Analytics reported that US consumers spent a record $11.8 billion online on Black Friday, up 9.1% year on year and well ahead of expectations. The strong sales figures likely reflect aggressive discounting, but they also point to underlying resilience in household demand.

Chart 1: US Online Black Friday Sales (2019–2025)

Source: Bloomberg

What is also striking is how AI is starting to directly impact consumer behaviour. According to data from Adobe, traffic to US retail sites from generative AI chat services and browsers surged more than 800% year on year. Shoppers are using AI tools not just to find deals, but to research products and compare options. So, while capital investment is clearly powering the top line growth story, the consumer is still doing their part — and increasingly with the help of AI.

Commodities are Right Back

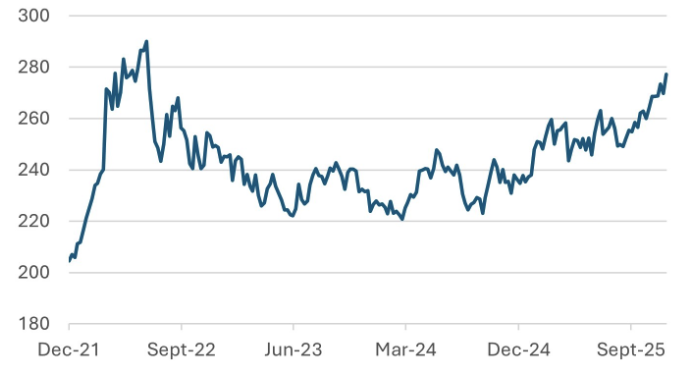

We continue to advocate for a strategic allocation to commodities within a multi-asset portfolio. Last week, the Bloomberg Commodity Total Return Index hit its highest level since June 2022, with metals leading the gains and energy lagging. The index is now up 15% year-to-date and still shows signs of supportive fundamentals as we enter 2026. An example of that bullish fundamental is copper, which accounts for close to 6% of the index. Last week, UBS raised its copper price forecast significantly, projecting prices to reach $13,000 per metric ton by the end of 2026. The bullish revision reflects a deepening global supply deficit driven by persistent mine disruptions, declining ore grades, and underinvestment in new capacity. At the same time, structural demand is surging due to the global energy transition, rapid growth in electric vehicle production, and the expansion of AI and data-centre infrastructure. UBS now sees copper as a core beneficiary of both cyclical recovery and long-term industrial transformation.

Chart 2: Bloomberg Commodity Price Index (TR)

Index

Source: Bloomberg

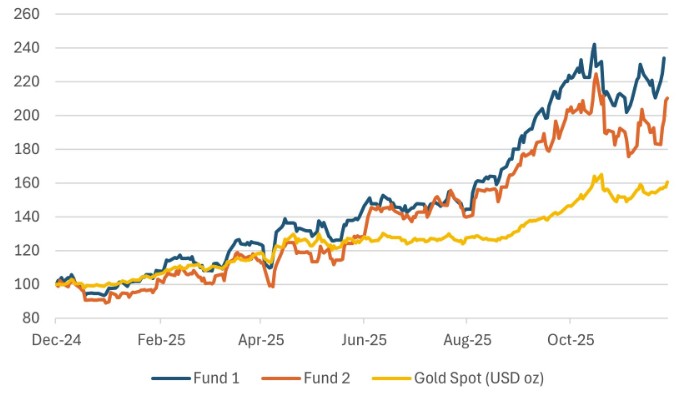

We participated in a series of one-on-one meetings with mining companies in Dubai last week and were particularly impressed by the quality of the firms. We observed strong balance sheets across the board, which provide solid funding bases for future double-digit growth. While ETFs have traditionally been the preferred vehicle for broad commodity exposure, actively managed mining funds are making a strong comeback. This trend has been especially evident in the precious metals space, where select funds have meaningfully outperformed the gold spot price. We highlight two such funds below:

Chart 3: Actively Managed Precious Metals Funds Outperform Gold Spot

All prices rebased to December 2024=100

Source: Bloomberg

UK Budget: Probably the Right Outcome, But the Wrong Way

The UK government’s budget last week triggered sharp political and public criticism, and it was not without reason. While the fiscal strategy may be sound in macro terms, the messaging was poorly judged. Before the budget, the Treasury warned of a major deficit and limited headroom. That set the stage for a wave of tax rises and frozen thresholds. Yet the Office for Budget Responsibility data told a different story. The deficit had narrowed more than expected. Some even suggest the books are now in modest surplus.

That gap between how the messaging was perceived and reality is hard to ignore. It raises the uncomfortable possibility that the public was misled – not by accident, but to provide cover for tax increases the government knew would be unpopular. If so, it worked. The tax hikes passed with little market reaction. From a policy perspective, the decision may have been right. It front-loads fiscal repair while growth remains fragile, and debt costs stay high. But politically, it has backfired. Voters do not like being misled.

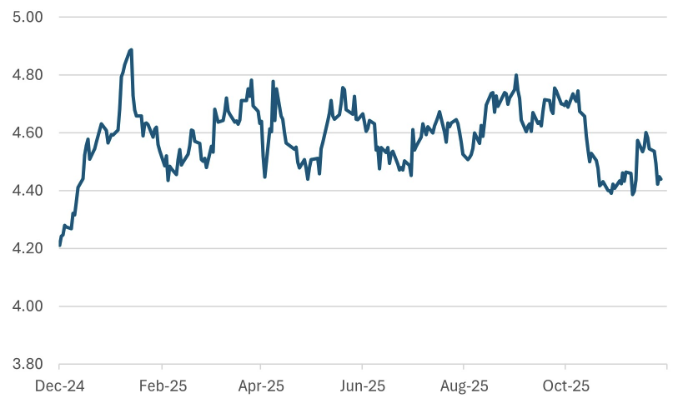

Tax rises are always a hard sell in democracies. Unless people are convinced, they are fair and necessary they tend to resist them. That trust now looks damaged. The gilt market has reacted calmly, however, with yields staying stable. Although much of the fiscal tightening is back-end loaded, it does, however, lean in the right direction as far as the gilt market is concerned. The UK 10- year yield stabilised close to recent lows.

Chart 4: UK 10-year Government Bond Yield Welcomes Austerity

Source: Bloomberg

Investors clearly prefer this version of fiscal discipline to the disorder the Truss era characterised. But the political cost is now clear. The government owns both the tax rises and the broken narrative. Whether voters will accept that trade-off remains to be seen.

Asian Economies see a Dip Before a Likely Re-acceleration

Asian markets appear to be entering a phase of consolidation as the growth momentum seen earlier in the year begins to taper. Much of the strength in the second and third quarters was driven by front-loaded demand, with manufacturers and exporters bringing forward orders to avoid tariff risks. That dynamic is now reversing. Consequently, some of the early fourth-quarter data has disappointed, reflecting a natural payback after a period of unsustainable acceleration.

In Korea, industrial production dropped sharply in October, prompting Q4 growth forecasts to be revised lower. Taiwan also saw weaker output, particularly in non-tech sectors. The broader regional picture suggests that while growth is slowing, the deceleration may be temporary. Tech output remains a relative bright spot and looser fiscal policies in several economies should help support consumption. Singapore, bucking the Asian slowdown, reported a notable jump in industrial production, largely driven by the strength in the pharmaceutical sector, raising the prospect of an upside surprise in its Q4 GDP.

Looking ahead, the shift in focus toward fiscal stimulus is likely to become more important in shaping the Asian region’s recovery path. Several Asian countries introduced significant fiscal easing this year and, while further stimulus in 2026 may be limited outside of China, Taiwan, and the Philippines, policymakers are likely to respond if domestic demand remains subdued.

In Japan, the government has rolled out an ambitious fiscal package that is expected to boost growth further. The combination of fiscal expansion and solid underlying activity may add to inflation pressures, increasing the likelihood of a policy adjustment by the Bank of Japan in the coming months. We remain overweight the Japanese equity market.