The Fed under Pressure

- Financial Insights

- Market Insights

- US bond market witnessed a sharp correction last week on unfavourable inflation data that unnerved investors

- Inflation data has signalled a persistence that must worry the Fed

- The FOMC is under pressure to reassess its guidance to the markets at this week’s meeting

- Market prices just two or three rate cuts this year, down from seven in December

- Strong wage growth may prompt the Bank of Japan to start to tighten policy

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

The turmoil in the US Treasury market last week has set a tense stage for the upcoming Federal Open Market Committee (FOMC) meeting. The unexpected surge in producer price inflation has rattled the market, fueling concerns that the Federal Reserve may not lower interest rates in the near term. The 10-year Treasury yield climbed 23 basis points over the week, continuing a pattern of sharp increases. This rise underscores a significant uptrend in long-term interest rates, which have surged from a December low of 3.79% after a strong fourth-quarter performance.

As of now, year-to-date losses of 2.4% and 3.0% for the Global Aggregate Index and the US Treasury Index, respectively, have nearly doubled in the past week. Interestingly, high-yield bonds have outperformed, benefiting from their shorter durations and a market sentiment that is still positive on US economic growth prospects.

Chart 1: US 10-year government bond yield spikes on a three-month trajectory higher

% yield to maturity

Source: Bloomberg

The current market consensus suggests that the Fed might cut interest rates only two or three times this year, a stark contrast from the seven cuts anticipated in December/early January. This adjustment on part of the market reflects a growing recognition of persisting inflation pressures, something that we have consistently dwelt upon. The market is gradually adopting a more cautious stance on the potential for rate reductions, aligning its expectations more closely with the enduring strength of economic growth.

As the market recalibrates its expectations for interest rate cuts, we continue to advocate for a shorter duration positioning. We have previously stated our belief that a 4.0% yield on the US 10-year note is around fair value. While the current yield of 4.30% is appealing, the heightened market volatility warrants caution. We recommend that investors be selective with their entry points, aiming for yields closer to 4.50%. This approach aligns with our strategy of capitalising on market fluctuations while managing risk effectively.

Chart 2: Market pricing of the number of rate cuts by the Federal Reserve by year-end 2024.

Number of Fed rate changes anticipated by the market pricing

Source: Bloomberg

Anticipating a Cautious Stance in This Week’s FOMC Meeting

The FOMC meeting later this week is expected to reveal the Federal Reserve’s concerns regarding the recent surge in growth and persistently high inflation. Notably, several economists have revised their forecasts, now anticipating the Fed to be reticent in reducing interest rates, possibly limiting cuts to just two by year-end.

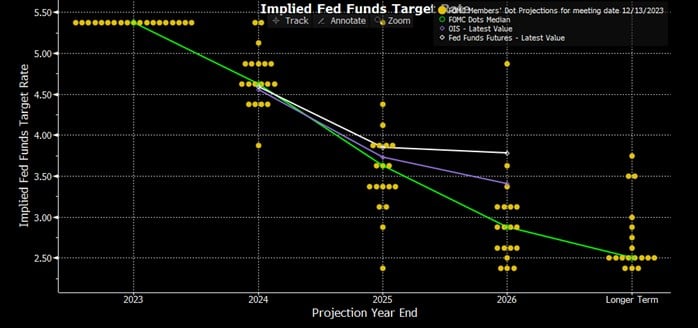

The Fed governors’ core insights will be encapsulated in the well-known ‘dot plot’, which illustrates the interest rate projections of individual Federal Reserve governors for the forthcoming years. The unexpected robust growth paired with higher-than-anticipated inflation is likely to have prompted a shift in the governors’ stance, reducing the urgency for aggressive rate cuts towards the year’s end. Additionally, there may be an upward reevaluation of the projections for medium-term Fed rate.

The Fed’s previous dot plot is now at odds with market pricing of future rate cuts. Indeed, Fed funds futures price a target Fed funds rate of 3.785% as against the Fed’s median dot of 2.875% (Chart 3). It’s ironic that the Fed finds itself behind the curve again in terms of what may be needed to bring the inflation problem under control.

Chart 3: The Fed’s current dot plot

Source: Bloomberg

Gold to Continue to Shine

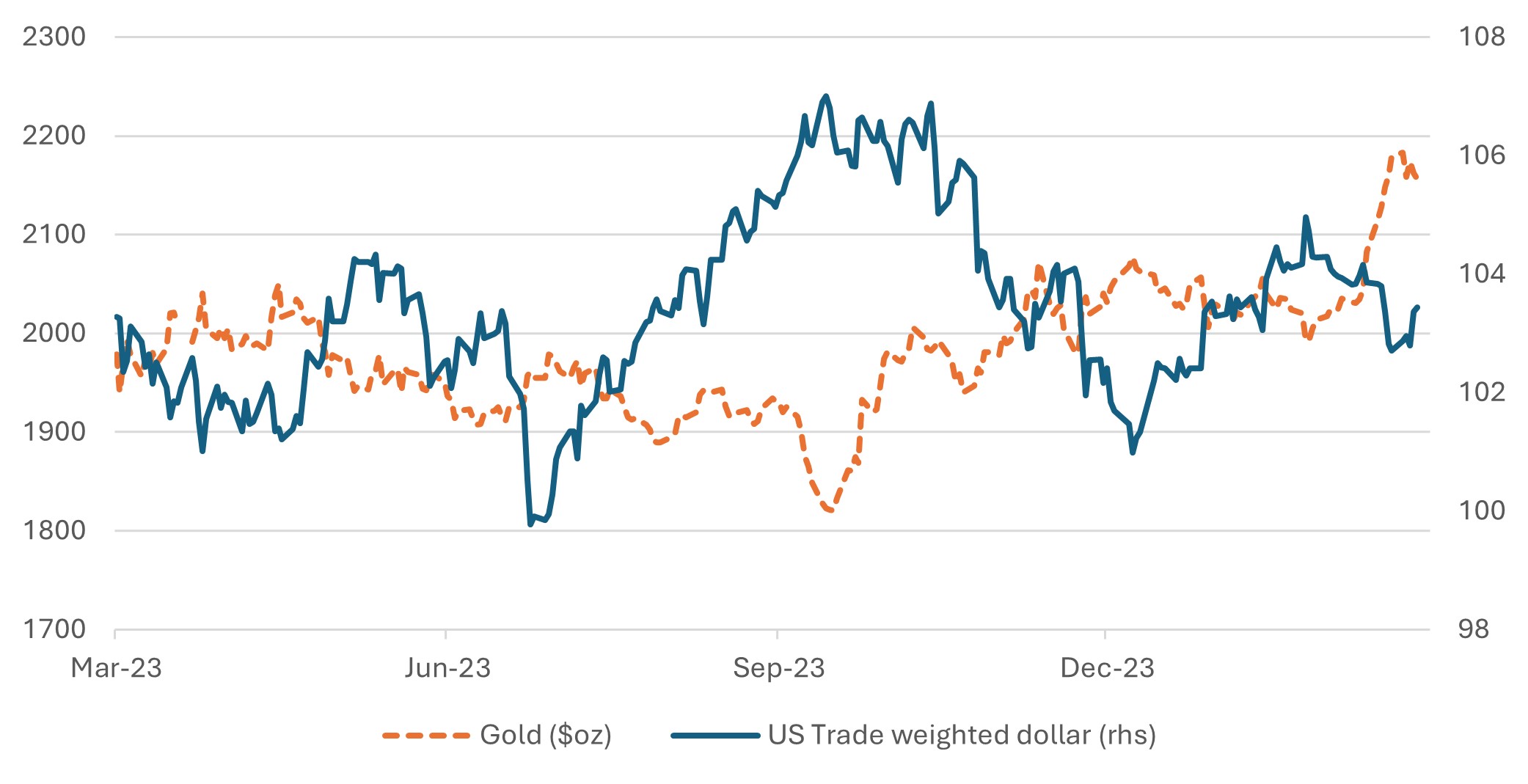

Given the market’s assumption of higher-for-longer interest rates in the United States, gold has largely maintained its highs of recent months. Indeed, only when the dollar pushed higher last week did we see a small bout of profit taking in gold. We maintain our view that the strength in gold price has as much to do with the increasing market angst around the ongoing substantial rise in U.S. government indebtedness and the Fed’s far-from-convincing policy making.

Chart 4: Gold maintains its strength despite weak dollar and assumptions of higher rates for longer

Source: Bloomberg

Japanese Market Update: Wage Growth Sparks Policy Shift Speculation

Starting with the positive, our optimistic outlook on the Japanese equity market is bearing fruit as wage increases begin to materialize, signalling potential for real income growth and a subsequent surge in consumer spending. Recent outcomes from Japan’s Shunto spring wage negotiations reveal a 3.7% average wage hike, fuelling optimism for economic momentum.

However, this development come with a caveat: It might prompt the Bank of Japan (BoJ) to end its Negative Interest Rate Policy (NIRP). While there’s ongoing debate among policymakers about the timing for monetary tightening, the consensus on the monetary policy committee appears to be leaning towards ending NIRP at this week’s meeting. It would mark the first rate hike in 17 years.

Despite the policy shift by the BoJ, we anticipate the Japanese equity market to remain buoyant as monetary conditions will likely stay comparatively lax. We expect the BoJ Governor to convey a cautious stance on further monetary tightening, especially given the economy’s subdued performance in the initial quarter of the year.

Strategic Shifts Amid Japanese Monetary Policy Adjustments

Investor apprehension is growing over the potential tightening of Japanese monetary policy, which could lead to a stronger yen and negate the recent advancements in local market indices. To navigate this landscape, we recommend investors consider transitioning from hedged to unhedged equity mutual funds. This move not only mitigates currency risk but also leverages the ongoing corporate restructuring within Japan, presenting a promising avenue for growth.

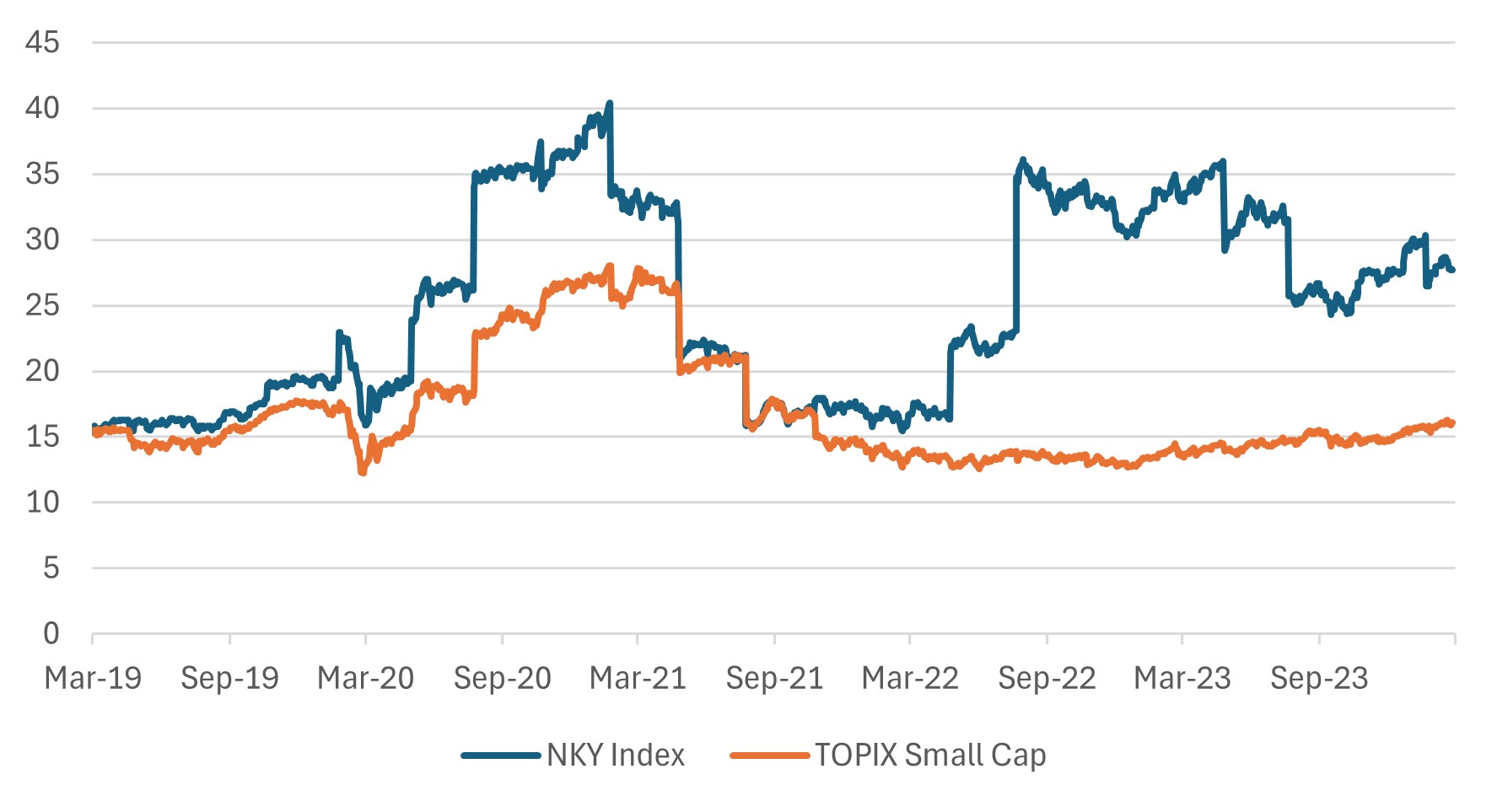

Exploring Opportunities in Japanese Small Caps

For investors seeking alternative entry points into the Japanese equity market, the TOPIX small cap index presents an intriguing prospect. In contrast to the significant revaluation observed in the Japanese large cap index, the small cap sector remains relatively undervalued. Despite a 43% increase in the Nikkei 225 over the past year, the TOPIX small cap index has seen a comparatively modest 29% gain. This discrepancy has left the small cap index valued at multiples similar to those seen five years ago, highlighting a potential opportunity for discerning investors (refer to Chart 5).

Chart 5: TOPPIX Small Cap awaiting a re-rating

Source: Bloomberg