Q1 2023 Market Review - Better than it Seemed

- Financial Insights

- Market Insights

- Markets rally but only after a banking crisis caused jitters

- Equities and bonds give good returns

- The market assumes the Fed will back off from a tight monetary policy

- Growth remains robust—and inflation is still a problem

Gary Dugan, Chadi Farah, Bill O'Neill

The Global CIO Office

The just-concluded first quarter was a roller coaster.

Just as the worries about higher inflation and higher interest rates for an extended period were unnerving the markets, the world changed suddenly. A mini-banking crisis took centre-stage almost out of nowhere. Nevertheless, central bankers were quick to ride to the rescue to save the situation and calm sentiments. By the end of the quarter, the markets had raked in decent gains. However, despite those gains, there were still too many questions for investors to be firmly secure in their outlook for the markets.

Growth forecasts up, but so is inflation

Growth forecasts have continued to inch up, and the overall inflation scenario still needs to improve. The economic surprise indices for G10 growth and G4 inflation, for instance, are rising. Central bankers still believe that the levels of core inflation are uncomfortably high. Perhaps that is why the Fed and the ECB continue to signal that policy interest rates will have to rise and remain elevated for longer, probably into 2024. Markets have rallied on the hopes of interest rates turning lower eventually, but we have yet to see emphatic signs of a significant slowdown in growth.

By loosening the monetary policy through the banking crisis the Fed has boosted hopes that we are beyond the worse and that easy money is here to stay. However, we have our own strong doubts. Inflation has recently reaccelerated and in our view could remain very sticky.

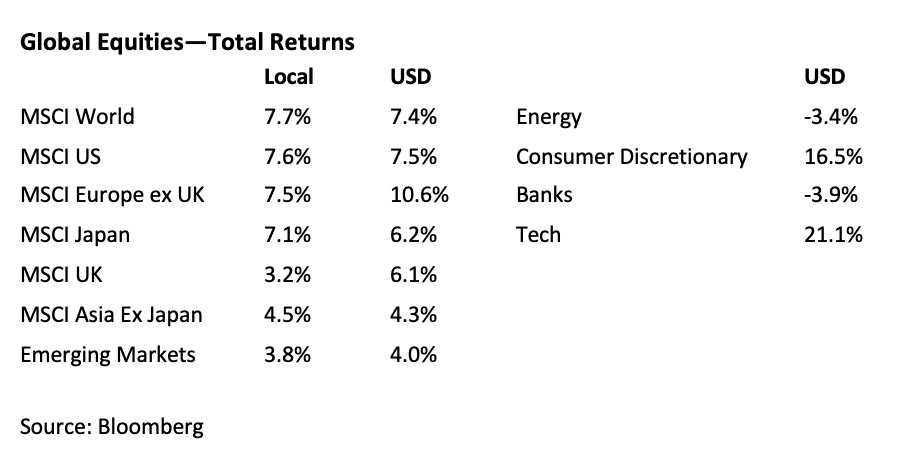

Nevertheless, despite the mini-banking crisis, the first quarter saw global equities notch up decent gains. However, in the context of the past year, the global equity market index remained in a broad trading range in the first quarter of 2023; at the end of March, though, the index was unchanged from June of last year.

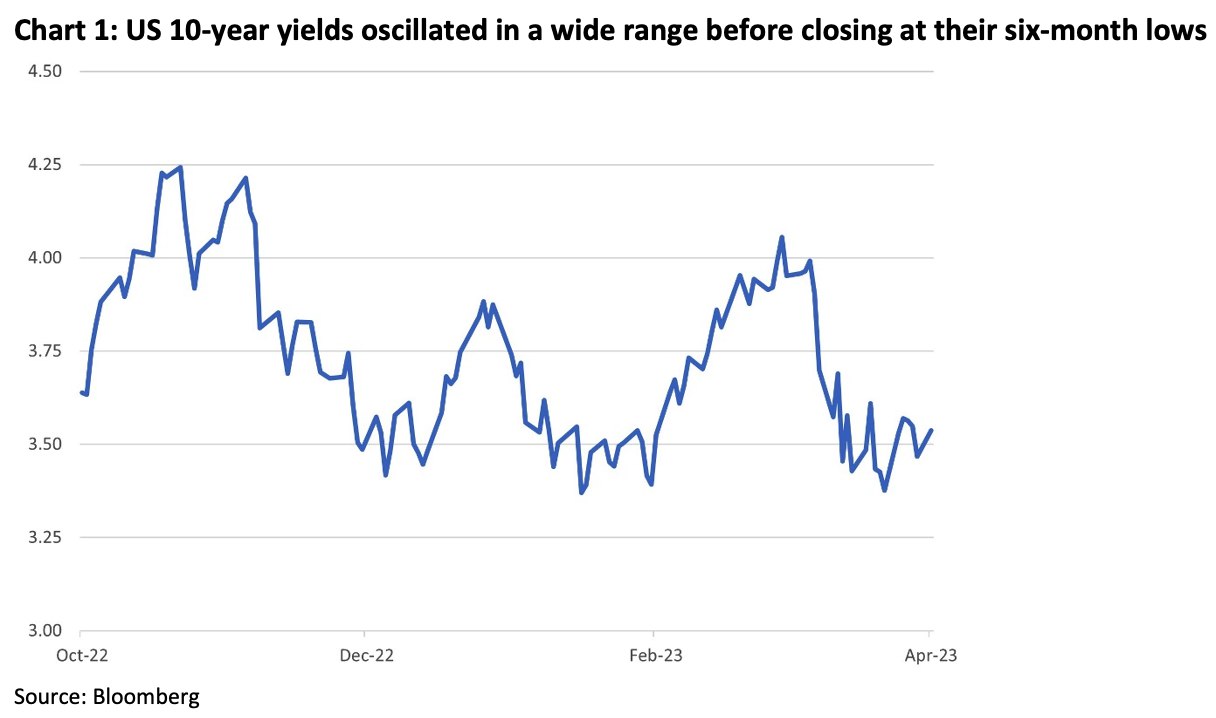

The central positive theme of the quarter was the drop in the long-term interest rates that prompted growth sectors such as technology and consumer discretionary to perform strongly. The US 10-year bond yield dropped 40bps, facilitating a 17% surge in the tech-heavy Nasdaq index. The relatively upbeat tone of the equity markets was quite surprising given the investors’ angst when the authorities had to bail out three medium-size US banks, including Silicon Valley Bank. The subsequent demise of Credit Suisse failed to dampen sentiments and hold back the equity market rally.

A bit of a silver lining

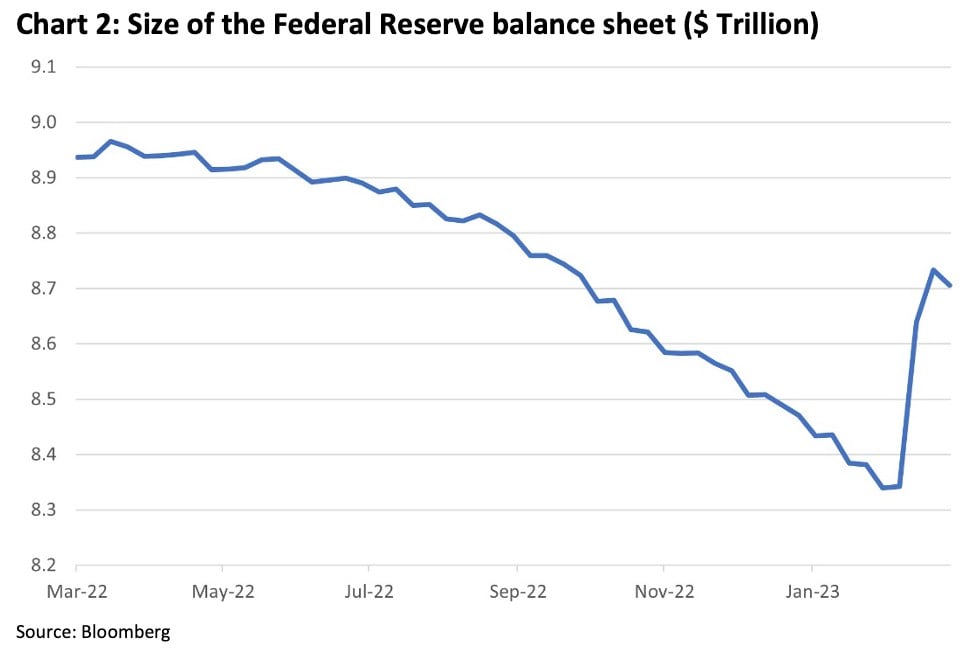

The dark clouds of the banking crisis, though, had the silver lining of generating hopes that the Fed would be more reluctant to increase policy rates in the future. Indeed, the market currently prices a cut in the Fed funds rate starting from around the September FOMC meeting. The Fed also decided to expand its balance sheet, essentially unwinding some of its recent quantitative tightening.

European equities have been buoyed by stronger-than-expected growth and a mild winter that has kept energy prices from spiralling and causing any headwinds to growth. Chinese equities (+5.2%) performed strongly in the early part of the quarter but were more subdued as the major markets rallied. Hence, gains on the quarter were more modest. It’s worth pointing out here that the MSCI China index is up 42.7% from its low at the end of October last year.

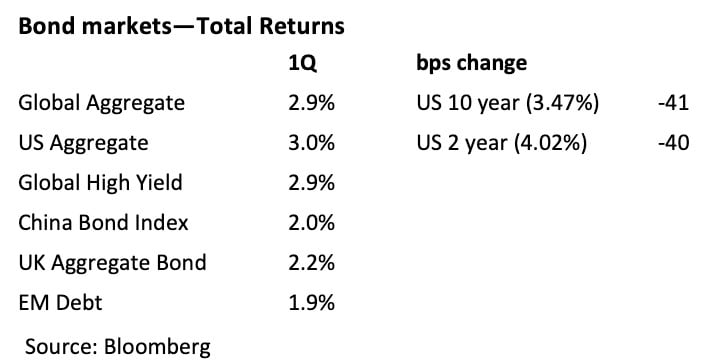

The good news played out in the bond markets, with yields ending lower across the board, generating 2-3% in total returns. The US 10-year government bond yield traded as high as 4.05% during the quarter but ended close to their six-month lows at 3.47%.

The banking crisis that unfolded during the quarter led to a substantial intervention by the Fed in the form of quantitative easing. In essence, the Fed pumped billions of dollars into the system, reversing almost 60% of the previous quantitative tightening seen since May 2022. Quantitative tightening, whereby the Fed sells bonds in the market, was one of the factors that had previously pushed yields higher.

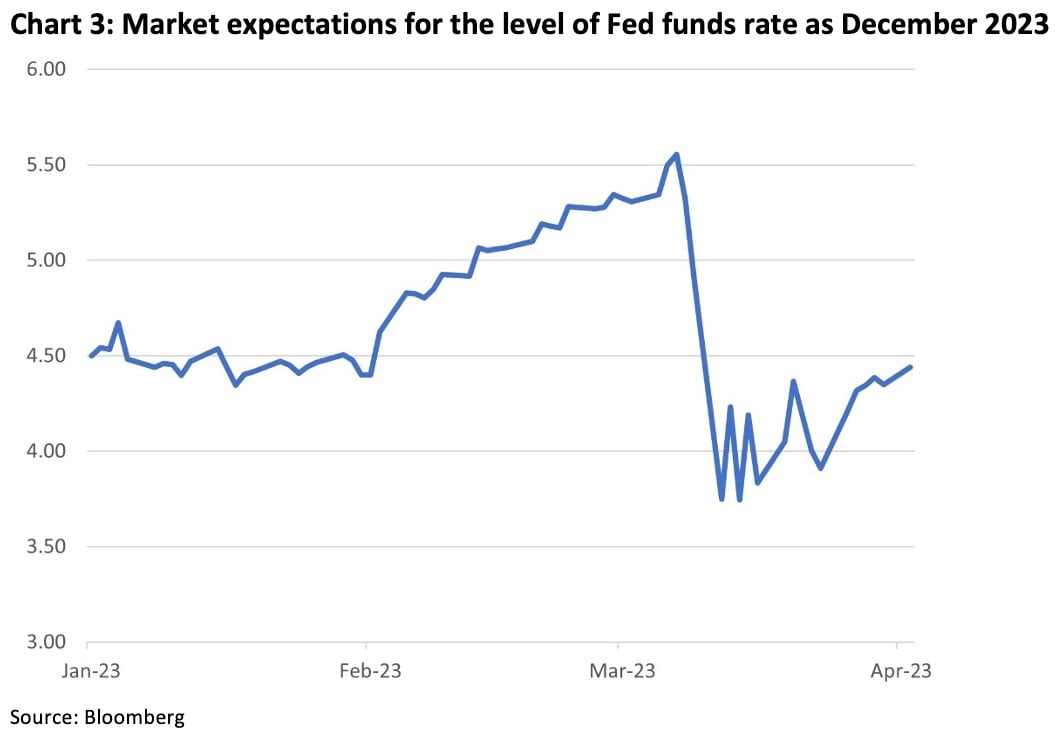

US government bond yields also moved lower on anticipation that the Federal Reserve would cut interest rates before the year’s end. The US money markets now price that the US Fed funds rate will be around 4.25-4.50% level at the December meeting, compared with the implied interest rate of 5.5% in early March.

US yields fell and so did the global yields, although the global yields had a more modest fall. European 10-year government bond yields were down close to 20bps. Credit performed in line with government bonds, although there was some spread widening in emerging market debt. Hence, despite the concerns about a global recession, high-yield bonds performed broadly in line with government bonds with little spread widening.

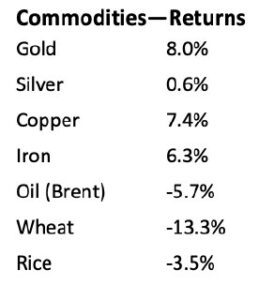

Part of the current dilemma that the markets face is effectively judging whether to discount a greater risk of recession or the still relatively impressive growth seen in the first quarter. As the banking crisis played out, gold performed well aided by some weakness in the dollar.

Industrial metals like copper and iron continued to react to the positive news that Chinese demand would re-accelerate. Oil prices, by contrast, were lower in the quarter as more technical factors affected the market. The decision by the US government to delay the rebuilding of strategic reserves and the entente cordiale formed between arch-rivals Iran and Saudi Arabia were both seen as being a drag on prices. US demand would be weaker in the near term, and the agreement with Iran could presage increased supply from Iran.

What does Q2 hold?

The path that inflation takes in the coming quarters will likely define the outlook for asset markets. If inflation remains sticky, as many central bankers expect it to be, interest rates will be higher. Hence, there remains a risk of a reversal of the good first-quarter performance.

For us, the banking crisis was a warning sign to investors of the imbalances that have built up in the financial system through years of ultra-loose monetary policy. Financial institutions and investors were carried away by the wave of liquidity the flooded the markets and anticipations that interest rates would remain near zero.

We expect more such imbalances to come to the fore through the coming quarters, which may provide quite a headwind for the markets.

Through the first quarter, growth remained relatively upbeat in many parts of the world. China is recovering and should accelerate as its consumers and manufacturers get back to the pre-COVID pace of spending.

Global growth could remain more resilient than expected, translating into the persistence of inflation beyond the comfort of central bankers. The peak in interest rates is usually seen only after we witness a significant growth setback. The Fed’s easier monetary conditions could be a false dawn for the markets. We remain wary of taking too much risk when there are likely to be many more challenging phases for the global economy.